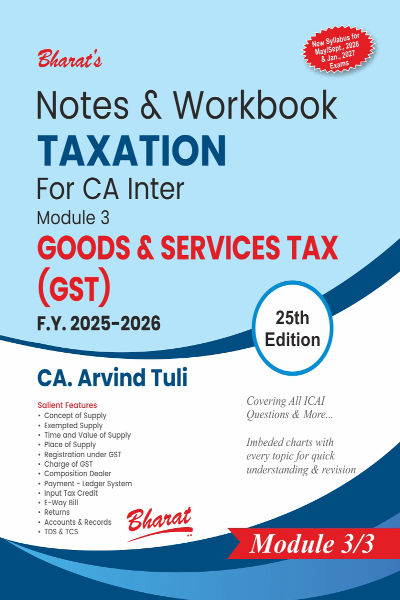

Notes & Workbook Taxation For CA Inter - Module 3 GST

by CA Arvind TuliCONTENTS

MODULE 3: GST

| Section | Chapter Name | No. of Pages | Section Page No. | Page No. of Book |

|---|---|---|---|---|

| A | Introduction to GST A1: Power to make law A2: Overview of GST A3: Taxes subsumed after GST A4: No of Acts of GST in India A5: GST Council A6: Items not covered under GST A7: Import of service |

12 | 1.3 1.3 1.5 1.5 1.8 1.8 1.10 1.12 |

3 3 5 5 8 8 10 12 |

| B | Concept of Supply B1: Overview of Sec 7 B2: Goods u/s 2(52) B3: Interest under GST B4: Import of Service u/s 7(1)(b) B5: Import of Service u/s 7(1)(b) & (c) B6: Distinct persons B7: Agents u/s 7(1)(c) B8: Negative List u/s 7(2) B9: Del Credere Agent |

40 | 1.1 1.1 1.2 1.6 1.13 1.15 1.16 1.18 1.26 1.19 |

15 15 16 20 27 29 30 32 40 33 |

| C | Exempted Supply C1: Health Care service C2: Old age home C3: Rehabilitation professionals C4: Education services C5: Agricultural services C6: Transportation of Goods & Passengers C7: Road Travel: Passenger C8: The total summary for ROI C9: Legal Services |

52 | 1.1 1.4 1.5 1.5 1.12 1.19 1.25 1.26 1.31 1.39 |

55 58 59 59 66 73 79 80 85 93 |

| D | Registration under GST D1: Liable to register D2: Compulsory registration u/s 24 D3: Exemption from registration u/s 23 D4: Effective date for registration D5: Effect on ITC & Concept of revised invoice D6: Procedure for registration D7: Amendment of Registration D8: Cancellation of Registration D9: Revocation of cancellation D10: Cancellation & Revocation |

40 | 1.1 1.2 1.16 1.22 1.26 1.27 1.28 1.32 1.34 1.35 1.36 |

107 108 122 128 132 133 134 138 140 141 142 |

| E | Charge of GST E1: Overview of Sec 9 E2: Transportation summary E3: GTA u/s 9(3) E4: Category II Summary E5: Govt./LA - Summary E6: Category III Summary E7: Category IV Summary E8: Sponsorship Service E9: Security Service E10: Banks Service E11: Builders u/s 9(4) E12: Eco u/s 9(5) |

28 | 1.1 1.2 1.9 1.8 1.10 1.12 1.12 1.15 1.16 1.17 1.22 1.23 1.25 |

147 148 155 154 156 158 158 161 162 163 168 169 171 |

| F | Composition Dealer F1: Overview of Sec 10(1) / (2A) F2: Overview of Sec 10(1) F3: RCM u/s 10(1) F4: Registration for new dealer F5: Registration for normal dealer to CD F6: Turnover in a State F7: RD opting for CD |

16 | 1.1 1.1 1.3 1.4 1.5 1.6 1.8 1.10 |

175 177 178 179 180 182 184 |

| G | Time of Supply G1: Overview of Sec 12 & 13 G2: Summary of Sec 12 G3: Sec 12(2) Forward Charge of goods G4: Sec 12(3) Reverse Charge of goods G5: Summary of Sec 13 G6: Sec 13(2) Forward Charge of Service G7: Sec 13(2) Reverse Charge of Service |

14 | 1.3 1.3 1.5 1.5 1.8 1.8 1.10 1.12 |

191 191 192 192 194 195 196 198 |

| H | Value of Supply | 12 | 1.1 | 205 |

| I | Payment – Ledger System | 16 | 1.1 | 217 |

| J | Input Tax Credit J1: Overview of Sec 16 J2: Blocked Credit – 1 J3: Blocked Credit – 2 J4: Blocked Credit – 3 J5: Blocked Credit – 4 |

48 | 1.1 1.1 1.17 1.18 1.19 1.21 |

233 233 249 250 251 253 |

| K | Documents under GST K1: Summary |

16 | 1.1 1.2 |

281 282 |

| L | E-Way Bill L1: Summary L2: Timelines E-Invoice L3: Summary |

18 | 1.1 1.4 1.6 1.12 1.15 |

297 300 302 308 311 |

| M | Returns | 22 | 1.1 | 315 |

| N | Accounts & Records | 10 | 1.1 | 337 |

| O | TDS & TCS | 12 | 1.1 | 347 |

| P | Place of Supply P1: Place of Supply of Goods P2: Place of Supply of Services Sec 12(2)/(3) P3: Place of Supply of Services Sec 12(4)/(6) P4: Place of Supply of Services Sec 12(10)/(7)/(5) P5: Place of Supply of Services Sec 12(8)/(9) P6: Place of Supply of Services Sec 12(12)/(13) |

20 | 1.1 1.3 1.5 1.7 1.8 1.9 1.11 |

359 361 363 365 366 367 369 |

About the Author

CA Arvind Tuli

FCA

Arvind Tuli is a well-known name in the field of CA education and direct taxation. Over the last 24 years, he has taught taxation to more than 1,50,000 CA and CS students through both face-to-face classroom teaching and online platforms. He is widely respected among students for his conceptual yet exam-oriented teaching methodology, which enables students to understand and internalise the law within the classroom itself. As a result, his students have consistently delivered strong results, with several securing All India highest ranks in CA Inter Taxation and CA Final Direct Tax.

In addition to teaching, he is a leading author in direct taxation with Bharat Law House, one of India's most respected legal publishers. His books are known for their clear structure, statutory linkage, and practical orientation, making them equally valuable for students and professionals seeking a strong conceptual foundation.

His handwritten summary charts are considered a valuable learning resource, as they condense complex taxation concepts into concise, easy-to-retain formats. Guided by his philosophy of "Fun while you learn," his classes are known to be engaging, disciplined, and academically rigorous.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia