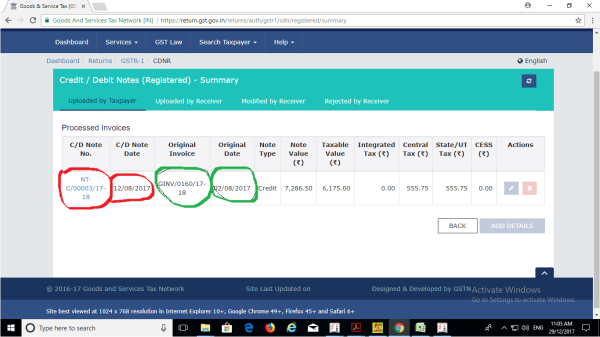

dear advisors, what is mean "processed with error" in debit note of gstr1.

I unable to file my gstr1, because of the above issue. even enter the value in debit note, it's not showing the values in preview. I send snapshot to gst help desk also there is no response. kindly solve my problem to file my gstr1.

Menu

debit note

Replies (14)

Recent Threads

- GST RATE OF OUT DOOR CATERING

- Non resident taxation & income tax in India

- GST Rate for oral Hygiene Combo Pack

- GST registration - Address error

- TDS on property pu

- Import of goods IMS action related

- Incometax Survey - Updated Return Filing after the

- TCS under 206C(1F)

- Effect on Cost of Control when Bonus Issue is from

- The deductor filed GSTR 7 turnover including tax.I

Related Threads

CAclubindia

CAclubindia