2.3-3 Public Financial Institutionn 1.33

2.4 When an action for enforcement of security can be initiated 1.33 2.4-1 Who is ‘ Borrower’ 1.34 1.34 2.4-3 Meaning of ‘ Default’ 1.34 1.35 2.4-5 Foreclosure of loan 1.35 2.4-6 Meaning of Non - Performing Asset 1.35 2.4-7 Guidelines of RBI in respect of NPA 1.36 2.5 How to enforce security interest 1.36 2.5-1 Requirements of notice 1.37 2.5-2 Mode of serving notice 1.37 2.5-3 Provision when joint financing is involved 1.38 2.5-4 Opportunity to borrower to reply 1.39 2.6 Measures that can be taken after non-payment within 60 days for notice 1.40 2.6-1 Can debtor of borrower be asked to make payment directly to Bank/FI 1.41 2.6-2 Cost and expenses can be recovered from borrower 1.42 2.6-3 Excess amount to be refunded to borrower 1.43 2.6-4 Secured creditor can proceed against borrower for balance amount 1.43 2.6-5 Secured creditor can directly proceed against guarantor 1.44 2.7 How the secured creditor can exercise his right 1.45 2.7-1 Restrictions on borrower after receipt of notice 1.45 2.7-2 Secured Creditor gets only rights which borrower had 1.46 2.7-3 Mortgageg property can be given on lease and then lessee cannot be disposed 1.46 2.8 Other related provisions 1.47 2.8-1 Effect of transfer of asset to third person 1.47 2.8-2 Significance of 'as if transfer is made by owner of Asset' 1.47 2.8-3 Right of secured creditor subject to statury right 1.47 2.8-4 Pririty of other dues 1.50 2.9 Borrower can pay amount any time before sale or transfer of aaset and take back possession 1.53 2.9-1 Time limit for taking action after serving of notice 1.54 2.10 Jurisdiction of civil court barred 1.55 2.10-1 When Courts may inyerfere 1.55 2.11 Protection to secured creditor for acts in good faith 1.56

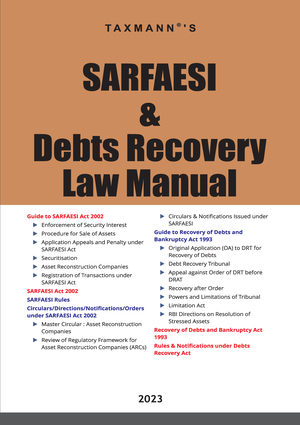

3

PROCEDURE FOR SALE OF ASSETS

3.1 Sale of asset directly or to ARC 1.57

3.1-1 Prudential norms for sale transactions 1.57 3.1-2 Assistance of magistrate to take over position 1.57 3.2 Procedure in respect of movable secured asset 1.60 .2-1 Valuation of movable secured asset 1.62 3.2-2 Sale movable secured assets 1.62 3.2-3 Transfer of mortgage, hypothecation or pledge of movable property or right or interest in security 1.63 3.2-4 Wide flexibility in sale of assets 1.64 3.2-5 Certificate of sale 1.64 3.3 Procedure in respect of sale of immovable secured asset 1.64 3.3-1 Valuation of immovable secured asset 1.65 3.3-2 Procedure for sale of ommovable secured assets 1.65 3.3-3 Provision in respect of immovable property subject to encumbrances 1.69 3.4 Appoinment of manager for secured assets 1.70 3.5 Provisions if borrower company is under winding up 1.72 3.5-1 Provision in respect of workmen's dues 1.74 3.5-2 Permission of Company Court required after winding up order made? 1.74 3.6 Takeover of managment of defaulting borrower 1.74 3.6-1 Change of directors/appointment of administrator 1.75 3.6-2 Effect of the notice of takeover of managment 1.75 3.6-3 Effect of takeover of managment 1.76 3.6-4 Guidelines for exercise of power 1.77

4

APPLICATION, APPEALS AND PENALTY UNDER SARFAESI ACT

4.1 Application against oder of Bank/FI before DRT 1.78

4.1-1 Who can file application before DRT 1.78 4.1-2 Application only after action has been taken under section 13(4) of SARFAESI 1.79 4.1-3 Any person can make application under section 17(1) 1.80 4.1-4 Application by lessee or talent 1.81 4.1-5 No automatic stay if application is filed 1.81 4.2 Jurisdiction of DRT where application to be filed 1.81 4.2-1 Consideration of application by DRT 1.82 4.2-2 DRT can consider and decide tenancy or leasehold 1.82 4.3 Appeal against order of DRT 1.83 4.3-1 Pre-deposit if appeal before DRAT 1.83 4.3-2 Procedure for appeal 1.84 4.3-3 Secured creditor or any person claiming right can file a caveat 1.85 4.4 Compensation to borrower for wrongful action by secure creditor 1.85 4.5 Punishment for offences 1.86 4.5-1 Ofeences by company 1.86

5

SECURITISATION

5.1 What is ‘securitisation’ 1.88

5.1-1 RBI guidelines on securitization of standard assets 1.89 5.1-2 Assignment of debts/NPAs between banks inter se is permissible 1.89 5.2 Purpose of securitisation 1.89 5.2-1 Securitisation with or without recourse 1.91 5.2-2 Definition of 'Securitisation' 1.91 5.2-3 Assets that can be securitised 1.91 5.2-4 Long dated assets and short dated funding sourcesa 1.92 5.2-5 M ortgage securitisation or asset secutisationo 1.92 5.3 How securitisation process works 1.92 5.3-1 Process of securitisation 1.93 1.94 5.3-3 Advantages of Securitisation 1.94 5.4 Credit rating is of assets securitised and not of the originator 1.96 5.5 Public issue and listing of securitised certificates or instruments 1.96 5.6 Accounting for securitisation 1.97 5.7 Legal framework for securitisation 1.97 5.7-1 Qualified Buyer(QB) 1.97 5.7-2 Forming a scheme and issue of security receipt 1.99 5.7-3 If assets not realised as per scheme 1.100 5.7-4 Registration of security receipt under Registation Act not required 1.100

6

ASSET RECONSTRUCTION COMPANIES

6.1 Role of ARC in SARFAESI Act 1.101

6.1-1 Registration of Asset Reconstruction Company 1.101 6.1-2 Requirements of Asset Reconstruction Compan y for registration 1.102 6.2 Procedure for registration of ARC 1.103 6.2-1 Cancellation of registration 1.103 6.2-2 Business that can be carried out by ARC 1.104 6.2-3 Asset Reconstruction comapany exempt from certain NBFC provisions 1.104 6.3 Powers of RBI over ARC 1.105 6.4 RBI guidelines for ARC 1.105 6.4-1 Policy of asset reconstruction 1.106 6.4-2 Securitisation and ARC 1.106 6.4-3 Other requirements in respect of ARC 1.106 6.5 Operational guidelines to ARC 1.107 6.6 Penalty on ARC for non-compaliance 1.107 6.7 Acquiring financial assets by ARC from Bank/FI 1.108 6.7-1 Modes of acquiring financial asset 1.109 6.7-2 Is it transfer of actionable claim 1.110 6.7-3 Company enters into shoes of Bank/FI after acquring asseto 1.110 6.7-4 Transfer of pending applications to one DRT 1.111 6.8 Notice to borrower/Register etc. 1.112 6.8-1 Effect of the notice 1.112 6.8-2 Arbitration Mandatory 1.113 6.9 Asset Reconstruction 1.113 6.9-1 Measures for asset reconstruction 1.114

7

REGISTRATION OF TRANSACTIONS UNDER SARFAESI ACT

7.1 Central Registry 1.115

7.1-1 Registration with Central Registry in addition to other registration that may be required 7.1-2 Maintenance of Central Register 1.116 7.1-3 Integration of Central Registry with other registering authorities 1.117 7.2 Registration of agreement 1.118 7.2-1 Rectifiaction in matter of delay or omission registration,modifiaction and satisfaction 1.118 7.2-2 Registration under Registration Act required in case of immovable property? 1.118 7.2-3 Satisfaction of Central Register 1.119 7.2-4 Inspection of Central Register 1.119 7.3 Registration of securities interest by Secured and other creditors 1.120 7.3-1 Creditors other than secured creditors can register security interest 1.120 7.3-2 Registration of transactions will be deemed to be public notice 1.121 7.3-3 No right of enforcement of securities unless security interest is registered 1.122 7.3-4 Priority to secured creditors if debt registered 1.122 7.4 Penalty for default 1.123

SUBJECT INDEX 1.125

DIVISION TWO

SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS AND ENFORCEMENT OF SECURITY INTEREST ACT, 2002

DIVISION THREE

RULES

Security Interest (Enforcement) Rules,2002 3.3 Securitisation and Reonstruction of Financial Asset and Enforcement of Security Interest(Central Registry)Rules,2011 3.35 Tribunals Reforms Act,2021 3.43

DIVISION FOUR

CIRCULARS/DIRECTIONS/NOTIFICATIONS/ORDERS

Reserve Bank of India(Securitisation of Standard Assets) Directions,2021 4.3 Master Circular: Asset Reconstruction Companies 4.48 Review of Regulatory Framework for Asset Reconstruction Companies(ARCs) 4.45 Circulars & Notifications issued under Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2004 4.98 Removal of Difficulty Order of 2002 4.108 Removal of Difficulty Order of 2004 4.110 Compendium of Old Instructions issued prior to Master Circular on Asset Reconstruction Companies 4.112

BOOK TWO

RECOVERY OF DEBTS AND BANKRUPTCY ACT, 1993

DIVISION FIVE

GUIDE TO RECOVERY OF DEBTS AND BANKRUPTCY ACT, 1993

1

BACKGROUND OF RDB ACT

1.1 Expeditious Recovery of bad debts 5.5

5.6 1.1-2 Overall scheme of the Act 5.6 1.1-3 RDB Act is mainly a procedural Act 5.7 1.1-4 Jurisdiction of DRT under SARFAESI Act 5.7 1.1-5 RDB Act and SARFAESI Act are compimentary to each other, actions under both possible 5.8 1.1-6 Actions can be taken under SARFAESI Act even if proceeding pending before DRT 5.8 1.1-7 Parallel proceedings under SARFAESI/RDBA and Insolvency Code permissible ARALLEL PROCEEDIN 5.8 1.2 Priority to secured creditors under RDB Act 5.10 1.3 Overriding provisions of RDB Act 5.10 1.4 Jurisdiction of civil court is barred 5.13 1.4-1 Court decree can be executed by DRT 5.14 1.4-2 Decree of foreign court should be executed through DRT only 5.14

2

ORIGINAL APPLICATION (OA) TO DRT FOR RECOVERY OF DEBTS

2.1 Who can apply to DRT under RDBA 5.15

2.1-1 Banks and Financial Institutions can apply to DRT for recovery of debt due 5.15 2.2 Monetary limit for applicability of the RDB Act 5.17 2.2-1 Limitation Act applicable to DRT 5.17 2.3 Meaning of 'debt' 5.18 5.19 2.3-2 Wide definition of 'debt' 5.20 2.3-3 Debt becomes due only when it is payable 5.21

3

DEBT RECOVERY TRIBUNAL

3.1 DRT as Adjudicating Authority for recovery of loan 5.22

3.2 Powers and jurisdication of DRT 5.24 3.2-1 Counter-claims can be considered bt DRT 5.24 3.3 Other Powers of DRT and DRAT 5.26 3.3-1 DRT and DRAT can review their interim and final orders 5.27 3.3-2 DRT cannot adjudicate workmen's claims 5.27 3.4 Procedure for Application before Debt Recovery Tribunal 5.28 3.4-1 Applications,documents and statements in electronic form 5.30 3.4-2 Procedure after filing of Original Application 'OA' 5.30 3.4-3 Final order, distribution of assets and recovery 5.33 3.5 Proceedings against guarantor before DRT 5.34 3.6 Procedure in office DRT 5.34 3.7 Common provisions relating to DRT and DRAT 5.35 3.8 List of DRT and DRAT benches as in 2022 5.37

4

APPEAL AGAINST ORDER OF DRT BEFORE DRAT

4.1 Appeal before DRAT 5.41 4.2 Jurisdictions of DRAT 5.42 4.3 Procedures at DRAT 5.43

4.3-1 Pre-deposit for filing appeal 5.44 4.3-2 Appeal against order of Adjudicating Authority or under Insolvency and Bankruptcy Code 5.45 4.3-3 Appeal against interim orders of DRT 5.45 4.4 DRAT and DRT can review their interim and final orders 5.45 4.5 Further appeals after order of DRAT 5.46 4.5-1 Which High Court will have jurisdiction 5.47

5

RECOVERY AFTER ORDER

5.1 Recovery powers after issue of certificate 5.49

6

POWERS AND LIMITATIONS OF TRIBUNAL

6.1 General Provisions in respect of Tribunal 5.53

6.1-1 DRT and DRAT are Tribunals constituted under Statue 5.54 6.1-2 Tribunal has trappings of 'Court' but is not a 'Court' 5.54 6.2 Inherent and Implied Powers of Tribunal 5.56 6.2-1 Power includes power to execute/implement the order 5.57 6.2-2 Some inherent and incidental powers of Tribunal 5.58 6.2-3 Tribunal can recalls/restore orders 5.59 6.3 Tribunal is final fact finding authority 5.62 6.4 Tribunal cannot review its orders unless the powers are specifically conferred on them 5.64 6.5 Mistakes apparent from records can be rectified by Tribunal 5.65 6.5-1 Rectification of order by Tribunal if Point raised but not considered 5.67 6.5-2 Rectification of orders if subsequent contrary decisions of other Courts,particularly SC or retrospective amendment to Act 5.68

7

LIMITATION ACT

7.1 Uncertainly in litigation bad 5.69

7.1-1 Limitation Act does not extinguish right,it only extinguishes remedy 5.70 7.1-2 Question of limitation must be considered even if not raised 5.71 7.1-3 No equity in Limitation Act,time period provided can be arbitrary 5.71 7.1-4 Limitation Act applies only to Courts 5.71 7.2 Bar of limitation in filing a suit 5.72 7.2-1 Period of limitation as prescribed in Schedule to the Limitation Act 5.72 7.2-2 Period of filing and application can be extended for sufficient reasons,but not suit 5.73 7.2-3 If court is closed on last day i.e. holoday 5.74 7.2-4 Continuous running of time 5.74 7.2-5 Extension of time if party was disabled 5.74

7.3 Computation of period of limitation 5.75 7.3-1 Time when party was pursuing remedy in wrong forum 5.75 7.3-2 Effect of fraud or mistake 5.76 7.4 Effect of acknowledgement in writing 5.76 7.4-1 If debt acknowledged,limitation starts from that date 5.77 7.4-2 Showing amount as payable in balance sheet is 'acknowledgement of debt' and sufficient to overcome bar of limitation 5.77 7.5 Fresh period of limitation of part payment made 5.78 7.6 Continuing breaches and torts 5.78 7.7 Acquisition of easement rights if used continuosly for 20 years 5.78 7.8 Provisions in special law prevails over provisions in Limitation Act 5.78 7.9 Limitation in criminal matters 5.79

8

RBI DIRECTIONS ON RESOLUTION OF STRESSED ASSETS

8.1 Background 5.81

8.1-1 Review of Resolution Timelines in view of COVID-19 5.82 8.2 RBI Directions on Prudential Framework for Resolution of Stresses Assetsr 5.83 8.2-1 Purpose of the RBI directions 5.83 8.3 Framework for Resolution of Stressed Assets as directed by RBI 5.84 8.3-1 Early identification and reporting of stress 5.84 8.3-2 Implementation of Resolution Plan 5.85 8.3-3 Implementation Conditions for RP 5.86 8.4 Provisioning in case of Delayed Implementation of Resolution Plan 5.87 8.5 Prudential Norms 5.87 8.6 Supervisory Review by RBI 5.87 8.7 Disclosures by lenders in financial statements 5.88 8.8 Exceptions to the directions for stressed assets 5.88

SUBJECT INDEX 5.89

DIVISION SIX

RECOVERY OF DEBTS AND BANKRUPTCY ACT, 1993

DIVISION SEVEN

RULES

Debts Recovery Tribunal (Financial and Administrative Power) Rules, 1997 7.3 Debts Recovery Tribunal (Procedure)Rules, 1993 7.7 Debts Recovery Tribunal (Procedure for Appointment as Presiding Officer of the Tribunal) Rules, 1998 7.27 Debts Recovery Tribunal (Procedure for Investigation of Misbehaviour or Incapacity of Presiding Officer)Rules, 2010 7.33 Debts Recovery Appellate Tribunal(Procedure) Rules,1994 7.41 Debts Recovery Appellate Tribunal(Procedure for Appoinment as Chairperson of the Appellate Tribunal) Rules,1998 7.53 Debts Recovery Appellate Tribunal(Financial Administrative Power) Rules,1997 7.59 Debts Recovery Appellate Tribunal (Refund of Court Fee) Rules,2013 7.63 Debts Recovery Tribunals & Debts Recovery Appellate Tribunals Electronic Filing Rules,2020 7.67

DIVISION EIGHT

NOTIFICATIONS

About the Author

Taxmann

Taxmann Publications has a dedicated

The statutory Keep the readers Prepare the Every content All evidence-based The golden rules of Choose a font and

View other books from GST

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CCI Books provides books by renowned authors and publishers. 5k+ Courses & Books, 32k+ Total Learners and 12 years+ Experience of Online Learning delivery.

We Accept All Major Debit & Credit Cards

© 2026 CAclubindia.com. India's largest network for Finance Professionals

India's largest network for

CAclubindia

CAclubindia