Advanced GST Training & Certification Course

Beginners to Advance Level

by CA Bimal Jain

(Content with latest Union Budget 2021 updates)

(Content with latest 45th GST Council updates)

Call us: 011-411-70713

GST Course on Scrutiny Notices, Assessment, Audit, Inspection, Search, Seizure and Arrest under GST by CA Bimal Jain

Price 6599.00

(Inclusive

of Registration and Tax)

- 61 hours of video classes

- E-Book on GST

- Video classes and E-Books in English Language

- E-Certificate after the completion of GST Course issued by CAclubindia

- Content with latest Union Budget 2021 updates

- Content with latest 45th GST Council updates

By CA Bimal Jain

Price 4350.00

(Inclusive of GST)

Know more

GST Law And Commentary With Analysis and Procedures

(Set of 3 Volumes) Edition November 2020

Published by - Bimal Jain and Isha Bansal

Rs. 5775 /-

Offer Price: Rs. 3176 /-

About GST Certification Course

GST is historical indirect tax reform in India. There has been a paradigm shift in the Indirect

Tax structure with the GST rollout on 01st July 2017. It is really important to understand and

assimilate the new GST in India, new compliances and the changes in processes in

operating business.

To help professionals and aspirants with the ongoing changes and to make them GST

experts CAclubindia has introduced the Certification Course on GST. The objective

of this Course is to provide knowledge of practical aspects of GST to all.

- Detailed understanding of GST Provisions with Practical Case Studies

- Analysis of open and burning issues in GST

- Preparation and filing of GSTR-9 and GSTR-9C – Table wise

- Divergent Judgements and Case studies from different Advance Ruling Authorities / HC

- Exclusive recorded sessions covering Q&A

- Understanding of all Recent Amendments and Implications

GST Course Content

At the end of the GST Certification course by CAclubindia, you will have a thorough

understanding of the GST regime and will be "GST Ready" for the coming future.

You will learn GST with Bimal Jain who is one of the most sought-after GST knowledge &

thought leader in the country with more than 19 years of experience in Indirect Taxation.

Through these GST Online Classes, you will be able to learn all the basic to advance

concepts and prepare yourself for the latest GST updates with this GST Online Course.

1: Levy & Supply under GST

- Scope of Supply under GST

- Levy and Collection (FCM & RCM) and Exemptions

- Composite and Mixed Supply

- Inter-State & Intra State

- Notifications of Rates (1/2017, 2/2017, 4/2017, 11/2017, 12/2017, 13/2017) etc

2: Taxable Person & Registration, Threshold limits, etc.

- Threshold limits for GST Registration

- Compulsory registration

- Distinct Person, Related Person – Discussion and Case Studies with Schedule I of CGST Act, 2017

- Provisions for registration under GST

3: Time and Value of Supply

- Time of Supply provisions for Goods

- Time of Supply provisions for Services

- Valuation of Goods and Services

4: Input Tax Credit

- Discussions on Section – 16,17, 18, 19 of CGST Act, 2017

- Availment of Input Tax Credit

- Utilization of Input Tax Credit

- Concept of Input Service Distributor (ISD)

- Reversal of Common credit

- Transitional arrangements of ITC and Miscellaneous transitional provisions

5: Place of Supply for Goods or Services

- Intra- State vs. Inter-State Supplies

- Place of Supply for Goods

- Place of Supply for Services

- Place of Supply for Export and Import of Services

6: Zero-rated Supply (including Refund)

- Supplies to SEZ, Export, Deemed Export

- Refund of IGST or ITC in case of Export

- Meaning of Zero-rated supply under GST.

- Treatment of export transactions.

7: Tax Invoice, Introduction of E-Invoicing under GST, and Job Work

- Tax Invoice under GST

- Concept of Credit and Debit Note

- Accounts and Records under GST

- Concept of Payment, Refund Vouchers, Payment Vouchers, Receipt Vouchers, etc

- E-Invoicing Under GST.

- Job Work Procedure

8: Existing Return and New GST Return System under GST & E- Way Bill

- Form GSTR-1, GSTR-3B, GSTR-5, GSTR-6, GSTR-7 (Including NRTP, Normal Taxpayer, ISD, Casual Taxpayer, TDS)

- Monthly, Quarterly, and other compliances of GST.

- New Return System: RET-1, RET-2, and RET-3 with GST ANX-1 and ANX-2

- Provisions and applicability of E-way bills

- Blockage of E-way Bills

9: Clause by Clause filing of GST Annual Return (Form GSTR-9)

- Preparation of Form GSTR-9 and GSTR-9A – Table wise discussion

- How to File GSTR-9 and GSTR-9A

- Compilation of data for GST Annual return

10: Clause by Clause filing of GST Audit Report (Form GSTR-9C)

- Preparation of GSTR-9C – Table wise discussion

- Compiling data for the reconciliation part of GSTR-9C.

- How to File GSTR-9C

- Conducting a GST audit and Drafting GST Audit Report.

11: Inspection, Search, Seizure, and Arrest under GST

- Power of Inspection, search, and Seizure

- Power to arrest under GST

- Power to summon under GST

- Inspection of documents

12: Advance Ruling under GST

- Authority of Advance Ruling

- Application and process of advance ruling

- An appeal under Advance Ruling

- Order under Advance Ruling and its binding

- Appeal to National Advance Ruling Authority and its order etc

- Power of authority under Advance Ruling

- Recent Judgement/Case Laws of AAR.

13: Appeal, Revision, Offence & Penalty in GST

- Appeal and procedure to Appellate Authority

- Power of Appellate Authority

- Order of Appellate Authority

- Appeal, Procedure to High Court and Supreme Court

- Power to impose penalties under GST

- Recent Judgement/Case Laws of Appellate Provisions.

14: Questions and Answers Questions related to the following Topics:

- Levy & Supply under GST

- Taxable Person & Registration, Threshold limits, etc.

- Time and Value of Supply

- Input Tax Credit

- Place of Supply for Goods or Services

- Zero-rated Supply (including Refund).

15: Questions and Answers

- Questions related to the following Topics:

- Tax Invoice, Introduction of E-Invoicing under GST and Job Work

- Existing Return and New GST Return System under GST & E-Way Bill

- GST Annual Return (GSTR-9)

- GST Audit Report (GSTR-9C) and Job Work

- Inspection, Search, Seizure and Arrest under GST

- Advance Ruling under GST

- Appeal, Revision, Offence & Penalty in GST

16.Intricacies in Supply, Deemed Supply, Cross Charge vs. ISD, Valuation, etc

17. Intricacies in Time of Supply and GST ITC with Q&A.

18. Overview & Intricacies of in Place of Supply for Goods and Services with Q&A.

19. Budget 2021.

This GST Certification Course will focus on practical aspects of GST with the support of the theoretical knowledge of the law and will build all the basics and advanced concepts in the mind of the students.

Who should enroll in this Online GST Course?

This GST Certification course is for everyone who wishes to learn and study GST and become an expert in GST or wants to become a certified GST practitioner with this GST Certification Course.

This GST learning course is for:

- CAs in Practice who wish to diversify their practice in the GST field

- CAs in Job who wish to get promoted and achieve greater goals

- CA Students and Fresher CAs who wish to learn the basic and advanced concepts of GST

- CS Professionals and students, IAS aspirants, MBA Finance, ICWA Professionals, CFO's, LLB practitioners and students, Independent Tax practitioners and Consultants, Accountants and Graduates.

- Accountants, B.Com / M.Com graduates who want to get a job under GST

- A graduate or postgraduate having a degree in Commerce, Law, Banking including Higher Auditing, or Business Administration or Business Management from any Indian University established by any law for the time being in force

-

Anyone who has passed any of the following examinations, namely :

- (a) (CA Final) Final examination of the Institute of Chartered Accountants of India or

- (b) (CMA Final) Final examination of the Institute of Cost Accountants of India or

- (c) (CS Final) Final examination of the Institute of Company Secretaries of India

- Retired officer of the Commercial Tax Department of any State Government or of the CBEC and has worked in a post not lower in rank than that of a Group-B gazetted officer for minimum period of two years or

- Sales Tax Practitioner or Tax Return Preparer under the existing law for a period of not less than five years.

What are the opportunities in GST field as a career after GST Certificate Online?

The new GST taxation system will be opening up an Ocean of Opportunities for all Tax/

Account Professionals, Manager Accounts, CFOs, Revenue Officials, CA and other Finance

Students.

Let's see what various reports in newspapers have to say about GST and Opportunities that will be unleashed with GST:

"GST opens job opportunities for finance, commerce graduates" - The Hindu Business Line

"GST rollout: Job market seeks over 100,000 employment opportunities. The job market is looking forward to a big boost from the new GST regime and expects over one lakh immediate new employment opportunities, including in specialized areas like taxation, accounting, and data analysis." - Business Standard

"Consultancy firm Ernst & Young India. In its Indirect Tax practice, the firm has seen over 60 percent increase in hiring. All the hiring were related to GST" - Sudhir Kapadia, National Tax Leader, EY India.

"GST will generate 10 lakh job opportunities" - Haryana Chief Minister Manohar Lal Khattar

What are the benefits of GST Training & Certification Course in India?

GST is the latest amendments in the Indian taxation regime which has brought plethora of opportunities for finance professionals in the field of practice as well as jobs. Few of the benefits of learning GST are enumerated below:

- Becoming GST Ready for the Future

- Ability to understand various new compliance requirements under new GST regime

- In-depth understanding of GST provisions

- Learn more about Impact of GST on various sectors and their business models

- Practical Training Exposure for GST Registration, Certificate and similar issues

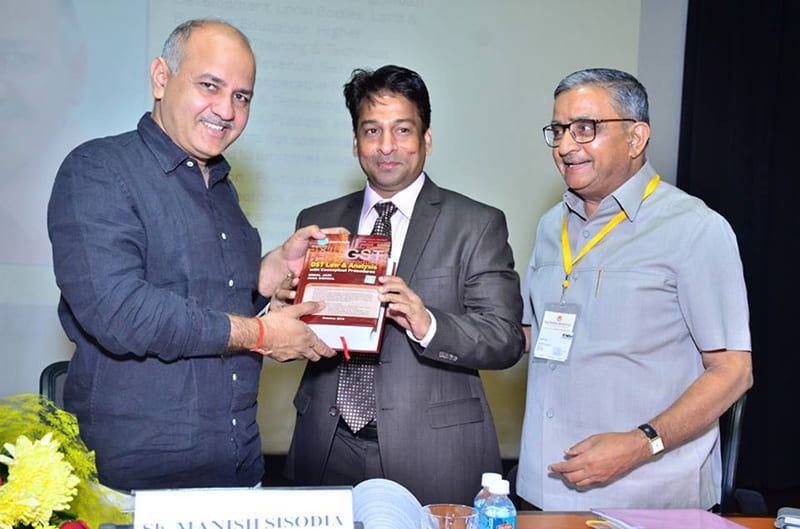

Experienced Faculty

Bimal Jain is a Member of Institute of Chartered Accountants of India since May 1994 and Member of Institute of Company Secretaries of India since December 2006 along with a Bachelor's degree in Law. Also, he is a Qualified SAP - FI/CO Consultant and has more than 21 years of experience in Indirect Taxation and specializes in all aspects of Service Tax, Value Added Tax (VAT)/ Central Sales Tax (CST), Central Excise, Customs, Foreign Trade Policy (FTP), Special Economic Zone (SEZ), Export Oriented Unit (EOU), Export-Import Laws and well acquainted with the concept and impact of way forward Goods and Services tax (GST).

CAclubindia has launched GST Certification Course with Bimal Jain which is available online on the website.

He has working experience of more than 18 years in renowned Companies viz. LG Electronics India Pvt. Ltd, Honda Motorcycle & Scooters India Pvt. Ltd, Hindustan Development Corporation Ltd, Khaitan & Company and presently he is the Executive Director of A2Z Taxcorp LLP - a boutique Indirect Tax firm.

Significant Transactions:

He has hands on experience in providing opinion & advisory services, carrying out diagnostic review of business operations, process review, structuring of business model, undertaking litigation services at all appropriate forum including CESTAT, representation before the TRU/ CBEC/ DGFT, etc. for various matters concerning to trade, industry and commerce.

Professional Membership:

- Chairman of Indirect Tax Committee of PHD Chamber of Commerce

- Chairman of the Corporate Advisory Committee of IPEM Group of Institutions

- Member of Indirect Tax Committee of ASSOCHAM/ FICCI

- Special invitee of Indirect Tax Committee of ICAI/ ICSI

- Member of eminent faculties in Indirect Tax Committee of ICAI/ ICSI/ ICMA

Awards & Recognitions:

- Keynote Speaker at Guinness World Record made by ICSI in "Largest Taxation Lesson" on GST, attended by 4500+ Participants, breaking earlier record of Japan

- Business Leader Award from Amity School, Noida

- Best Speaker Award from NIRC- ICAI/ ICWAI

- Young Achievers Award at Igniting Minds, 2015

- Best Participant Award in MSOP- 117th Batch by ICSI

Buy now

FAQs on Online GST Course

How much time will it take to complete this online course?

This GST Online Course will take up to one and half months to get complete understanding of the topics.

How does this GST Online Training will help in placements or promotions in career?

GST has now become the need of the hour and companies are hiring Individuals with understanding of GST regime and compliances. Also, it will become easy for professionals to get promotions when they acquire in-demand skills of GST.

Is there any requirement of prior knowledge / skills for this course?

Students are encouraged to have a basic understanding of Indirect Tax system in India.

Is there GST on training courses?

Yes there is GST on training courses at the rate of 18%

What is GST training?

GST training is a comprehensive workshop cum class based learning of Goods and Service Tax Act with practical application insights.

How do I become a GST professional?

One can be a GST professional by taking online courses on GST and then practice by serving the clients.

How do I become a GST practitioner?

One can take online classes to learn the concepts of GST and then appear for the Government certification exam. Once the exam is cleared you become a qualified GST Practitioner.

CAClubIndia Service Rating

Terms and Conditions

- Total Length of Videos: 61 hrs.

- Expiry: 2 months or 122 Hrs

- Videos are meant for web viewing only and cannot be downloaded. Videos are available in the Full-Screen viewing

- Course/Subject purchased once cannot be cancelled.

Buy now

- Best suited for slow Internet connection.

- Videos can be viewed depending on validity of the subject.

- Videos can viewed even while you are offline.

- Videos can be viewed on website for 30hrs also(updates will be provided online).

- Pen drive available for additional Rs 1000 for each subject.

- Pen Drive will be shipped in 3-4 working days.

- Pen Drives can used for personal purpose after expiry of subject or after viewing of stipulated hours (which ever is earlier).

- Runs just on one PC.

- Refund Policy.

- Video will self expire as per the subject expiry.

- Minimum 2GB free space required in C: Drive

- Supported OS : Windows 7 & above.

- Windows Media Player & .NET Framework 3.5 or higher must be pre installed.

- Antivirus software must be pre installed.

- Genuine Windows recommended for Win XP users. One time internet connection is required for activation.

- Interaction with teacher via click to call and email service.

- 5% extra discount for existing enrolled students. Final Price visible in checkout page.

CAclubindia

CAclubindia