Dear Experts,

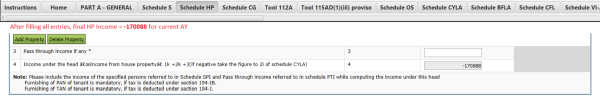

I am facing a problem with ITR Utility - both excel and java versions. Issue: House Property(HP) set-off from previous years is possible only when income from HP is positive and does not allow upto exemption limit of Rs -2,00,000. I think this is a bug, please let me know if my understanding is wrong.

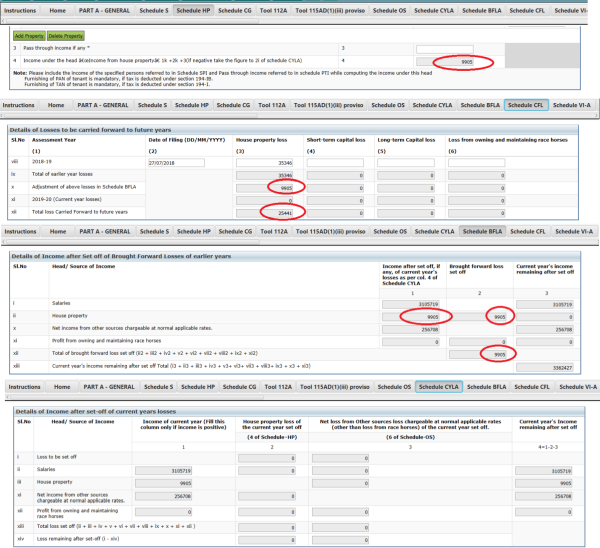

Step 1: Enter details in Schedule HP of either Java(PR 3.2) or Excel utility (PR 3.1)

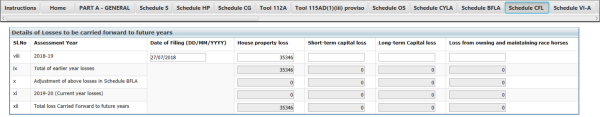

Step 2: Enter HP loss from earlier years in Schedule CFL

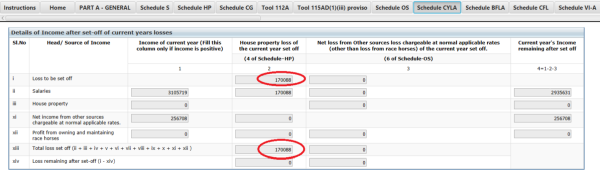

Step 3: Check Schedule CYLA, the loss is set off correctly

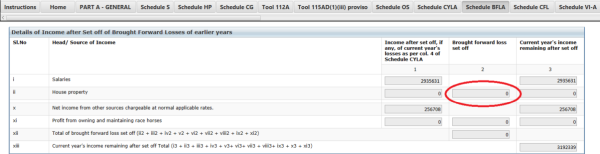

Step 4: Check Schedule BFLA, the loss from previous year is not set off as expected

Expectation is that Rs 29,912 from previous year is set off for current year and the remaining Rs 5,434 is carried forward, so that total allowed HP exemption of Rs 2,00,000 is possible. Please let me know if my calculation/expectation is correct.

Further, I checked that set off is possible only when income from HP is positive, in which case set-off works until amount becomes 0. This is correct in case of Short/Long term capital gains but not in case of HP. HP must allow set-off until -2,00,000. Please see screenshots for the same.

CAclubindia

CAclubindia