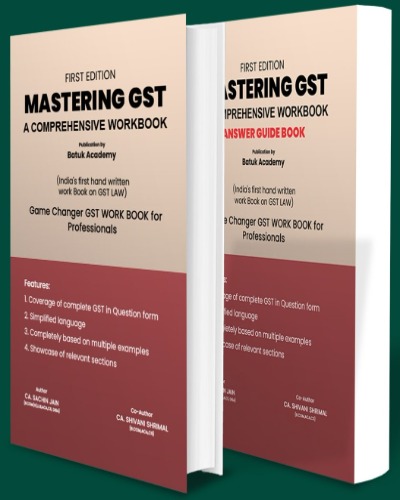

MASTERING GST

by Sachin JainTable of Contents

| Chapter - 1 Analysis of Section 7 of CGST Act,2017 (Q.I to Q.35) | � |

| Chapter - 2 Analysis of Composite & Mixed Supply under GST (Q.36 to Q.39) | � |

| Chapter - 3 Analysis of Reverse Charge Mechanism under GST (Q.40 to Q.43) | � |

| Chapter – 4 Analysis of Time of Supply under GST (Q.44 to Q.60) | � |

| Chapter - 5 Analysis of Value of Supply under GST (Q.61 to Q.78) | � |

| Chapter - 6 Input tax Credit under GST (Q.79 to Q.100) | � |

| Chapter - 7 Place of Supply under GST (Q.101 to Q.121) | � |

| Chapter - 8 Refund of Tax under GST (Q.122 to Q.142) | � |

| Chapter - 9 Audit and Assessment under GST (Q.143 to Q.157) | � |

| Chapter - 10 Demand and Recovery under GST (Q.158 to Q.158) | � |

| Chapter - II Registration under GST (Q.159 to Q.176) | � |

| Chapter - 12 Tax Invoice, Debit Note & Credit Note (Q.177 to Q.186) | � |

| Chapter - 13 Accounts & Records under GST (Q.187 to Q.191) | � |

| Chapter - 14 Returns under GST (Q.177 to Q.204) | � |

| Chapter - 15 Payment of Tax under GST (Q.205 to Q.213) | � |

| Chapter - 16 Inspection,Search, Seizure and Arrest (Q.214 to Q.232) | � |

| Chapter - 17 Demand & Recovery - Part 2 (Q.233 to Q.247) | � |

| Chapter - 18 Liability to pay in certain cases (Q.248 to Q.254) | � |

| Chapter - 19 Advance Ruling (Q.255 to Q.267) | � |

| Chapter - 20 Appeal under GST (Q.268 to Q.273) | � |

| Chapter - 21 Misc. Topics (Q.274 to Q.287) | � |

About the Author

Sachin Jain

CA SACHIN JAIN is a practicing chartered accountant and partner at M/S JAIKUMAR JAIN & COMPANY, a leading ca firm in Rajasthan. He is a young and dynamic chartered accountant with unique and innovative thinking. He has vast experience in the field of Indirect Taxation, Auditing, and Commercial Laws etc. He is an advocate and company secretary also. He has trained more than 20,000 professionals across India. He has written many articles on GST, concurrent Audit, MCA Compliances etc. He has authored the book

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia