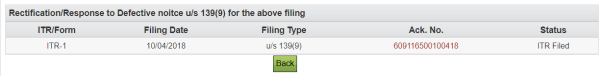

So I had submitted Income Tax return for AY 16-17 in which My tax liability was 488 Rs and while submitting I forgot to mention BSR Code Details in return.After few days I received defective notice U/S 139(9) to which I responded under option E-File in response to u/s 139(9) and uploaded the corrected X M L including the BSR code.

Within few days of submission I received Intimation u/s 143(1) in which department made request of payment of Rs 490 though I had paid 488 and within few hours of receiving intimation my tax payable started showing in Response to Outstanding Tax Demand.Though while submitting eresponse u/s 139(9) in the X M L I had only submitted bsr code of Rs 488 only not Rs 2

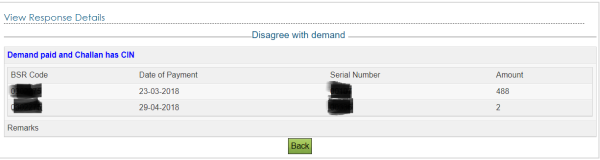

I paid Rs 2 and in the response I choosed to Disagree and submitted Challan Details for my liability Rs 490

And in the Rectification I choosed No further data correction required reprocess the case.

And today I received another mail from department stating the request for rectification has been rejected and below is what it was stated in mail.

THE ASSESSEE HAS SUBMITTED A RECTIFICATION REQUEST, TICKING THE - “TAX/INTEREST COMPUTATION” BOX, UNDER THE

CATEGORY - “NO FURTHER DATA CORRECTION REQUIRED, REPROCESS THE CASE”. IT IS SEEN THAT, TAX HAS BEEN COMPUTED

CORRECTLY, ON THE INCOME RETURNED BY THE ASSESEE. THE INTEREST U/S. 234B, HAS BEEN CORRECTLY COMPUTED, AS PER

THE PROVISIONS OF THAT SECTION. SIMILARLY, INTEREST U/S 234A HAS BEEN CORRECTLY COMPUTED ON THE AMOUNT OF TAX AS

PROVIDED IN SECTION 234A(1). ALSO, INTEREST U/S 234C HAS BEEN COMPUTED, CONSIDERING THE DATE OF REALISATION OF THE

ADVANCE TAX PAYMENTS, WHICH IS TO BE ADOPTED AS PER THE PROVISIONS OF GOVERNMENT TREASURY RULES AND RECEIPT &

PAYMENT RULES. IN CASE OF DEMAND PAID, CREDIT IS GIVEN AND THE DEMAND IS ROUNDED OFF, AUTOMATICALLY. THERE IS NO

REQUIREMENT FOR FILING A RECTIFICATION APPLICATION. IF THE REQUEST IS FOR CANCELLATION OF THE ADJUSTMENT OF

DEMAND, OF EARLIER YEAR(S). THE ADJUSTMENT OF THE EARLIER YEAR(S) DEMAND, IS CORRECT, SINCE THE DEMAND HAS BEEN

CORRECTLY COMPUTED IN “CPC” AND THE SAME HAS ALREADY BEEN INTIMATED TO THE ASSESSEE. IN CASE THE ASSESSEE

CONSIDERS THE DEMAND RAISED FOR EARLIER YEAR(S) IS INCORRECT, THE ASSESSEE IS REQUIRED TO FILE AN ONLINE

RECTIFICATION REQUEST, FOR THAT YEAR(S). AS REGARDS THE DEMAND UPLOADED BY THE ASSESSING OFFICER, THE SAME HAS

ALSO BEEN CORRECTLY ADJUSTED, SINCE THE JURISDICTIONAL ASSESSING OFFICER HAS UPLOADED THE SAID DEMAND FOR

THAT YEAR(S). THE ASSESSEE IS REQUESTED TO CONTACT THE JURISDICTIONAL ASSESSING OFFICER, IF THAT YEAR(S) DEMAND IS

INCORRECT AND GET THE SAME RECTIFIED BY THE JURISDICTIONAL ASSESSING OFFICER. THE RECTIFICATION RIGHTS, IN YOUR

CASE ARE BEING TRANSFERRED TO YOUR ASSESSING OFFICER. KINDLY CONTACT YOUR ASSESSING OFFICER FOR THE SAME. THE

DETAILS OF THE JURISDICTIONAL ASSESSING OFFICER ARE AVAILABLE IN THE “SERVICES” SECTION, ON THE WEBSITE

https://www.incometaxindiaefiling.gov.in . IN VIEW OF THE ABOVE, THIS RECTIFICATION APPLICATION IS REJECTED.

Now I am confused what am I supposed to do.Kindly help me

CAclubindia

CAclubindia