Dear sir,

please clarify few points on WCT.works contract tax.

i am working in a construction company. 100% of works

are given to sub-contractor. some are having vat and

service tax reg. some are not having any tax

registration.

now

1) on sub-contractor bills, who have to deduct(or)

collect tax?

If sub-con is allowed to collect tax from us( we have

all registration for vat and cst) , does he pay to

govt or not? how to ensure it.

2) if i have to collect tax from sub-con(is it

possible) shall i collect and pay to sale dept on

behalf of sub-cons?

pls clarifty on karnataka state vat and wct.

kind reagrds,

a.kingsly

I have received a mail from Mr.Kinglsy on the above query. I felt it is wise to share my views through this constellation fourm.

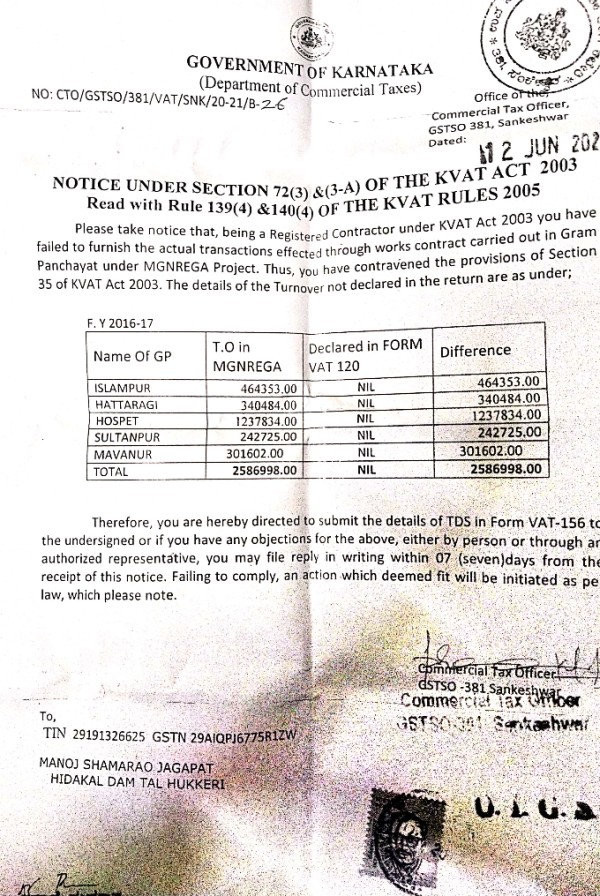

For this, one should refer Sec.9A read with Rule 44 of Karnataka VAT.

- As per Sec.9A, tax shall be deducted by the works contractor from the payments to the sub-contractors irrespective of his status under VAT.

- Deductor shall issue a certificae to that effect to the deductee in VAT Form-156 within 15 days from the end of month in which tax deducted.

- VAT-156 is non-transferrable.

- Such tax deducted shall be remitted with the Govt. within 20 days of close of the preceding month in which tax deducted.

- Decutor shall submit a statement in Form-125 to the CT department.

- VAT-156 shall be obtained from the CT department @ Rs.2 each for issuing the same to the deductee and detailed account shall be maintained for receipt, usage etc., This is like way bills account.

Regarding the queries of the queriest:

- Sub-contractor is not entitled to deduct/collect tax from the works contractor (main contractor).

- Main contractor shall deduct and remit the same into Govt. account.

As per the recent notification no.No.KSA.CR.76/08-09 dt.28/07/2008 w.ef 01.08.2008, tax shall be collected from the payments to suppliers against their supplies i.e., iron, steel etc.,

CAclubindia

CAclubindia