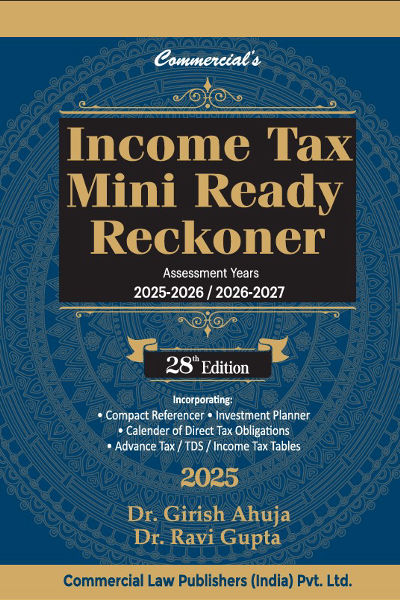

Income Tax Mini Ready Reckoner

by Dr. Girish Ahuja & Dr. Ravi GuptaCONTENTS

DIVISION 1

Compact Referencer

| CR-1 Important amendments brought in the Income-Tax Act by The Finance Act, 2025 | 1 |

| CR-2 Rates of Taxation | 51 |

| CR-3 Direct Tax Rates for Last Ten Assessment Years | 69 |

| CR-4 Cost Inflation Index & Exemptions Available in Computation of Capital Gain | 84 |

| CR-5 Deductions to be made in Computing Total Income | 91 |

| CR-6 TDS & TCS at a glance | 103 |

| CR-7 Investment Planner | 132 |

| CR-8 Gold & Silver Rates since 1-4-2001 | 150 |

| CR-9 State Bank of India: Interest Rates w.e.f. 01.04.2024 for the purpose of computing perquisite valuation | 152 |

DIVISION 2

Part A: Income Tax

| Chapter 1 Introduction [Sections 1 to 4] | 161 |

| Chapter 2 Scope of Total Income & Residential Status [Sections 5 to 9B] | 171 |

| Chapter 3 Incomes which do not form part of Total Income [Sections 10, 10AA and 11 to 13A] | 189 |

| Chapter 4 Heads of Income [Section 14] and Income under the Head "Salaries"[Sections 15 to 17] | 202 |

| Chapter 5 Income under the Head "Income from House Property" [Sections 22 to 27] | 261 |

| Chapter 6 Income under the Head "Profits and Gains of Business or Profession" [Sections 28 to 44D] | 275 |

| Chapter 7 Income under the Head "Capital Gains" [Sections 45 to 55A] | 347 |

| Chapter 8 Income under the Head "Income from Other Sources" [Sections 56 to 59] | 456 |

| Chpater 9 Income of Other Persons included in Assessee's Total Income (Clubbing of Income) [Sections 60 to 65] | 475 |

| Chapter 10 Unexplained Cash Credits, Investments, Money, etc. [Sections 68 to 69D] | 482 |

| Chapter 11 Set off or Carry Forward and Set off of Losses [Sections 70 to 80] | 487 |

| Chapter 12 Deductions to be made in Computing Total Income [Sections 80A to 80U (Chapter VIA)] | 503 |

| Chapter 13 Agricultural Income & its Tax Treatment [Sections 2(1A) and 10(1)] | 522 |

| Chapter 14 Computation of Tax Liability of Various Categories of Persons | 526 |

| Chapter 15 Return of Income and Procedure of Assessment [Sections 139 to 154] | 546 |

| Chapter 16 Permanent Account Number and Aadhaar Number [Section 139A and 139AA] | 611 |

| Chapter 17 Deduction and Collection of Tax at Source [Sections 190 to 206CA] | 622 |

| Chapter 18 Advance Payment of Tax [Sections 207-211, 217 & 219] | 689 |

| Chapter 19 Interest and Fee Payable [Sections 201(1A), 220(2), 234A, 234B,234C, 234D, 234E, 234F, 234G,234H & 244A] | 695 |

| Chapter 20 Refunds [Sections 237 to 241 & 245] | 717 |

| Chapter 21 Penalties | 725 |

| Chapter 22 Appeals and Revision [Sections 246 to 268] | 767 |

| Chapter 23 Miscellaneous Provisions | 790 |

DIVISION 3

Tables

| 1 As per new regime | 805 |

| 1A Tax Deduction at source from monthly taxable salary during the | 809 |

| 2A As per new regime (View Important Notes) | 814 |

| 2B As per old regime (View Important Notes) | 821 |

| 3A As per New regime (View Important Notes) | 830 |

| 3B As per old regime (View Important Notes) | 838 |

| 4 As per old regime | 847 |

| 5 As per old regime | 850 |

About the Author

Dr. Girish Ahuja & Dr. Ravi Gupta

Dr. Girish Ahuja did his graduation and post-graduation from Shri Ram College of Commerce, Delhi and was a position holder. He was awarded a Ph.D. degree by Faculty of Management Studies (FMS), Delhi University. He is a Fellow of the Institute of Chartered Accountant of India (ICAI) and was a rank holder of both Intermediate and Final examinations of the Institute. He had been nominated by the Government of India as a member of the Task Force for redrafting the Income-tax Act and New Income-tax Law. He is also on the Board of Directors of many reputed companies and has a vast and rich experience in the field of finance and taxation. He has been nominated by the Government of Directors of UNITECH LTD with the approval of the Supreme Court to Board and was also been nominated by the Govt. of India as Independent Director of the Central Board of State Bank of India. Dr. Ahuja is a author of various books on Direct Taxation and he has addressed more than 5000 seminars organized by the ICAI, ICSI, ICWAI, Chambers of Commerce.

Dr. Ravi Gupta did his graduation and post-graduation from Shri Ram College of Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the Delhi University. He had been a faculty member at Shri Ram College of Commerce (Delhi University). He is an advocate and leading consultant at Delhi NCR and also has vast practical experience in handling tax matters of trade and industry. He has been appointed by the Government of India as a member of the Committee consututed for Simplification of Income Tax Act. He is also a Central Council member of ICAI (Government of India Nominee) and on the Board of various reputed companies. He is a co-author of various books on Income-tax. He has addressed more than 3000 seminars on Direct Taxes organized by ICAI, Chambers of Commerce, Universities, etc.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia