Hello experts ,

I am going to file my Septemebr month 2018 GSTR-3B today .

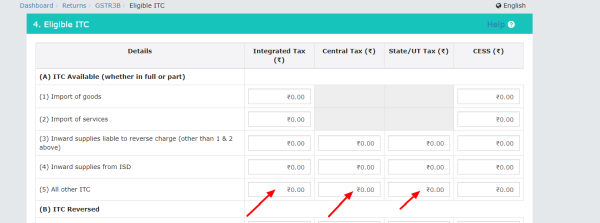

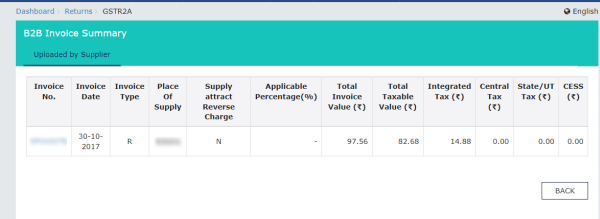

I have not taken any ITC in any month till now . while checking my GSTR 2A today , I found that my Banks has shown GST paid to them by me . I want to use this GST already paid to bank to offset my liability of tax to be paid in Sepetemeber 2018 GSTR-3B.

My GSTR 2A is showing information below.

| Month | Service Provider 1 (IGST) | Service Provider 2 (CGST +SGST) |

| Dec 2017 | Rs.10 | Rs.30+ Rs.30 |

| Jan 2018 | Rs. 60 | Rs.10+Rs.10 |

| Feb 2018 | Rs.80 | Rs.10+Rs.10 |

| March | Rs.90 | Rs.20+Rs.20 |

Total IGST : 240 /-

Total CGST = Total SGST= 70 /-

My query is -

should I enter 240 in IGST and 70 in CGST/SGST ? and file my Sept 2018 GSTR 3B as usual ? is this correct ?

CAclubindia

CAclubindia