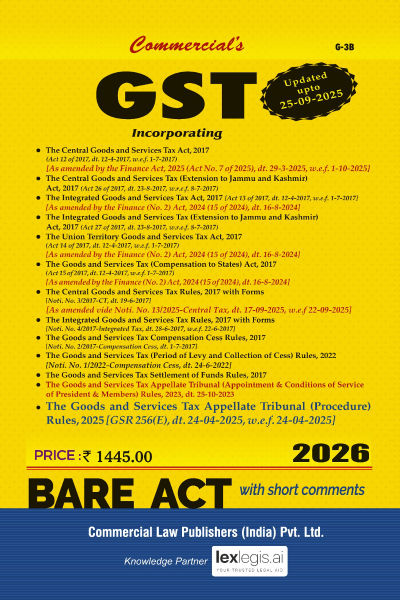

GST Incorporating - Bare Act

by CommercialCONTENTS

| RELEVANT EXTRACTS FROM FINANCE ACT, 2025 | (xxxviii-xli) |

| RELEVANT EXTRACTS FROM FINANCE (NO. 2) ACT, 2024 | (xlii-li) |

| RELEVANT EXTRACTS FROM FINANCE ACT, 2024 | (lii) |

PART I : STATUTORY PROVISIONS

THE CENTRAL GOODS AND SERVICES TAX ACT, 2017

CHAPTER I

PRELIMINARY

| 1. Short title, extent and commencement | 1 |

| 2. Definitions | 1 |

CHAPTER II

ADMINISTRATION

| 3. Officers under this Act | 16 |

| 4. Appointment of officers | 16 |

| 5. Powers of officers | 17 |

| 6. Authorisation of officers of State tax or Union territory tax as proper officer in certain circumstances | 17 |

CHAPTER III

LEVY AND COLLECTION OF TAX

| 7. Scope of supply | 18 |

| 8. Tax liability on composite and mixed supplies | 19 |

| 9. Levy and collection | 19 |

| 10. Composition levy | 21 |

| 11. Power to grant exemption from tax | 25 |

| 11A. Power not to recover Goods and Services Tax not levied or short-levied as a result of general practice | 26 |

CHAPTER IV

TIME AND VALUE OF SUPPLY

| 12. Time of supply of goods | 26 |

| 13. Time of supply of services | 28 |

| 14. Change in rate of tax in respect of supply of goods or services | 29 |

| 15. Value of taxable supply | 30 |

CHAPTER V

INPUT TAX CREDIT

| 16. Eligibility and conditions for taking input tax credit | 32 |

| 17. Apportionment of credit and blocked credits | 35 |

| 18. Availability of credit in special circumstances | 38 |

| 19. Taking input tax credit in respect of inputs and capital goods sent for job work | 40 |

| 20. Manner of distribution of credit by Input Service Distributor | 41 |

| 21. Manner of recovery of credit distributed in excess | 42 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA Aarish Khan

CA/CMA INTER EASY NOTES COLOURED

CA Aarish Khan

CA/CMA INTER INCOME TAX QUESTION BANK

CA Aarish Khan

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

CA Arpita Tulsyan

Join Us !!

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia