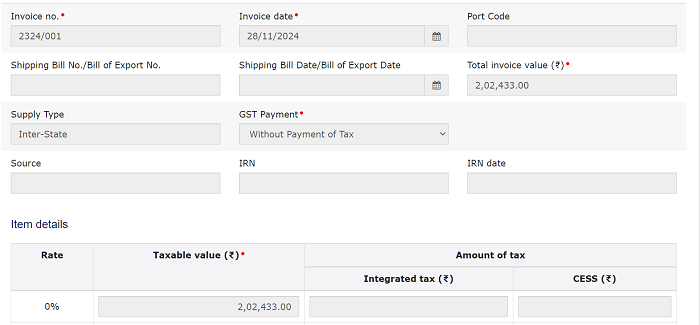

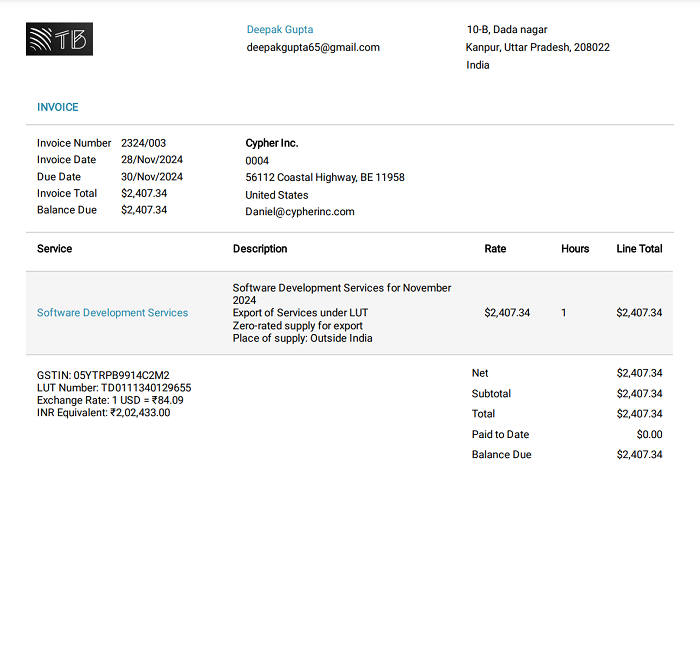

I work as a software developer on a contract basis with a foreign company and they send me monthly payment using wire transfer to my bank account and i got recently gst registered so for the month of novemeber i got registration done on 24 nov, and my invoice got raised on 29 nov. So i filled for GSTR1 today with these details

Already verfieid and filed

Just wanted to know if everything is correct in here and do i need to do any other steps after this ?

Also there was no option to upload my invoice in here .. is it needed to be uploaded or not ?

Menu

GSTR 1 For freelancer income

Replies (3)

Recent Threads

- Key Corporate Compliance Requirements for Private

- Gst Non Filling Return Notice

- GSTR 2B ( MULTIPLE MONTHS )

- Eway bill generation for export material.

- International Tax clarification UK.

- E way bill expired penalty

- Best SME Focused AIF Funds in India for High Growt

- How does employee management software help in stat

- Clarification Required – Section 18 of Wage

- How to split freelance project income with a frien

Related Threads

CAclubindia

CAclubindia