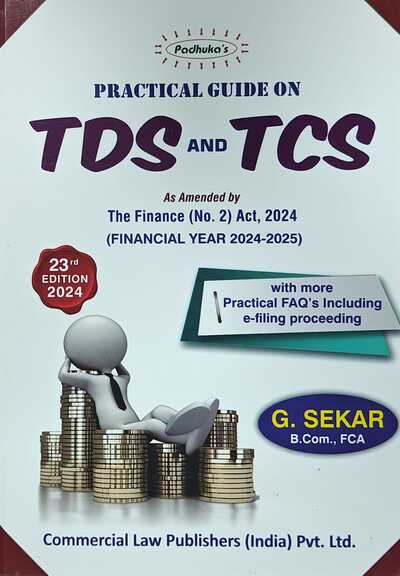

Practical Guide On TDS/TCS

by CA G. SekarSUBJECT INDEX

| FTR Finance (no.2) Act 2024 Amendements | F.1-F.22 |

| Chapter 1 Tax Deducted at Source (TDS)- Ready Reckoner | 1.1-1.40 |

| Chapter 2 Salaries [Sec.192],[Sec.192A] | 2.1-A-2.88 |

| Chapter 3 Interest on Securities[Sec.193] | 3.1-3.4 |

| Chapter 4 Dividends[Sec.194] | 4.1-4.4 |

| Chapter 5 Interest other than Interest in securities[Sec.194A] | 5.1-5.10 |

| Chapter 6 Winnigs from Lottery,Crossword Puzzles,Horse Races etc [Sec.194B and 194BB] | 6.1-6.8 |

| Chapter 7 Payments to Contractors[Sec.194C] | 7.1-7.12 |

| Chapter 8 Insurance Commission[Sec.194D],[Sec.194DA] | 8.1-8.4 |

| Chapter 9 NSS Payments, Repurchase of units by Mutual Funds & UTI, Lottery Commission[Sec.194EE,194F,194G] | 9.1-9.2 |

| Chapter 10 Commission or Brokerage[Sec.194H] | 10.1-10.4 |

| Chapter 11 Rent[Sec.194-I] and Transfer of Certain Immovable Property Other than Agricultural Land [Sec.194-IA] | 11.1-11.12 |

| Chapter 12 Fees for Professional or Techical Services [Sec.194J] | 12.1-12.6 |

| Chapter 13 Income from Units,Payments of Certain Sums & Payments by E-Commerce Operator [Sec.194K-194T] | 13.1-13.26 |

| Chapter 14 TDS on Compensation on Acquisition of Certain Immovable Properties [Sec.194LA] | 14.1-14.2 |

| Chapter 15 TDS in respect of payments to non-residents | 15.1-15.20 |

| Chapter 16 Tax Deduction Account nNumber(TAN), TDS Certificates and Penal Provisions | 16.1-16.16 |

| Chapter 17 Tax Collected at Source (TCS) [Sec.206C] | 17.1-17.22 |

| Chapter 18 E-TDS & TCS Returns & Online Tax A/c Systems | 18.1-18.206 |

| Chapter 19 Forms | 19.1-19.126 |

| Annex.1 FAQ's on Form 24G | A.1.1-A.1.12 |

| Annes.2 Statement of Financial Transactions or Reportable A/c | A.2.1-A.2.22 |

About the Author

CA G. Sekar

G. Sekar is a Chartered Accountant in practice for the last 35 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa's Institute of Management, an Institution providing education for all

levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member Central Council of ICAI 2013-16, 2016-19 & 2019-22.

Chairman Direct Taxes Committee of ICAI - 2014.

Chairman Auditing And Assurance Standards Board of ICAI 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their 150 years of Income Tax in India Celebrations, for his contribution

and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB). It is worthy to note

that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions,

for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals GST Manual, GST Self Learning, GST Ready Reckoner

(j) Company Law Ready Reckoner

(k) Practitioner's Manual on Direct Taxes Vivad Se Vishwas Act, 2020

(l) Professional's Handbook on Faceless Assessment

9. Author of Books for CA Students Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa's Institute of Management

is the First and Only Educational Institution in India to accomplish this feat

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia