Hi everyone,

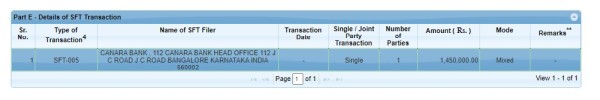

Please find below image for my 26AS form: After spending sometime I came to know this SFT-005 code for deposits. I don't have any deposit with canara bank. But my father having deposit in canara bank with joint name. 2nd depositor name is with name of mine. Is it the reason its showing in my 26AS Form? But same amount is not reflecting at my father's 26AS form. As of me deposit always belongs to first depositor. please let me know if i am wrong.

After spending sometime I came to know this SFT-005 code for deposits. I don't have any deposit with canara bank. But my father having deposit in canara bank with joint name. 2nd depositor name is with name of mine. Is it the reason its showing in my 26AS Form? But same amount is not reflecting at my father's 26AS form. As of me deposit always belongs to first depositor. please let me know if i am wrong.

Is there any care i have to take while filing the ITR? do i resolve anything before filing ITR? what action needs to take?

Please guide me for my query. Thanks.

CAclubindia

CAclubindia