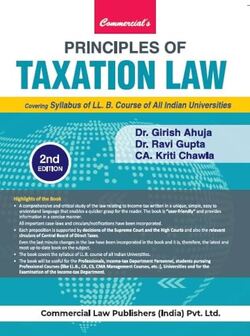

Principles of Taxation Law

by Dr. Girish Ahuja, Dr. Ravi Gupta & CA Kriti ChawlaDetailed Contents

| Preface | vii |

| Contents at a Glance | ix |

Part 1

Direct Taxation

| Chapter 1 Introduction to Tax Law | 3 |

| 1.1 History behind Taxation in India | 3 |

| 1.2 Meaning of Tax? | 3 |

| 1.3 Uses of Tax | 4 |

| 1.4 Components of Tax | 5 |

| 1.5 What makes a good tax system? | 5 |

| 1.6 Other Canons of Taxation in Modern World | 6 |

| 1.7 Types of Taxes | 6 |

| 1.8 Organisational setup for Tax Administration in India | 7 |

| 1.9 Central Board of Direct Taxes (CBDT) | 8 |

| 1.10 Central Board of Indirect taxes, and Customs | 8 |

| 1.11 Other Types of Levy | 8 |

| Chapter 2 Taxes and Constitution | 10 |

| 2.1 Constitutional Background [Pre-GST] | 10 |

|

11 |

|

11 |

| 2.2 Tax and Freedom to Trade, Commerce and Intercourse (Part XIII of the Constitution of India) | 12 |

| Chapter 3 Interpretation of Tax Statute | 14 |

| 3.1 Principles of Interpretation | 14 |

| Chapter 4 Basic Concepts of Direct Taxation | 24 |

| 4.1 Sources of Income Tax Law | 24 |

| 4.2 Scheme of Taxation | 26 |

| 4.3 Important Concepts | 27 |

|

27 |

|

29 |

|

29 |

|

32 |

|

33 |

|

36 |

|

37 |

|

38 |

|

38 |

|

49 |

|

50 |

|

50 |

| 4.4 Method of Accounting [Section 145] | 50 |

| Chapter 5 Scope of Total Income & Residential Status [Sections 5 to 9B] | 51 | |

| 5.1 Definition of Total Income [Section 2(45)] | 51 | |

| 5.2 Scope of Total Income/Incidence of tax [Section 5] | 51 | |

|

51 | |

|

52 | |

|

52 | |

| 5.3 Need to determine Residential Status? | 53 | |

| 5.4 Basic rules for determining residential status of an assessee | 53 | |

| 5.5 Rules for determining the residential status of an individual [Sections 6(1) & 6(1A)] | 53 | |

|

54 | |

|

55 | |

|

56 | |

|

57 | |

|

57 | |

| 5.6 Residential Status of Hindu Undivided Family (HUF) [Section 6(2)] | 65 | � |

|

65 | |

|

65 | |

|

66 | |

|

66 | |

| 5.7 Residential Status of Firm, Association of Persons (AOP), Body of Individuals (BOI) and of other persons (except companies) [Sections 6(2) and 6(4)] | 67 | |

|

67 | |

|

67 | |

| 5.8 Residential Status of a Company [Section 6(3)] | 67 | |

|

67 | |

|

67 | |

| 5.9 Incomes received or deemed to be received in India [Section 7] | 71 | |

| 5.10 Incomes which accrue or arise in India or are deemed to accrue or arise in India[Section 9] | 72 | |

| 5.11 Income on receipt of capital asset or stock in trade by specific person from specified entity [Section 9B inserted w.r.e.f. Assessment Year 2021-22] | 86 | |

| 5.12 The provisions regarding incidence of tax above may be summarised in the following table | 86 |

| Chapter 6 Computation of Total Income and Tax Liability [Sections 14, 14A, 288A and 288B] | 91 |

| 6.1 Heads of Income [Section 14] | 91 |

| 6.2 No deduction for expenditure incurred in respect of exempt income against taxable income [Section 14A] | 91 |

| 6.3 What is Gross Total Income [Section 80B(5)] | 92 |

| 6.4 What is Total Income [Section 2(45)] | 92 |

| 6.5 How to Compute Total Income | 92 |

| Chapter 7 Income under the Head "Salaries" [Sections 15 to 17] | 94 |

| 7.1 Computation of Income under the head Income from "Salaries" | 94 |

|

94 |

|

96 |

|

96 |

|

96 |

|

96 |

|

96 |

|

97 |

| 7.2 Basis of Charge [Section 15] | 97 |

|

98 |

|

98 |

| 7.3 Meaning of Salary | 99 |

| 7.4 Wages | 100 |

| 7.5 Annuity | 100 |

| 7.6 Retirement benefits | 100 |

| 7.7 Treatment of Bonus | 100 |

| 7.8 Salary in lieu of notice period | 101 |

| 7.9 Fee and Commission | 101 |

| 7.10 Overtime Payments | 101 |

| 7.11 Meaning and Type of Allowances | 101 |

| 7.12 House Rent Allowance [Section 10(13A) and Rule 2A] (exemption under section 10(13A) allowed, only when the employee opts to be taxed under the old regime) | 101 |

| 7.13 Prescribed allowances which are exempt to a certain extent [Section 10(14)] | 102 |

|

103 |

|

104 |

| 7.14 Treatment of Entertainment Allowance | 105 |

| 7.15 Allowances which are exempt in case of certain persons if such person opts to be taxed under the old regime | 106 |

| 7.16 Allowances which are fully taxable under both regimes 106 | |

| 7.17 What are perquisites? | 106 |

| 7.18 Definition of 'Perquisite' as per section 17(2) | 107 |

| 7.19 Perquisites which are taxable in the hands of all categories of employees | 109 |

| 7.20 Perquisites which are taxable only in the case of specified employees | 110 |

|

111 |

| 7.21 Rent free accommodation or accommodation provided at concessional rate | 112 |

| 7.22 Valuation of monetary obligation of the employee discharged by the employer | 112 |

| 7.23 Valuation of Life Insurance premium/deferred annuity premium paid/payable by the employer | 113 |

| 7.24 Fringe benefits or amenities which shall be taxable perquisite in the hands of all employees | 113 |

|

117 |

| 7.25 Valuation of motor car/other vehicles [Rule 3(2)] | 117 |

| 7.26 Provision by the employer of services of a sweeper, a gardener, a watchman or personal attendant [Rule 3(3)] | 120 |

| 7.27 Value of benefit to the employee resulting from the supply of gas, electric energy or water for household consumption [Rule 3(4)] | 120 |

| 7.28 Valuation in respect of free or concessional educational facilities to any member of employees' household [Rule 3(5)] | 121 |

| 7.29 Free or concessional journey given to the transport employees and their family members [Rule 3(6)] | 121 |

| 7.30 Value of any specified security or sweat equity shares | 122 |

| 7.31 Contribution made by the employer in a recognised provident fund, in the scheme referred to in section 80CCD(1); and in an approved superannuation fund exceeding `7,50,000 [Section 17(2)(vii)] | 123 |

| 7.32 Annual Accretion to the balance at the credit of the fund or scheme referred to in section 17(2)(vii) [Section 17(2)(viia) inserted w.e.f. A.Y. 2021-22] | 123 |

| 7.33 Contribution made by the Central Government in the previous year, to the Agniveer Corpus Fund account of an individual enrolled in the Agnipath Scheme referred to in section 80CCH. | 124 |

| 7.34 Tax-free Perquisites (for all employees) | 124 |

| 7.35 Treatment of medical facilities [Proviso to section 17(2)] | 126 |

| 7.36 Treatment of Leave Travel Concession or Assistance (LTC/LTA) [Section 10(5)][Exemption will not be available if the employee opts to be taxed under section 115BAC] | 127 |

| 7.37 Profits in lieu of salary [Section 17(3)] | 129 |

| 7.38 Gratuity | 130 |

|

132 |

|

132 |

| 7.39 Treatment of Pension [Section 17(1)(ii)] | 132 |

| 7.40 Treatment of Leave Salary | 133 |

| 7.41 Retrenchment Compensation [Section 10(10B)] | 135 |

| 7.42 Compensation received on Voluntary Retirement [Section 10(10C)] | 135 |

| 7.43 Contribution by the employer to recognised provident fund | 136 |

| 7.44 Interest credited to recognised provident fund | 136 |

| 7.45 Amount comprised in the transferred balance | 136 |

| 7.46 Standard deduction [Section 16(ia)] | 136 |

| 7.47 Entertainment Allowance [Section 16(ii)] | 136 |

| 7.48 Tax on Employment (Professional Tax) [Section 16(iii)] | 137 |

| 7.49 Treatment of Provident Fund | 137 |

|

137 |

|

138 |

| 7.50 Deduction from gross total income | 141 |

| Chapter 8 Income under the Head "Income from House Property" [Sections 22 to 27] | 142 |

| 8.1 Chargeability [Section 22] | 142 |

| 8.2 Basis of Charge | 142 |

| 8.3 Essential conditions for taxing income under this head | 143 |

| 8.4 Cases of Composite Rent | 146 |

| 8.5 When income from house property is not charged to tax | 147 |

| 8.6 What is Annual Value? | 147 |

| 8.7 Computation of annual value of a property [Section 23(1)] | 148 |

| 8.8 Treatment of unrealised rent [Explanation to section 23(1)] | 151 |

| 8.9 Deductions from income from house property [Section 24] | 152 |

| 8.10 Computation of Income of a property which is self-occupied for residential purposes or which could not actually be self occupied owing to employment [Section 23(2), (3) & (4)] | 153 |

|

153 |

|

154 |

|

154 |

|

154 |

| 8.11 Computation of income of house property which is partly let and partly self occupied | 155 |

| 8.12 No notional income for house property held as stock-in-trade for a period upto two years [Section 23(5)] | 155 |

| 8.13 Interest when not deductible from "Income from House Property" [Section 25] | 156 |

| 8.14 Special provision for arrears of rent and unrealised rent received subsequently [Section 25A] | 156 |

| 8.15 Property owned by Co-owners [Section 26] | 156 |

| 8.16 Can Annual Value (Net Annual Value) be negative? | 156 |

| 8.17 Can there be any loss under the head income from house property? 156 |

| Chapter 9 Income under the Head "Profits and Gains of Business or Profession"[Sections 28 to 44D] | 158 |

| 9.1 Business or Profession | 158 |

| 9.2 General and specific provisions of chargeability of tax under section 28(i) to (vii) | 159 |

|

161 |

| 9.3 Profits and gains of business | 162 |

| 9.4 Business must be carried on during the previous year | 162 |

|

163 |

| 9.5 Business loss | 163 |

|

164 |

| 9.6 Legal business v illegal business | 164 |

| 9.7 Cases where income from certain business is not taxable under the head 'Profits and gains of business' | 164 |

| 9.8 Income from business or profession — how to be computed | 164 |

| 9.9 General principles for allowability of deductions | 165 |

| 9.10 Distinction between business expense and business loss | 165 |

| 9.11 Method of Accounting [Section 145] | 165 |

|

166 |

| 9.12 Expenses which are expressly allowed as a deduction [Sections 30 to 37] | 166 |

| 9.13 Rent, rates, taxes, repairs and insurance for buildings [Section 30] | 167 |

|

167 |

|

167 |

| 9.14 Repairs and insurance of machinery, plant and furniture [Section 31] | 167 |

| 9.15 Depreciation [Section 32] | 168 |

|

169 |

|

172 |

|

173 |

|

174 |

|

175 |

|

177 |

|

177 |

|

177 |

|

178 |

| 9.16 Special provisions for depreciation in certain cases | 178 |

|

178 |

|

179 |

|

180 |

|

180 |

| 9.17 Carry forward and set off of unabsorbed depreciation [Section 32(2)] | 181 |

| 9.18 Tea Development Account, Coffee Development Account and Rubber Development Account [Section 33AB] | 181 |

| 9.19 Site Restoration Fund [Section 33ABA] | 184 |

| 9.20 Expenditure on Scientific Research [Section 35] | 186 |

|

186 |

|

187 |

|

187 |

|

187 |

|

189 |

| 9.21 Expenditure for obtaining licence to operate telecommunication services and amortisation of spectrum fee for purchase of spectrum | 189 |

| 9.22 Deduction in respect of expenditure on specified business [Section 35AD] | 192 |

| 9.23 Expenditure by way of payments to associations and institutions for carrying out Rural Development Programmes [Section 35CCA] | 194 |

| 9.24 Deduction for expenditure incurred on agricultural extension project [Section 35CCC] | 194 |

| 9.25 Deduction for expenditure incurred by a company on skill development project [Section 35CCD] | 195 |

| 9.26 Amortisation of certain preliminary expenses [Section 35D and Rule 6AB] | 195 |

| 9.27 Amortisation of expenditure in case of amalgamation or demerger [Section 35DD] | 197 |

| 9.28 Amortisation of expenditure incurred under voluntary retirement scheme [Section 35DDA] | 197 |

| 9.29 Deduction for expenditure on prospecting, etc., for certain minerals [Section 35E and Rule 6AB] | 197 |

| 9.30 Other deductions [Section 36] | 198 |

|

198 |

|

198 |

|

199 |

|

199 |

|

199 |

|

199 |

|

200 |

|

200 |

|

200 |

|

200 |

|

201 |

|

201 |

|

202 |

|

202 |

|

203 |

|

203 |

|

203 |

|

203 |

| 9.31 General Deductions [Section 37(1)] | 203 |

|

204 |

|

205 |

|

206 |

| 9.32 Advertisement to political parties [Section 37(2B)] | 206 |

| 9.33 Building, plant and machinery or furniture not exclusively used for the purpose of business or profession [Section 38] | 206 |

| 9.34 Amounts not deductible [Section 40] | 207 |

| 9.35 Expenses or payments not deductible in certain circumstances: [Section 40A] | 209 |

|

209 |

|

210 |

|

212 |

| 9.36 Disallowance in respect of contributions to non-statutory funds [Section 40A(9)] | 212 |

| 9.37 Marked to market loss or other expected loss not to be allowed except provided in section 36(1)(xviii) [Section 40A(13) inserted] | 213 |

| 9.38 Certain deductions to be allowed only on actual payment [Section 43B] | 213 |

| 9.39 Special provision for full value of consideration for transfer of assets other than capital assets in certain cases [Section 43CA] | 215 |

| 9.40 Computation of income from construction and service contracts [Section 43CB inserted] 216 | |

| 9.41 How to compute the income from business or profession | 216 |

| 9.42 Undisclosed income and investments taxed as deemed income | 217 |

|

217 |

|

218 |

|

218 |

|

218 |

|

218 |

|

218 |

|

218 |

| 9.43 Deemed profits chargeable to tax | 219 |

| 9.44 Maintenance of accounts by certain persons carrying on profession or business [Section 44AA and Rule 6F] | 222 |

|

222 |

|

223 |

|

224 |

|

225 |

| 9.45 Compulsory audit of accounts [Section 44AB] | 225 |

|

226 |

|

227 |

| 9.46 Special provisions for computing profits and gains of any business (excluding the business covered under section 44AE) [Section 44AD] | 227 |

| 9.47 Special provision for computing profits and gains of profession on presumptive basis [Section 44ADA] | 229 |

| 9.48 Special provisions for computing profits and gains of business of plying, hiring or leasing goods carriages [Section 44AE] | 230 |

| 9.49 Special provisions for computing profits and gains [Sections 44B, 44BB, 44BBA and 44BBB] | 232 |

| Chapter 10 Income under the Head "Capital Gains" [Sections 45 to 55A] | 235 |

| 10.1 Basis of Charge [Section 45(1)] | 235 |

| 10.2 (A) There must be a capital asset | 235 |

|

235 |

|

240 |

| 10.3 Capital gain arises only when there is a transfer of capital asset. If the capital asset is not transferred or if there is any transaction which is not regarded as transfer (See para 10.3b), there will not be any capital gain. However, in case of profits or gains from insurance claim due to damage or destruction of property, there will be capital gain although no asset has been transferred in such case. | 244 |

|

244 |

|

250 |

| 10.4 Capital gain should arise in the previous year in which transfer took place | 253 |

| 10.5 Computation of capital gains [Section 48] | 253 |

| 10.6 Full value of consideration | 255 |

| 10.7 Expenses on transfer | 257 |

| 10.8 Cost of acquisition [Section 55(2)] | 257 |

|

258 |

|

262 |

|

263 |

|

264 |

|

264 |

|

265 |

|

265 |

| 10.9 Treatment of advance money received [Section 56(2)(ix), w.e.f. A.Y. 2015-16] | 270 |

| 10.10 Cost of improvement [Section 55(1)(b)] | 271 |

| 10.11 Indexed cost of acquisition (Explanation (iii) to section 48) | 271 |

|

272 |

|

275 |

| 10.12 Indexed cost of improvement [Explanation (iv) to section 48] | 276 |

| 10.13 Computation of capital gain in certain cases | 277 |

|

277 |

|

278 |

|

279 |

|

279 |

|

280 |

|

280 |

|

288 |

|

290 |

|

291 |

|

291 |

|

291 |

|

292 |

|

293 |

|

294 |

|

295 |

|

295 |

|

296 |

|

297 |

|

297 |

|

298 |

|

298 |

|

299 |

|

299 |

|

300 |

| 10.14 Transfer of securities by depository [Section 45(2A)] | 300 |

| 10.15 Withdrawal of exemption in certain cases [Section 47A] | 301 |

| 10.16 Capital gain in the case of transfer of shares/debentures by non-residents (Proviso 1 to section 48 and rule 115A) | 303 |

|

304 |

|

304 |

| 10.17 Types of exemption of capital gains | 304 |

| 10.18 Profit on transfer of house property used for residence [Section 54] | 305 |

| 10.19 Capital Gain on transfer of land used for agricultural purposes [Section 54B] | 310 |

| 10.20 Capital Gain on compulsory acquisition of land and buildings forming part of an industrial undertaking [Section 54D] | 312 |

| 10.21 Capital gain on transfer of long-term capital assets being land or building or both not to be charged on investment in certain bonds [Section 54EC] | 314 |

| 10.22 Capital gain not to be charged on investment in units of a specified fund [Section 54EE](This section has no significance as no long-term specified asset has been notified till date) | 316 |

| 10.23 Capital Gain on transfer of asset, other than a residential house [Section 54F] | 316 |

| 10.24 Capital gain on transfer of assets in cases of shifting of industrial undertakings from urban areas [Section 54G] | 320 |

| 10.25 Exemption of capital gain on transfer of assets of shifting of industrial undertaking from urban area to any Special Economic Zone [Section 54GA] | 322 |

| 10.26 Exemption of long-term capital gains tax on transfer of residential property if invested in a new manufacturing SME company [Section 54GB] | 323 |

| 10.27 Extension of time limit for acquiring new asset or depositing or investing amount of capital gain, in case of compulsory acquisition [Section 54H] | 326 |

| 10.28 Tax on short-term capital gains in case of equity shares and units of equity oriented fund [Section 111A] | 326 |

| 10.29 Computation of tax on long-term capital gains other than referred to in section 112A [Section 112] | 327 |

| 10.30 Rate of tax on long-term capital gain (other than referred to in section 112A) in certain cases | 329 |

| 10.31 Tax on long-term capital gains in certain cases [Section 112A] | 329 |

| Chapter 11 Income under the Head "Income from Other Sources" [Sections 56 to 59] | 335 |

| 11.1 Chargeability | 335 |

| 11.2 Method of Accounting | 335 |

| 11.3 Specific incomes included under 'Income from Other Sources' [Section 56(2)] | 335 |

| 11.4 Other incomes which are normally included under the head 'Income from Other Sources' | 337 |

| 11.5 Taxability of Dividend [Section 56(2)(i)] | 338 |

|

338 |

|

341 |

| 11.6 Winnings from Lotteries, Crossword Puzzles, Horse Races and Card Games [Section 56(2)(ib)] | 341 |

|

|

|

|

| 11.7 Special rate of income-tax in case of winnings from online games [Section 115BBJ inserted by the Finance Act, 2023, w.e.f. A.Y. 2024-25] | 342 |

| 11.8 Interest on Securities [Section 56(2)(id)] | 342 |

|

342 |

|

343 |

|

343 |

| 11.9 Income from letting out of machinery, plant or furniture [Section 56(2)(ii)] | 343 |

|

343 |

|

343 |

| 11.10 Income of any person to include not only gift of money from any person(s) but also the gift of property (whether movable or immovable) or property acquired for inadequate consideration [Section 56(2)(x)] | 344 |

| 11.11 Share premium in excess of the fair market value to be treated as income in the hands of closely held company [Section 56(2)(viib)] | 346 |

| 11.12 Interest on compensation or enhanced compensation [Section 56(2)(viii)] | 346 |

| 11.13 Forfeiture of advance received for transfer of a capital asset to be taxed under the head "income from other sources" [Section 56(2)(ix)] | 347 |

| 11.14 Any sum received, including the amount allocated by way of bonus, at any time during a previous year, under a life insurance policy, which is not exempt under Section 10(10D) [Section 56(2)(xiii) inserted by the Finance Act, 2023 w.e.f. A.Y. 2024-25] | 347 |

| 11.15 Family pension payments received by the legal heirs of a deceased employee | 348 |

| 11.16 Contribution of the employee towards his welfare fund, deducted/received by the employer [Section 56(2)(ic)] | 348 |

| 11.17 Any other income taxable under this head | 348 |

| 11.18 Amounts not deductible in computing the income under the head 'Income from Other Sources' [Section 58] | 348 |

| 11.19 Deemed income chargeable to tax [Section 59] | 350 |

| Chapter 12 Income of Other Persons Included in Assessee's Total Income (Clubbing of Income) [Sections 60 to 65] | 351 |

| 12.1 Transfer of income where there is no transfer of assets [Section 60] | 352 |

| 12.2 Revocable transfer of assets [Section 61] | 352 |

|

352 |

|

352 |

| 12.3 Income of an individual to include income of spouse, minor child, etc. [Section 64] | 353 |

|

353 |

|

355 |

|

357 |

|

357 |

|

357 |

| 12.4 Clubbing of income of a minor child [Section 64(1A)] | 358 |

| 12.5 Income from self-acquired property converted to joint family property [Section 64(2)] | 359 |

| 12.6 Under which head of income will the clubbed income be assessed | 360 |

| 12.7 Liability of person i.e. the transferee in respect of income included in the income of another person i.e. transferor [Section 65] | 360 |

| Chapter 13 Set off or Carry Forward and Set off of Losses [Sections 70 to 80] | 361 |

| 13.1 Set off of loss from one source against income from another source under the same head of income [Section 70] | 361 |

| 13.2 Set off of loss from one head against income from another head (Inter-head adjustment) [Section 71] | 362 |

| 13.3 Carry forward and set off of losses | 364 |

|

365 |

| 13.4 Carry forward and set off of loss from house property [Section 71B] | 365 |

| 13.5 Carry forward and set off of business losses [Section 72] | 366 |

| 13.6 Set off and Carry forward and Set off of Speculation Loss [Section 73] | 370 |

| 13.7 Set off and carry forward and set off of loss of a specified business referred to in section 35AD [Section 73A] | 370 |

| 13.8 Carry forward of losses under the head 'capital gains' [Section 74] | 371 |

| 13.9 Set off and carry forward and set off of loss from activity of owning and maintaining race horses [Section 74A] | 371 |

| 13.10 Brought forward losses must be set off in the immediately succeeding year/years 372 | |

| 13.11 Special provisions of set off of losses in case of an individual or HUF or AOP/BOI or Artificial Juridical Person who is taxable under section 115BAC(1A) | 372 |

| 13.12 Carry forward and set off of the accumulated business losses and unabsorbed depreciation allowance in amalgamation or demerger, etc. [Section 72A] | 373 |

|

373 |

|

373 |

|

373 |

|

373 |

|

374 |

| 13.13 Losses of firms | 374 |

| 13.14 Carry forward and set off of losses on succession of any person [Section 78(2)] | 374 |

| 13.15 Carry forward and set off of losses in case of certain companies [Section 79] | 374 |

| Chapter 14 Deductions to be made in Computing Total Income [Sections 80A to 80U (Chapter VIA)] | 377 |

| 14.1 Basic rules of deductions [Sections 80A/80AB/80AC] | 377 |

| 14.2 Deduction on account of certain payments are allowed from sections 80C to 80GGC.Deduction in respect of Life Insurance Premium, deferred annuity,contributions to provident fund,subscription to certain equity shares or debentures, etc. [Section 80C] | 378 |

| 14.3 Deduction in respect of contribution to certain pension funds [Section 80CCC] | 382 |

| 14.4 Deduction in respect of contribution to pension scheme of Central Government by Central Government or any other employer [Section 80CCD] | 383 |

| 14.5 Limit on deductions under sections 80C, 80CCC and 80CCD [Section 80CCE] | 384 |

| 14.6 Deduction in respect of Medical Insurance premia [Section 80D] | 384 |

| 14.7 Deduction in respect of maintenance including medical treatment of a dependant who is a person with disability [Section 80DD] | 387 |

| 14.8 Deduction in respect of medical treatment, etc. [Section 80DDB] | 388 |

| 14.9 Deduction for interest paid on loan taken for pursuing higher education [Section 80E] | 389 |

| 14.10 Deduction in respect of interest on loan taken for residential house property[Section 80EE] | 389 |

| 14.11 Deduction in respect of interest on loan taken for certain house property [Section 80EEA] | 390 |

| 14.12 Deduction in respect of purchase of electric vehicle [Section 80EEB] | 391 |

| 14.13 Deduction in respect of donations to certain funds, charitable institutions, etc.[Section 80G] | 392 |

| 14.14 Deductions in respect of rent paid [Section 80GG] | 394 |

| 14.15 Deduction in respect of certain donations for scientific research or rural development [Section 80GGA] | 395 |

| 14.16 Deduction in respect of contributions given by companies to political parties[Section 80GGB] | 396 |

| 14.17 Deduction in respect of contribution given by any person to political parties[Section 80GGC] | 396 |

| 14.18 Deduction in respect of royalty income, etc., of authors of certain books other than text books [Section 80QQB] | 396 |

| 14.19 Deduction in respect of royalty on patents [Section 80RRB] | 397 |

| 14.20 Deduction in respect of interest on deposits in savings accounts to the maximum extent of ₹10,000 [Section 80TTA] | 399 |

| 14.21 Deduction in respect of interest on deposits in case of senior citizens [Section 80TTB] | 399 |

| 14.22 Deduction in case of a person with disability [Section 80U] | 400 |

| Chapter 15 Agricultural Income & its Tax Treatment [Sections 2(1A) and 10(1)] | 401 |

| 15.1 Summarised definition of Agricultural Income [Section 2(1A)] | 401 |

|

402 |

|

403 |

|

403 |

| 15.2 What does agriculture include? | 404 |

| 15.3 Agricultural income | 404 |

| 15.4 Non-agricultural income | 405 |

| Chapter 16 Return of Income [Sections 139 to 140A] | 406 |

| 16.1 Submission of return of income [Section 139(1)] | 406 |

|

407 |

|

408 |

|

408 |

| 16.2 Mandatory to file return before due date if certain losses are to be carried forward [Section 139(3)] | 408 |

| 16.3 Belated return [Section 139(4)] | 409 |

| 16.4 Form and manner of furnishing return of income [Rule 12] | 410 |

| 16.5 Revised return [Section 139(5)] | 411 |

|

411 |

|

412 |

|

412 |

|

412 |

| 16.6 Updated return [Section 139(8A) and Section 140B] | 412 |

| 16.7 Defective return [Section 139(9)] | 414 |

| 16.8 Power of Board to dispense with furnishing documents, etc. with the return [Section 139C] | 414 |

| 16.9 Filing of return in electronic form [Section 139D] | 414 |

| 16.10 Permanent account number [Section 139A] 415 | |

|

416 |

|

416 |

| 16.11 Quoting of Aadhaar number [Section 139AA] | 419 |

| 16.12 Return by whom to be verified [Section 140] | 420 |

| 16.13 Self assessment and tax on updated return | 421 |

| 16.14 Processing of return [Section 143(1)] | 425 |

| 16.15 Assessment after hearing evidence/scrutiny assessment [Section 143(3)] | 426 |

| 16.16 New scheme for scrutiny assessment [Section 143(3A)/(3B)/(3C)] | 426 |

| 16.17 Best judgment assessment [Section 144] | 427 |

| Chapter 17 Appeals and Revision [Sections 246 to 264] | 428 |

| 17.1 Remedy available against the order of the Joint Commissioner (Appeals) or the Commissioner (Appeals)/ Revision orders of CIT | 429 |

| 17.2 Remedy against orders of Appellate Tribunal | 429 |

| 17.3 Appeal against order of High Court to Supreme Court | 429 |

| 17.4 First appeal | 430 |

|

430 |

|

432 |

|

432 |

|

434 |

|

434 |

| 17.5 Appellate Tribunal [Section 252] | 435 |

| 17.6 Appeals to Appellate Tribunal [Section 253(1) and (2)] | 435 |

|

437 |

|

438 |

| 17.7 Orders of Appellate Tribunal [Section 254] | 438 |

|

439 |

|

439 |

| 17.8 Remedy against the order of Appellate Tribunal | 439 |

|

439 |

|

441 |

| 17.9 Appeal to the Supreme Court [Section 261] | 441 |

| 17.10 Revision by the Principal Commissioner or Commissioner | 443 |

|

443 |

|

445 |

|

445 |

| Chapter 18 Penalties | 448 |

| 18.1 Penalties | 448 |

| 18.2 Certain penalties discussed in detail | 449 |

| 18.3 Penalty for under-reporting and misreporting of income [Section 270A] | 452 |

| 18.4 Penalty not to be imposed in certain cases [Section 273B] | 455 |

| Chapter 19 Income Tax Authorities [Sections 116 to 119] | 457 |

| 19.1 Authorities constituted [Section 116] | 457 |

| 19.2 Appointment of Income-tax authorities [Section 117] | 457 |

| 19.3 Central Board of Direct Taxes | 458 |

| 19.4 Taxpayer's Charter [Section 119A] | 460 |

| 19.5 Jurisdiction of Income-tax authorities [Section 120] | 460 |

| 19.6 Powers of Director-General/Director of Income-tax | 461 |

| 19.7 Powers of Principal Commissioner or Commissioner/Principal Chief Commissioner or Chief Commissioner | 462 |

| 19.8 Powers of Joint Commissioner (Appeals) or Commissioner (Appeals) | 462 |

| 19.9 Powers of Joint Commissioner of Income-tax | 463 |

| 19.10 Jurisdiction/Powers of the Assessing Officer | 463 |

|

463 |

|

463 |

|

465 |

|

466 |

| 19.11Inspectors of Income-tax | 467 |

Part 2

International Taxation

| Chapter 20 Double Taxation Relief [Sections 90, 90A and 91] | 471 |

| 20.1 Double Taxation Relief | 471 |

| 20.2 Bilateral relief | 471 |

| 20.3 Unilateral relief | 472 |

| 20.4 Where there is agreement with foreign countries [Section 90] [Bilateral relief] | 472 |

|

475 |

|

476 |

|

476 |

| 20.5 Adoption by Central Government of agreements between specified association for double taxation relief [Section 90A] | 477 |

| 20.6 Certificate for claiming relief under an agreement referred to in sections 90 and 90A [Rule 21AB] | 479 |

| 20.7 Countries with which no agreement exists [Section 91] [Unilateral Relief] | 481 |

| 20.8 Procedure for giving effect to the terms of any agreement for the granting of relief in respect of double taxation [Section 295(2)(h)] | 485 |

|

486 |

| Chapter 21 Tax Avoidance and Tax Evasion | 488 |

| 21.1 Tax Planning, Tax Avoidance and Tax Evasion: Meaning and Differences | 488 |

|

488 |

|

488 |

|

489 |

| 21.2 Perception of Courts on Tax Avoidance | 489 |

| 21.3 Difference between Tax Avoidance and Tax Evasion | 490 |

| 21.4 General Anti-Avoidance Rule [Chapter X-A] | 490 |

| Chapter 22 Special Provisions Relating to Avoidance of Tax Introduction to Transfer Pricing (Transfer Pricing Provisions for International Transactions and Other Provisions relating to Avoidance of Tax)[Chapter X, Sections 92 to 92F, 93, 94A, 94B] | 499 |

| 22.1 Transfer pricing provisions relating to avoidance of tax in case of an international transaction | 500 |

| 22.2 Computation of income from international transaction having regard to arm's length price [Section 92] | 501 |

|

501 |

|

502 |

|

502 |

| 22.3 Meaning of associated enterprise [Section 92A] | 503 |

|

503 |

|

503 |

|

507 |

|

|

| 22.4 Meaning of international transaction [Section 92B] | 508 |

| 22.5 Meaning and Computation of arm's length price | 512 |

|

512 |

|

512 |

|

513 |

| 22.6 Most appropriate method [Section 92C(2) and Rule 10C] | 520 |

|

521 |

|

522 |

| 22.7 Reference to Transfer Pricing Officer (TPO) [Section 92CA] | 523 |

|

523 |

|

524 |

|

525 |

|

529 |

| 22.8 Power of Board to make safe harbour rules [Section 92CB, w.e.f. 1.4.2009] | 529 |

| 22.9 Board with the approval of Central Government allowed to enter into Advance Price Agreement [Section 92CC] | 531 |

| 22.10 Effect of Advance Price Agreement [Section 92CD, w.e.f. 1.7.2012] | 534 |

| 22.11 Maintenance, keeping of information and document by persons entering into an international transaction [Section 92D and Rule 10D] | 535 |

| 22.12 Report from an accountant to be furnished by persons entering into international transaction [Section 92E and Rule 10E] | 538 |

| 22.13 Penalty provisions applicable to the above Chapter | 540 |

Part 3

Goods and Services Tax

| Chapter 23 Introduction of Goods and Services Tax (GST) | 545 |

| 23.1 Comparative constitutional provisions of pre-GST regime and GST regime in respect of indirect taxes | 549 |

| 23.2 Need for GST | 550 |

| 23.3 Taxes subsumed in GST | 550 |

| 23.4 Taxes not subsumed into GST | 551 |

| 23.5 Benefits of GST | 551 |

| 23.6 Historical perspective | 553 |

| 23.7 Salient Features of GST | 555 |

| 23.8 Acts and Rules passed for implementation of GST | 557 |

| 23.9 Provisions of Central Goods and Service Tax Act, 2017 are also applicable to IGST Act and UTGST Act | 558 |

| Chapter 24 Levy and Collection (Taxable Event) | 561 |

| 24.1 Kinds of supply on which tax is leviable under GST | 561 |

| 24.2 Levy of GST on Intra-State supply | 562 |

| 24.3 Levy of GST on Inter-State supply | 563 |

| 24.4 Zero Rated Supply [Section 16 of IGST Act, 2017] | 564 |

| 24.5 Levy and Collection under CGST Act, IGST Act and UTGST Act | 565 |

| 24.6 Tax payable on reverse charge basis [Section 9(3) of CGST Act, section 5(3) of IGST Act and section 7(3) of the UTGST Act] | 566 |

|

566 |

|

567 |

| Chapter 25 Supply under GST | 571 |

| 25.1 Meaning of the word "supply" [Section 7 of the CGST Act, 2017] | 571 |

| 25.2 Activities or transactions which constitute a "supply" to be treated as either supply of goods or supply of services as referred to in Schedule II [Section 7(1A)] | 578 |

| 25.3 Necessary elements that constitute supply under CGST/SGST Act | 583 |

| 25.4 Types of supply | 587 |

| 25.5 Activities which shall be treated neither as a supply of goods nor a supply of services [Section 7(2) CGST Act] | 587 |

| Chapter 26 Taxability of Composite and Mixed Supply | 591 |

| 26.1 Tax liability on composite and mixed supplies [Section 8 of CGST Act, 2017] | 591 |

|

591 |

|

592 |

|

593 |

|

593 |

| Chapter 27 Composition Levy (Composition Scheme) | 595 |

| 27.1 Composition levy (Composition Scheme) [Section 10(1) of CGST Act, 2017] | 595 |

|

595 |

| 27.2 Restrictions on the registered person availing composition levy [Section 10(2) of CGST Act, 2017] | 596 |

|

597 |

| 27.3 Composition scheme primarily for supplier of services Section 10(2A) of CGST Act, 2017] | 597 |

| 27.4 Lapse of the option of composition scheme [Section 10(3) of CGST Act, 2017] | 598 |

| 27.5 Person who opts for composition scheme shall not collect any tax and shall not be eligible for input tax credit [Section 10(4) of CGST Act, 2017] | 598 |

| 27.6 Consequences of wrongful availment of composition scheme [Section 10(5) of CGST Act, 2017] | 598 |

| 27.7 Inclusion in and exclusion from “aggregate turnover� for determining the eligibility to pay tax under composition levy — Inserted with effect from 01.01.2020 — Explanation 1 to Section 10 of the CGST Act | 598 |

| 27.8 Exclusions from the “turnover in State/Union territory� for determining the tax payable under composition levy- — Explanation 2 to Section 10 of the CGST Act | 599 |

| 27.9 Meaning of "Aggregate turnover" –Section 2(6) of the CGST Act, 2017 | 599 |

| 27.10 Meaning of registered person | 599 |

| 27.11 Relevant rules for composition levy | 599 |

| � | |

| 27.12 Benefits of composition scheme | 603 |

| 27.13 Statement of payment of self-assessed tax to be filed on quarterly basis | 603 |

| 27.14 Annual furnishing of return | 603 |

| Gist of Landmark Judicial Decisions | 604 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

CA Aarish Khan

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

CA Arpita Tulsyan

AUDIT MCQ BOOK NEW SYLLABUS

CA Aarti Lahoti

Strategic Management (SM) Book May 26 & Sept 26 onwards

CA Aarti Lahoti

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

CA Aarti Lahoti

Join Us !!

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia