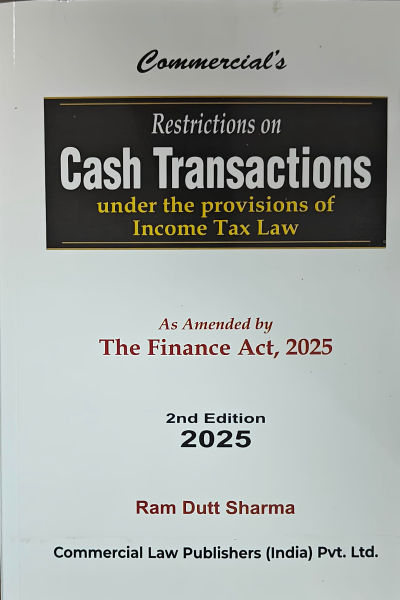

Restrictions on Cash Transactions

by Ram Dutt SharmaCONTENTS

| Chapter | |

| 1 Introduction | 1 |

| 2 Different stages of Evolution of Money | 8 |

| 3 Restrictions on Political Parties [Section 13A] | 13 |

| 4 Disallowance of Depreciation under Section 32 on Cash Payments [Second proviso to Section 43(1)] | 22 |

| 5 Disallowance of Expenditure on Specified Business - Cash payments [Section 35AD(8)(f)] | 24 |

| 6 Disallowance for Cash Payments exceeding Prescribed Limit [Section 40A(3)] | 25 |

| 7 If an expense is Recorded in the Prior Year but paidfor in the Next Year [Section 40A(3A)] | 81 |

| 8 Incentives to encourage Cashless Business Transactions[Sections 44AB & 44AD] | 89 |

| 9 Cash Transactions in Tax Audit Report - Reporting Requirement | 95 |

| 10 Unexplained Cash Attracts Section 69A | 99 |

| 11 Restrictions on Amount Borrowed or Repaid on Hundi [Section 69D] | 111 |

| 12 Restrictions on Income Tax Deductions [Chapter VIA] | 126 |

| 13 Compulsorily filing of Income Tax Return [Seventh proviso to section 139(1)] | 129 |

| 14 TDS from Cash Withdrawal Exceeding Rs. 1 Crore from Banks or Co-operative Bank or Post Office [Section 194N] | 132 |

| 15 Prohibition on Acceptance of Cash Loans,Deposits, etc. [Section 269SS] | 150 |

| 16 Restrictions on Cash Transactions [Section 269ST] | 182 |

| 17 Mandating acceptance of Payments through prescribed Electronic Modes [Section 269SU] | 190 |

| 18 Prohibition on repayment of Loans or Deposits in Cash [Section 269T] | 196 |

| 19 List of High Value Cash Financial Transactions reported to Income Tax Department | 213 |

| 20 Compliances in respect of Cash Transactions[Section 285BA read with rule 114E] | 219 |

| 21 Cash Deposits in Banks | 222 |

| 22 Treatment of Cash Gifts | 262 |

| 23 Treatment of Cash Sales | 268 |

| 24 Cash Discount | 285 |

| 25 Payment of on-Money for Purchase of Property | 289 |

| 26 Cash Transactions under GST | 301 |

| 27 Cash Restrictions on Charitable Trusts | 303 |

| 28 Cash transactions in Agricultural Sector | 310 |

| 29 Treatment of Cash found during Search Operation | 327 |

| 30 Cash Book - Test to be Satisfied | 349 |

| 31 Cash in Hand : Test to be Satisfied | 358 |

| 32 Negative Cash Balance | 364 |

| 33 Accounting methods for Income Tax Calculation [Section 145] | 371 |

| 34 Demonetisation | 381 |

| 35 Assessment of Cash Deposits in Operation Clean Money (OCM) Cases | 406 |

| 36 Revision of orders under Section 263 of the Income Tax Act,1961 over unexplained Cash Deposit | 442 |

| 37 Penalty for Failure to Comply with the Provisions of Section 269SS [Section 271D] | 455 |

| 38 Penalty for Failure to provide Facility to Pay Through Prescribed Electronic Modes [Section 271DB] | 521 |

| 39 Penalty for Failure to Comply with the Provisions of Section 269T [Section 271E] | 525 |

| 40 Prosecution Proceedings | 539 |

About the Author

Ram Dutt Sharma

Ram Dutt Sharma was born on 27th June, 1958 in Narnaul, Haryana. He got his post-graduation from M.D. University, Rohtak in 1980. He joined the Income-tax Department in the year 1983 and retired as Income Tax Officer on 30.06.2018. He worked at various stations of North-West Region of Income-tax Department. He has wide experience of all wings of Income-tax Department such as Assessment Unit, Special Range, TDS Wing, Investigation Wing, etc. He has been Contributing articles and addressing on topics relating to Income Tax at NADT Regional Campus, Chandigarh & Bhopal. He has also addressed number of seminars organized by the Income-tax Department, Chartered Accountants, Advocates and various Trade Associations.

He is recipient of first-ever Finance Minister's Award 2017, the Income Tax Departments highest honour for sustained devotion, commitment to duty & promoting excellence in the field of Direct Taxation at National Level. The Hon'ble Union Finance Minister, Shri ArunJaitley conferred this Finance Ministers Award for Excellence for his meritorious services at VigyanBhawan, New Delhi on 24.07.2017.

Awarded by Hon'ble Member (Revenue& TPS), CBT, Special Secretary to the Government of India Certificate of Appreciation for his contribution recognized and included in the chapter Miscellaneous Orders in Let Us Share A compilation of Best Practices & Orders Vol. VIII released on 31stOctober, 2016.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia