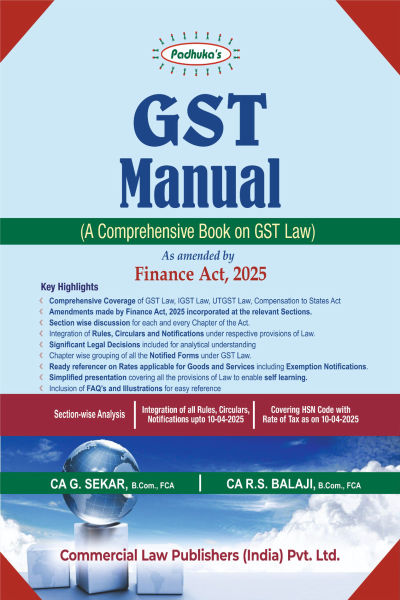

GST Manual

by CA G. SekarCONTENTS

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

CHAPTER I – PRELIMINARY

| Sec.1 Short Title, extent and Commencement | I.1 |

| Sec.2 Definitions | I.1 |

CHAPTER II – ADMINISTRATION

| Sec.3 Office under this Act | II.1 |

| Sec.4 Appointment of Officers | II.1 |

| Sec.5 Power of Officers | II.1 |

| Sec.6 Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances. | II.8 |

CHAPTER III – LEVY AND COLLECTION OF TAX

Schedule I III.7 Schedule II III.15 Schedule III III.16

| Sec.7 Scope of supply. | III.1 |

| Sec.8 Tax liability on composite and mixed supplies. | III.5 |

| Sec.9 Levy and collection. | III.20 |

| Sec.10 Composition levy. | III.24 |

| Sec.11 Power to grant exemption from tax. | III.32 |

| Sec.11A Power Not to recover GST not levied or short levied as a result of general practice | III.33 |

CHAPTER IV – TIME AND VALUE OF SUPPLY

| Sec.12 Time of supply of goods. | IV.1 |

| Sec.13 Time of supply of services. | IV.4 |

| Sec.14 Change in rate of tax in respect of supply of goods or services. | IV.7 |

| Sec.15 Value of taxable supply. | IV.8 |

CHAPTER V – INPUT TAX CREDIT

| Sec.16 Eligibility and conditions for taking input tax credit. | V.1 |

| Sec.17 Apportionment of credit and blocked credits. | V.15 |

| Sec.18 Availability of credit in special circumstances. | V.36 |

| Sec.19 Taking ITC in respect of inputs and capital goods sent for job work. | V.44 |

| Sec.20 Manner of distribution of credit by Input Service Distributor. | V.46 |

| Sec.21 Manner of recovery of credit distributed in excess | V.48 |

CHAPTER VI – REGISTRATION

| Sec.22 Persons liable for registration. | VI.1 |

| Sec.23 Persons not liable for registration. | VI.2 |

| Sec.24 Compulsory registration in certain cases. | VI.5 |

| Sec.25 Procedure for registration. | VI.6 |

| Sec.26 Deemed registration. | VI.19 |

| Sec.27 Special provisions relating to casual taxable person and non–resident taxable person. | VI.20 |

| Sec.28 Amendment of registration. | VI.22 |

| Sec.29 Cancellation or suspension of registration. | VI.24 |

| Sec.30 Revocation of cancellation of registration | VI.31 |

CHAPTER VII – TAX INVOICE, CREDIT AND DEBIT NOTES

| Sec.31 Tax invoice. | VII.1 |

| Sec.31A Facility of digital payment to recipient | VII.10 |

| Sec.32 Prohibition of unauthorized collection of tax. | VII.10 |

| Sec.33 Amount of tax to be indicated in tax invoice and other documents. | VII.10 |

| Sec.34 Credit and debit notes. | VII.11 |

CHAPTER VIII – ACCOUNTS AND RECORDS

| Sec.35 Accounts and other records. | VIII.1 |

| Sec.36 Period of retention of accounts. | VIII.5 |

CHAPTER IX – RETURNS

| Sec.37 Furnishing details of outward supplies. | IX.1 |

| Sec.38 Communication of details of inward supplies and input tax credit | IX.4 |

| Sec.39 Furnishing of returns. | IX.7 |

| Sec.40 First return. | IX.23 |

| Sec.41 Availment of input tax credit | IX.24 |

| Sec.42 Matching, reversal and reclaim of input tax credit. [Omitted] | - |

| Sec.43 Matching, reversal and reclaim of reduction in output tax liability. [Omitted] | - |

| Sec.43A Procedure for furnishing return and availing input tax credit [Omitted] | - |

| Sec.44 Annual return | IX.25 |

| Sec.45 Final return | IX.28 |

| Sec.46 Notice to return defaulters | IX.29 |

| Sec.47 Levy of late fee. | IX.29 |

| Sec.48 Goods and services tax practitioners | IX.32 |

CHAPTER X – PAYMENT OF TAX

| Sec.49 Payment of tax, interest, penalty and other amounts. | X.1 |

| Sec.49A Utilisation of Input Tax Credit subject to certain conditions | X.8 |

| Sec.49B Order of utilization of input tax credit | X.10 |

| Sec.50 Interest on delayed payment of tax. | X.10 |

| Sec.51 Tax deduction at source. | X.14 |

| Sec.52 Collection of tax at source | X.19 |

| Sec.53 Transfer of input tax credit. | X.23 |

| Sec.53A Transfer of certain amounts | X.24 |

CHAPTER XI – REFUNDS

| Sec.54 Refund of tax. | XI.1 |

| Sec.55 Refund in certain cases. | XI.15 |

| Sec.56 Interest on delayed refunds. | XI.81 |

| Sec.57 Consumer Welfare Fund. | XI.83 |

| Sec.58 Utilisation of Fund. | XI.83 |

CHAPTER XII – ASSESSMENT

| Sec.59 Self–assessment. | XII.1 |

| Sec.60 Provisional assessment. | XII.1 |

| Sec.61 Scrutiny of returns. | XII.3 |

| Sec.62 Assessment of non–filers of returns. | XII.3 |

| Sec.63 Assessment of unregistered persons. | XII.6 |

| Sec.64 Summary assessment in certain special cases. | XII.6 |

CHAPTER XIII – AUDIT

| Sec.65 Audit by tax authorities. | XIII.1 |

| Sec.66 Special audit. | XIII.2 |

CHAPTER XIV – INSPECTION, SEARCH, SEIZURE AND ARREST

| Sec.67 Power of inspection, search and seizure. | XIV.1 |

| Sec.68 Inspection of goods in movement. | XIV.5 |

| Sec.69 Power to arrest. | XIV.20 |

| Sec.70 Power to summon persons to give evidence and produce documents | XIV.20 |

| Sec.71 Access to business premises. | XIV.21 |

| Sec.72 Officers to assist proper officers. | XIV.22 |

CHAPTER XV – DEMANDS AND RECOVERY

| Sec.73 Determination of tax, pertaining to the period upto FY 2023-24, not paid or short paid or erroneously refunded or ITC wrongly availed or utilised for any reason other than fraud or any willful misstatement or suppression of facts. | XV.1 |

| Sec.74 Determination of tax pertaining to the period upto FY 2023-24, not paid or short paid or erroneously refunded or input tax credit wrongly availed or utilised by reason of fraud or any wilful misstatement or suppression of facts. | XV.4 |

| Sec.74A Determination of tax, not paid or short paid or erroneously refunded or ITC wrongly availed or utilised for any reason pertaining to FY 2024-25 onwards. | XV.7 |

| Sec.75 General provisions relating to determination of tax. | XV.10 |

| Sec.76 Tax collected but not paid to Government. | XV.14 |

| Sec.77 Tax wrongfully collected and paid to Central / State Government | XV.15 |

| Sec.78 Initiation of recovery proceedings. | XV.17 |

| Sec.79 Recovery of tax | XV.17 |

| Sec.80 Payment of tax and other amount in instalments. | XV.26 |

| Sec.81 Transfer of property to be void in certain cases. | XV.27 |

| Sec.82 Tax to be first charge on property. | XV.27 |

| Sec.83 Provisional attachment to protect revenue in certain cases. | XV.28 |

| Sec.84 Continuation and validation of certain recovery proceedings. | XV.29 |

CHAPTER XVI – LIABILITY TO PAY IN CERTAIN CASES

| Sec.85 Liability in case of transfer of business. | XVI.1 |

| Sec.86 Liability of agent and principal. | XVI.1 |

| Sec.87 Liability in case of amalgamation or merger of companies. | XVI.1 |

| Sec.88 Liability in case of company in liquidation. | XVI.2 |

| Sec.89 Liability of directors of private company. | XVI.2 |

| Sec.90 Liability of partners of firm to pay tax. | XVI.3 |

| Sec.91 Liability of guardians, trustees, etc. | XVI.3 |

| Sec.92 Liability of Court of Wards, etc. | XVI.3 |

| Sec.93 Special provisions regarding liability to pay tax/interest/penalty in certain cases. | XVI.4 |

| Sec.94 Liability in other cases. | XVI.5 |

CHAPTER XVII – ADVANCE RULING

| Sec.95 Definitions. | XVII.1 |

| Sec.96 Authority for advance Ruling. | XVII.1 |

| Sec.97 Application for advance ruling. | XVII.1 |

| Sec.98 Procedure on receipt of application. | XVII.2 |

| Sec.99 Appellate Authority for Advance Ruling. | XVII.4 |

| Sec.100 Appeal to Appellate Authority. | XVII.4 |

| Sec.101 Orders of Appellate Authority. | XVII.5 |

| Sec.101A Constitution of National Appellate Authority for Advance Ruling | XVII.5 |

| Sec.101B Appeal to National Authority | XVII.7 |

| Sec.101C Order of National Appellate Authority | XVII.8 |

| Sec.102 Rectification of advance ruling. | XVII.8 |

| Sec.103 Applicability of advance ruling. | XVII.9 |

| Sec.104 Advance ruling to be void in certain circumstances. XVII.9 | |

| Sec.105 Powers of Authority and Appellate Authority. | XVII.10 |

| Sec.106 Procedure of Authority and Appellate Authority. | XVII.10 |

CHAPTER XVIII – APPEALS AND REVISION

| Sec.107 Appeals to Appellate Authority. | XVIII.1 |

| Sec.108 Powers of Revisional Authority. | XVIII.7 |

| Sec.109 Constitution of Appellate Tribunal and Benches thereof. | XVIII.10 |

| Sec.110 President and Members of Appellate Tribunal, their qualification,appointment, conditions of service, etc. | XVIII.11 |

| Sec.111 Procedure before Appellate Tribunal. | XVIII.15 |

| Sec.112 Appeals to Appellate Tribunal. | XVIII.16 |

| Sec.113 Orders of Appellate Tribunal. | XVIII.21 |

| Sec.114 Financial and administrative powers of President. | XVIII.23 |

| Sec.115 Interest on refund of amount paid for admission of appeal. | XVIII.23 |

| Sec.116 Appearance by authorised representative. | XVIII.23 |

| Sec.117 Appeal to High Court. | XVIII.25 |

| Sec.118 Appeal to Supreme Court. | XVIII.27 |

| Sec.119 Sums due to be paid notwithstanding appeal, etc. | XVIII.28 |

| Sec.120 Appeal not to be filed in certain cases. | XVIII.28 |

| Sec.121 Non appealable decisions and orders. | XVIII.29 |

CHAPTER XIX – OFFENCES AND PENALTIES

| Sec.122 Penalty for certain offences. | XIX.1 |

| Sec.122A Penalty for failure to register certain machines used in manufacture of goods as per special procedure | XIX.4 |

| Sec.122B Penalty for contravention of Provision related to Track & Trace Mechanism u/s 148A | XIX.4 |

| Sec.123 Penalty for failure to furnish information return. | XIX.5 |

| Sec.124 Fine for failure to furnish statistics. | XIX.5 |

| Sec.125 General penalty. | XIX.5 |

| Sec.126 General disciplines related to penalty. | XIX.6 |

| Sec.127 Power to impose penalty in certain cases. | XIX.7 |

| Sec.128 Power to waive penalty or fee or both. | XIX.7 |

| Sec.128A Waiver of interest or penalty or both relating to demands raised section 73, for certain tax periods. | XIX.7 |

| Sec.129 Detention, seizure and release of goods and conveyances in transit. | XIX.23 |

| Sec.130 Confiscation of goods or conveyances and levy of penalty. | XIX.24 |

| Sec.131 Confiscation or penalty not to interfere with other punishments. | XIX.26 |

| Sec.132 Punishment for certain offences. | XIX.26 |

| Sec.133 Liability of officers and certain other persons. | XIX.28 |

| Sec.134 Cognizance of offences. | XIX.28 |

| Sec.135 Presumption of culpable mental state. | XIX.28 |

| Sec.136 Relevancy of statements under certain circumstances. | XIX.29 |

| Sec.137 Offences by companies. | XIX.29 |

| Sec.138 Compounding of offences. | XIX.30 |

CHAPTER XX – TRANSITIONAL PROVISIONS

| Sec.139 Migration of existing taxpayers. | XX.1 |

| Sec.140 Transitional arrangements for input tax credit. | XX.1 |

| Sec.141 Transitional provisions relating to job work. | XX.9 |

| Sec.142 Miscellaneous transitional provisions. | XX.10 |

CHAPTER XXI – MISCELLANEOUS

| Sec.143 Job work procedure. | XXI.1 |

| Sec.144 Presumption as to documents in certain cases. | XXI.7 |

| Sec.145 Admissibility of micro films, facsimile copies of documents and computer printouts as documents and as evidence. | XXI.8 |

| Sec.146 Common Portal. | XXI.9 |

| Sec.147 Deemed exports. | XX1.12 |

| Sec.148 Special procedure for certain processes. | XXI.13 |

| Sec.148A Track & trace mechanism for certain goods | XXI.17 |

| Sec.149 Goods and services tax compliance rating. | XXI.18 |

| Sec.150 Obligation to furnish information return. | XXI.18 |

| Sec.151 Power to call information. | XXI.18 |

| Sec.152 Bar on disclosure of information. | XXI.19 |

| Sec.153 Taking assistance from an expert. | XXI.19 |

| Sec.154 Power to take samples. | XXI.20 |

| Sec.155 Burden of proof. | XXI.20 |

| Sec.156 Persons deemed to be public servants. | XXI.20 |

| Sec.157 Protection of action taken under this Act. | XXI.20 |

| Sec.158 Disclosure of information by a public servant. | XXI.20 |

| Sec.158A Consent based sharing of Information furnished by taxable person | XXI.22 |

| Sec.159 Publication of information in respect of persons in certain cases. | XXI.23 |

| Sec.160 Assessment proceedings, etc. not to be invalid on certain grounds. | XXI.23 |

| Sec.161 Rectification of errors apparent on the face of record. | XXI.24 |

| Sec.162 Bar on jurisdiction of civil courts. | XXI.24 |

| Sec.163 Levy of fee. | XXI.24 |

| Sec.164 Power of Government to make rules. | XXI.24 |

| Sec.165 Power to make regulations. | XXI.25 |

| Sec.166 Laying of rules, regulations and notifications. | XXI.25 |

| Sec.167 Delegation of powers. | XXI.25 |

| Sec.168 Power to issue instructions or directions. | XXI.26 |

| Sec.168A Power of Government to extend time limit in special circumstances | XXI.28 |

| Sec.169 Service of notice in certain circumstances. | XXI.29 |

| Sec.170 Rounding off of tax, etc. | XXI.29 |

| Sec.171 Anti–profiteering measure. | XXI.30 |

| Sec.172 Removal of difficulties. | XXI.36 |

| Sec.173 Amendment of Act 32 of 1994. | XXI.37 |

| Sec.174 Repeal and saving. | XXI.37 |

THE INTEGRATED GOODS AND SERVICES TAX ACT, 2017

CHAPTER I – PRELIMINARY

| Sec.1 Short title, extent and commencement. | IGST.1 |

| Sec.2 Definitions. | IGST.1 |

CHAPTER II – ADMINISTRATION

| Sec.3 Appointment of Officers | IGST.6 |

| Sec.4 Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances | IGST.6 |

CHAPTER III – LEVY AND COLLECTION OF TAX

| Sec.5 Levy and collection. | IGST.7 |

| Sec.6 Power to grant exemption from tax | IGST.8 |

| Sec.6A Power Not to recover Goods and Services Tax not levied or short levied as a result of general practice | IGST.11 |

CHAPTER IV – DETERMINATION OF NATURE OF SUPPLY

| Sec.7 Inter–State supply | IGST.11 |

| Sec.8 Intra–State supply | IGST.12 |

| Sec.9 Supplies in territorial waters. | IGST.13 |

CHAPTER V – PLACE OF SUPPLY OF GOODS OR SERVICES

| Sec.10 Place of supply of goods other than supply of goods imported into, or exported from India | IGST.13 |

| Sec.11 Place of supply of goods imported into, or exported from India | IGST.15 |

| Sec.12 Place of supply of services where location of supplier and recipient is in India | IGST.15 |

| Sec.13 Place of supply of services where location of supplier or location of recipient is outside India | IGST.26 |

| Sec.14 Special provision for payment of tax by a supplier of online information and database access or retrieval services | IGST.41 |

| Sec.14A Special Provision for specified actionable claims supplied by a person located outside taxable territory | IGST.42 |

CHAPTER VI – REFUND OF INTEGRATED TAX TO INTERNATIONAL TOURIST

| Sec.15 Refund of integrated tax paid on supply of goods to tourist leaving India. | IGST.43 |

CHAPTER VII – ZERO RATED SUPPLY

| Sec.16 Zero rated supply | IGST.43 |

CHAPTER VIII – APPORTIONMENT OF TAX AND SETTLEMENT OF FUNDS

| Sec.17 Apportionment of tax and settlement of funds | IGST.49 |

| Sec.17A Transfer of certain amounts | IGST.50 |

| Sec.18 Transfer of input tax credit | IGST.50 |

| Sec.19 Tax wrongfully collected and paid to Central or State Government | IGST.51 |

CHAPTER IX – MISCELLANEOUS

| Sec.20 Application of provisions of Central Goods and Services Tax Act | IGST.51 |

| Sec.21 Import of services made on or after the appointed day IGST.54 | |

| Sec.22 Power to make rules | IGST.54 |

| Sec.23 Power to make regulation IGST.54 | |

| Sec.24 Laying of rules, regulations and notification | IGST.55 |

| Sec.25 Removal of difficulties | IGST.55 |

THE UNION TERRITORY GOODS AND SERVICES TAX ACT, 2017

CHAPTER I – PRELIMINARY

| Sec.1 Short title, extent and commencement. | UTGST.1 |

| Sec.2 Definitions. | UTGST.1 |

CHAPTER II – ADMINISTRATION

| Sec.3 Officers under this Act. | UTGST.2 |

| Sec.4 Authorisation of officers. | UTGST.2 |

| Sec.5 Powers of officers. | UTGST.3 |

| Sec.6 Authorisation of officers of central tax as proper officer in certain circumstances. | UTGST.3 |

CHAPTER III – LEVY AND COLLECTION OF TAX

| Sec.7 Levy and collection. | UTGST.4 |

| Sec.8 Power to grant exemption from tax. | UTGST.5 |

| Sec.8A Power Not to recover GST not levied or short levied as a result of general practice | UTGST.5 |

CHAPTER IV – PAYMENT OF TAX

| Sec.9 Payment of tax. | UTGST.6 |

| Sec.9A Utilisation of Input Tax Credit | UTGST.6 |

| Sec.9B Order of utilisation of Input Tax Credit UTGST.6 | |

| Sec.10 Transfer of input tax credit. | UTGST.7 |

CHAPTER V – INSPECTION, SEARCH, SEIZURE AND ARREST

| Sec.11 Officers required to assist proper officers. | UTGST.7 |

CHAPTER VI – DEMANDS AND RECOVERY

| Sec.12 Tax wrongfully collected and paid to Central Government or Union territory Government. | UTGST.7 |

| Sec.13 Recovery of tax. | UTGST.8 |

CHAPTER VII – ADVANCE RULING

| Sec.14 Definitions. | UTGST.8 |

| Sec.15 Constitution of Authority for Advance Ruling. | UTGST.8 |

| Sec.16 Constitution of Appellate Authority for Advance Ruling. | UTGST.9 |

CHAPTER VIII – TRANSITIONAL PROVISIONS

| Sec.17 Migration of existing tax payers. | UTGST.9 |

| Sec.18 Transitional arrangements for input tax credit. | UTGST.10 |

| Sec.19 Transitional provisions relating to job work. | UTGST.12 |

| Sec.20 Miscellaneous transitional provisions. | UTGST.13 |

CHAPTER IX – MISCELLANEOUS

| Sec.21 Application of provisions of Central Goods and Services Tax Act. | UTGST.17 |

| Sec.22 Power to make rules. | UTGST.18 |

| Sec.23 General power to make regulations. | UTGST.19 |

| Sec.24 Laying of rules, regulations and notifications. | UTGST.19 |

| Sec.25 Power to issue instructions or directions. | UTGST.19 |

| Sec.26 Removal of difficulties. | UTGST.19 |

THE GOODS AND SERVICES TAX (COMPENSATION TO STATES) ACT, 2017

| Sec.1 Preliminary | Comp.1 |

| Sec.2 Definitions. | Comp.1 |

| Sec.3 Projected growth rate | Comp.2 |

| Sec.4 Base year | Comp.2 |

| Sec.5 Base year revenue | Comp.2 |

| Sec.6 Projected revenue for any year | Comp.4 |

| Sec.7 Calculation and release of compensation | Comp.4 |

| Sec.8 Levy and collection of cess | Comp.6 |

| Sec.8A Power Not to recover Cess not levied or short levied as a result of general Practice | Comp.7 |

| Sec.9 Returns, payments and refunds | Comp.7 |

| Sec.10 Crediting proceeds of cess to Fund | Comp.8 |

| Sec.11 Other provisions relating to cess | Comp.9 |

| Sec.12 Power to make rules | Comp.10 |

| Sec.13 Laying of rules before Parliament | Comp.11 |

| Sec.14 Power to remove difficulties | Comp.11 |

ANNEXURES

Annexures – Rate Tariff for Goods

| A1 Rate of Tax with Schedule – Goods A.1 – A.72 | |

| A2 Nil Rate of Tax – Goods | A.73 – A.90 |

| A3 Tax Payable on Reverse Charge Basis – Goods | A.91 – A.92 |

| A4 No Refund Cases for unutilised – ITC | A.93 – A.9 |

Annexures – Rate Tariff for Services

| A5 Rate of Tax – Services | A.97 – A.112 |

| A6 Exempted Services | A.113 – A.148 |

| A7 Tax Payable on Reverse Charge Basis – Services | A.149 – A.156 |

| A8 Compensation Cess Rates | A.156 – A.166 |

About the Author

CA G. Sekar

G. Sekar is a Chartered Accountant in practice for the last 35 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa's Institute of Management, an Institution providing education for all

levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member Central Council of ICAI 2013-16, 2016-19 & 2019-22.

Chairman Direct Taxes Committee of ICAI - 2014.

Chairman Auditing And Assurance Standards Board of ICAI 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their 150 years of Income Tax in India Celebrations, for his contribution

and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB). It is worthy to note

that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions,

for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals GST Manual, GST Self Learning, GST Ready Reckoner

(j) Company Law Ready Reckoner

(k) Practitioner's Manual on Direct Taxes Vivad Se Vishwas Act, 2020

(l) Professional's Handbook on Faceless Assessment

9. Author of Books for CA Students Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa's Institute of Management

is the First and Only Educational Institution in India to accomplish this feat

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia