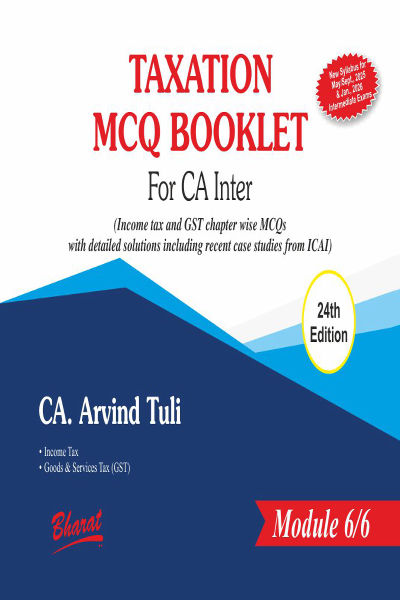

Taxation MCQ Booklet For CA Inter

by CA Arvind TuliCONTENTS

MODULE 6

PART 1. INCOME TAX QUESTIONS

| M1 - Part A Basics / Residential Status / Scope of Income / Rates of Tax | 1 |

| M1 - Part B Gifts | 23 |

| M1 - Part C Returns | 28 |

| M1 - Part D(a) Advance Tax | 34 |

| M1 - Part D(b) & (c) TDS and TCS | 38 |

| M1 - PART F House Property | 46 |

| M1 - PART G Salary | 52 |

| M2 - PART A Capital Gains | 58 |

| M2 - PART B & C Business & Profession | 66 |

| M2 - PART D Other Sources | 74 |

| M2 - PART E Clubbing | 78 |

| M2 - PART F Set off of losses | 83 |

| M2 - PART G Deductions from GTI | 87 |

| M2 - PART H Total Income | 94 |

PART 2. GST QUESTIONS

| M3 - Section A Introduction to GST | 99 |

| M3 - Section B GST Supply | 103 |

| M3 - Section C GST Exemptions | 109 |

| M3 - Section D GST Registration | 114 |

| M3 - Section E & F Charge of GST | 120 |

| M3 - Section G Time of Supply | 125 |

| M3 - Section H Value of Supply | 129 |

| M3 - Section I GST Payment | 135 |

| M3 - Section J Input Tax Credit - ITC | 138 |

| M3 – Section K Documents Including E-way bill & E_invoice | 144 |

| M3 - Section M to P Returns, TDS, TCS, Accounts & records, POS | 150 |

PART 3. INCOME TAX SOLUTIONS

| M1 - Part A Basics / Residential Status / Scope of Income / Rates of Tax | 156 |

| M1 - Part B Gifts | 164 |

| M1 - Part C Returns | 167 |

| M1 - Part D(a) Advance Tax | 170 |

| M1 - Part D(b) & (c) TDS and TCS | 172 |

| M1 - Part F House Property | 176 |

| M1 - Part G Salary | 180 |

| M2 - Part A Capital Gains | 187 |

| M2 - Part B & C Business & Profession | 193 |

| M2 - Part D Other Sources | 199 |

| M2 - Part E Clubbing | 201 |

| M2 - Part F Set off of losses | 205 |

| M2 - Part G Deductions from GTI | 208 |

| M2 - Part H Total Income | 213 |

PART 4. GST SOLUTIONS

| M3 - Section A Introduction to GST | 216 |

| M3 - Section B GST Supply | 218 |

| M3 - Section C GST Exemptions | 224 |

| M3 - Section D GST Registration | 228 |

| M3 - Section E & F Charge of GST | 233 |

| M3 - Section G Time of Supply | 238 |

| M3 - Section H Value of Supply | 243 |

| M3 - Section I GST Payment | 247 |

| M3 - Section J Input Tax Credit - ITC | 251 |

| M3 - Section K Documents Including E-way bill & E_invoice | 257 |

| M3 - Section M to P Returns, TDS, TCS, Accounts & records, POS | 261 |

PART 5. CASE STUDIES

| Income Tax | 267 |

| Goods & Service Tax | 279 |

About the Author

CA Arvind Tuli

FCA

Arvind Tuli is a well-known name in the field of CA education and direct taxation. Over the last 24 years, he has taught taxation to more than 1,50,000 CA and CS students through both face-to-face classroom teaching and online platforms. He is widely respected among students for his conceptual yet exam-oriented teaching methodology, which enables students to understand and internalise the law within the classroom itself. As a result, his students have consistently delivered strong results, with several securing All India highest ranks in CA Inter Taxation and CA Final Direct Tax.

In addition to teaching, he is a leading author in direct taxation with Bharat Law House, one of India's most respected legal publishers. His books are known for their clear structure, statutory linkage, and practical orientation, making them equally valuable for students and professionals seeking a strong conceptual foundation.

His handwritten summary charts are considered a valuable learning resource, as they condense complex taxation concepts into concise, easy-to-retain formats. Guided by his philosophy of "Fun while you learn," his classes are known to be engaging, disciplined, and academically rigorous.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia