I hv following query in one of my client.

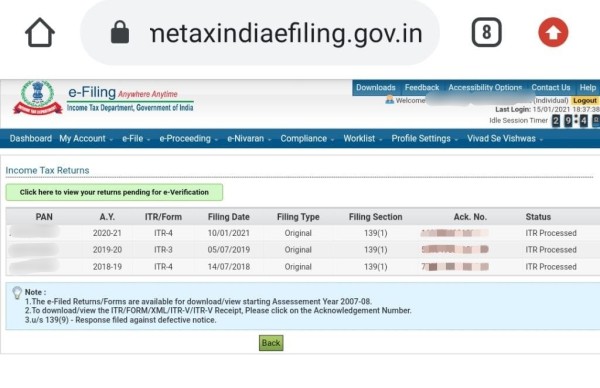

ITR 4 filed for A. Y 2018-19 . Then Since ITR 3 has been filed for A.Y 2019-20 so whether same was required to be filed for A.Y 2020-21 also...

whether return of A.Y 20-21 need to be revised & to be filed ITR 3 instead of ITR 4 filed.. if return needs to be revised then what about audit under section 44ad(5) for A.Y 2019-20 and 2020-21

Attached File : 1175981 20210204010405 44ad query .pdf downloaded: 35 times

CAclubindia

CAclubindia