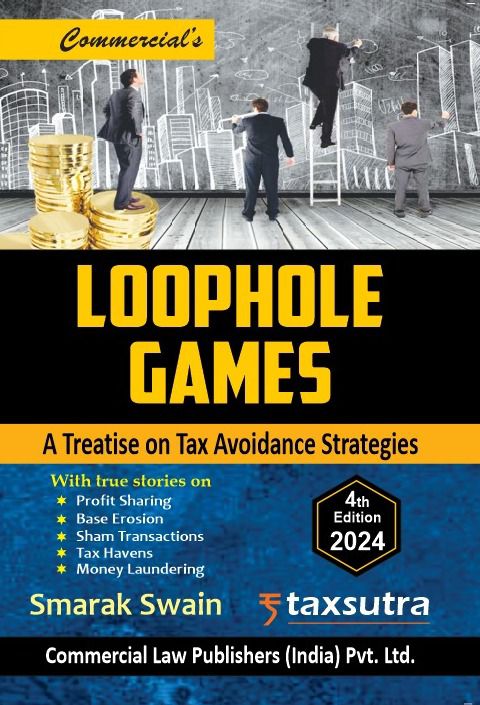

Loophole Games

by Smarak SwainGeneral Contents

| Preface | v |

| About the Author | vii |

| Detailed Contents | xi |

| Introduction: “Don’t be Evil� | 1 |

Part I: Profit Suppression

| 1. Deferral of Revenue | 13 |

| 2. Exploiting the Mercantile System of Accounting | 20 |

| 3. Manipulating Segmental Accounts | 28 |

| 4. SPV and JDA Structures | 35 |

| 5. Characterisation of Revenue as Capital Receipt | 45 |

| 6. Rate Arbitrage | 51 |

Part II: Gain Suppression

| 7. Avoiding Tax through Capital Receipts | 63 |

| 8. Capital Loss Harvesting | 75 |

| 9. Structuring through Non-compete Fees | 81 |

| 10. Bonus Stripping | 89 |

Part III: Profit Shifting

| 11. Intra-Group Services | 97 |

| 12. Thin Capitalisation | 108 |

| 13. IP Migration Strategies | 115 |

| 14. Cost Sharing Arrangements Used for Tax Avoidance | 127 |

| 15. Restructuring into a Contract Manufacturer | 133 |

| 16. Structuring of Sourcing and Procurement Activities | 145 |

| 17. The Dummy’s Guide to Structuring | 153 |

Part IV: Base Erosion

| 18. Permanent Establishment Manipulations | 167 |

| 19. Taxing the Cloud | 179 |

| 20. Structuring of OTT Business | 188 |

| 21. Circumventing the Equalisation Levy | 194 |

| 22. Migrating HNWIs and Professionals | 206 |

Part V: Sham Transactions

| 23. Use of Third Party Intermediaries | 217 |

| 24. Colouring Loans as Finance Lease | 224 |

| 25. Employer-Employee Collusion | 235 |

| 26. Tax Avoidance through Merger & Acquisition | 243 |

| 27. Saving on Dividend Tax | 256 |

| 28. More sham characterisations | 269 |

Part VI: Trends in Blatant Evasion

| 29. Shell Companies | 279 |

| 30. Tax Evasion through Stock Exchanges | 294 |

| 31. Under-Invoicing and Over-Invoicing | 308 |

| 32. Hawala | 318 |

| 33. Tax Havens | 349 |

| 34. Exchange of tax information | 366 |

Detailed Contents

| Preface | v |

| About the Author | vii |

| General Contents | xi |

| Introduction: “Don’t be Evil� |

Part I: Profit Suppression

| 1. Deferral of Revenue | � |

|

14 |

|

15 |

|

18 |

| 2. Exploiting the Mercantile System of Accounting | 20 |

|

20 |

|

21 |

|

22 |

|

23 |

|

24 |

|

25 |

|

26 |

| 3. Manipulating Segmental Accounts | 28 |

|

29 |

|

31 |

|

34 |

| 4. SPV and JDA Structures | 35 |

|

35 |

|

36 |

|

37 |

|

38 |

|

40 |

|

42 |

|

44 |

| 5. Characterisation of Revenue as Capital Receipt | 45 |

|

47 |

|

48 |

|

48 |

|

50 |

| 6. Rate Arbitrage | 51 |

|

51 |

|

54 |

|

55 |

|

56 |

|

57 |

|

59 |

Part II: Gain Suppression

| 7. Avoiding Tax through Capital Receipts | 63 |

|

64 |

|

64 |

|

65 |

|

71 |

|

73 |

|

75 |

| 8. Capital Loss Harvesting | 75 |

|

76 |

|

78 |

|

79 |

|

80 |

|

81 |

| 9. Structuring through Non-compete Fees | 81 |

|

83 |

|

86 |

| 10. Bonus Stripping | 89 |

|

91 |

|

91 |

Part III: Profit Shifting

| 11. Intra-Group Services | 97 |

|

98 |

|

102 |

|

103 |

|

105 |

| 12. Thin Capitalisation | 108 |

|

108 |

|

109 |

|

110 |

|

110 |

|

113 |

| 13. IP Migration Strategies | 115 |

|

115 |

|

117 |

|

118 |

|

119 |

|

120 |

|

120 |

|

122 |

|

123 |

|

125 |

|

126 |

| 14. Cost Sharing Arrangements Used for Tax Avoidance | 127 |

|

129 |

|

129 |

|

130 |

| 15. Restructuring into a Contract Manufacturer | 133 |

|

136 |

|

137 |

|

139 |

|

140 |

|

140 |

| 16. Structuring of Sourcing and Procurement Activities | 145 |

|

146 |

|

150 |

|

152 |

| 17. The Dummy’s Guide to Structuring | 153 |

|

153 |

|

155 |

|

157 |

|

157 |

|

159 |

|

161 |

Part IV: Base Erosion

| 18. Permanent Establishment Manipulations | 167 |

|

169 |

|

171 |

|

173 |

|

174 |

|

175 |

| 19. Taxing the Cloud | 179 |

|

180 |

|

183 |

|

184 |

|

185 |

| 20. Structuring of OTT Business | 188 |

|

190 |

|

191 |

| 21. Circumventing the Equalisation Levy | 194 |

|

195 |

|

197 |

|

199 |

|

201 |

|

202 |

|

204 |

|

205 |

| 22. Migrating HNWIs and Professionals | 206 |

|

206 |

|

210 |

|

213 |

Part V: Sham Transactions

| 23. Use of Third Party Intermediaries | 217 |

|

|

|

221 |

|

|

| 24. Colouring Loans as Finance Lease | 224 |

|

224 |

|

226 |

|

227 |

|

229 |

|

232 |

|

233 |

| 25. Employer-Employee Collusion | 235 |

|

235 |

|

236 |

|

237 |

|

237 |

|

238 |

|

239 |

|

242 |

| 26. Tax Avoidance through Merger & Acquisition | 243 |

|

243 |

|

246 |

|

247 |

|

248 |

|

251 |

|

253 |

| 27. Saving on Dividend Tax | 256 |

|

258 |

|

259 |

|

261 |

|

261 |

|

263 |

|

265 |

|

266 |

|

267 |

|

269 |

| 28. More sham characterisations | 269 |

|

271 |

|

272 |

|

273 |

Part VI: Trends in Blatant Evasion

| 29. Shell Companies | 279 |

|

280 |

|

280 |

|

282 |

|

282 |

|

283 |

|

283 |

|

289 |

|

292 |

| 30. Tax Evasion through Stock Exchanges | 294 |

|

295 |

|

298 |

|

299 |

|

300 |

|

301 |

|

304 |

| 31. Under-Invoicing and Over-Invoicing | 308 |

|

311 |

|

314 |

|

316 |

| 32. Hawala | 318 |

|

320 |

|

329 |

|

333 |

|

337 |

|

340 |

|

341 |

|

343 |

|

344 |

|

345 |

|

346 |

| 33. Tax Havens | 349 |

|

349 |

|

|

|

|

|

|

|

|

|

|

|

359 |

|

363 |

| 34. Exchange of tax information | 366 |

|

368 |

|

369 |

|

370 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

CA Aarish Khan

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

CA Arpita Tulsyan

AUDIT MCQ BOOK NEW SYLLABUS

CA Aarti Lahoti

Strategic Management (SM) Book May 26 & Sept 26 onwards

CA Aarti Lahoti

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

CA Aarti Lahoti

Join Us !!

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia