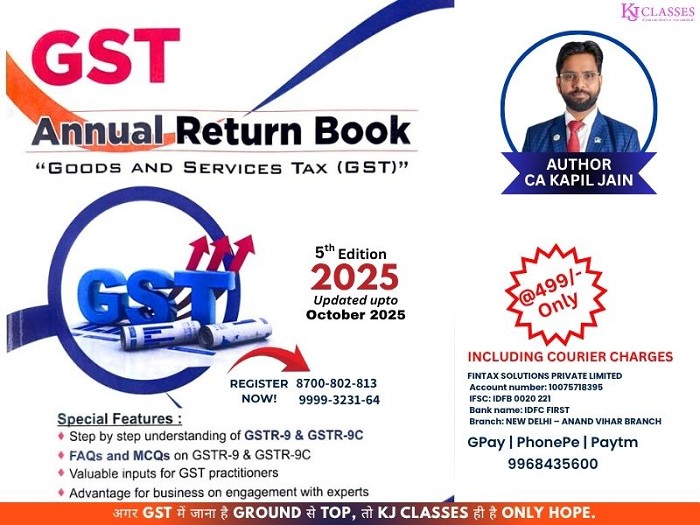

GST Annual Return Book

by Kapil Jain

| DESCRIPTION | PAGE NO. |

|---|---|

| Important Information Regarding GSTR-9 | 3 - 4 |

| Various changes in Form GSTR-9 and 9C FY-2024-2025 | 5 - 16 |

| Annual Return [Section 44] - Analysis | 17 - 21 |

| Sri Shanmuga Hardware's Electricals - Madras High Court | 23 - 25 |

| Annual Return [Rule 80] - Analysis | 27 - 29 |

| Instructions for Filling GSTR-9 | 31 - 45 |

| Mandatory and Optional Tables of GSTR-9 - FY 2024 - 25 | 47 - 48 |

| How to file GSTR-9 (Annual Return for normal taxpayer) | 49 - 50 |

| Details which are required to be furnished in Table 4 &; 5 | 51 - 62 |

| Case studies for Table 4 & 5 of the FORM GSTR-9 | 63 - 67 |

| Details which are required to be furnished in Table 6, 7, and 8 | 69 - 86 |

| Case studies for better understanding of the Table 6, 7 & 8 of the FORM GSTR-9 | 87 - 90 |

| Details which are required to be furnished in Table 9 | 91 - 91 |

| Details which are required to be furnished in Table 10,11,12 and 13 | 93 - 96 |

| Table 14 and Particulars of Demands and Refunds (Table 15) | 97 - 99 |

| Details which are required to be furnished in Table 16 - 19 | 101 - 104 |

| Annual Return for composition dealer [GSTR-9A] | 105 - 105 |

| Annual Return for E-commerce operator [GSTR-9B] | 107 - 107 |

| Person having aggregate turnover exceeding rupees 5 Cr in the F.Y for which Annual Return is to be filed. [GSTR-9C] | 109 - 139 |

| Late fees in case of non-filing/delay filing (Sec-47) & Notice u/s 46 & Penalty in case of non-filing | 141 - 142 |

| FAQs on GSTR-9/9A/9C | 143 - 152 |

| FAQs issued by CBIC | 153 - 170 |

| Relevant Circulars | 171 - 180 |

About the Author

Kapil Jain

CA

FCA Kapil Jain, is a practicing Chartered Accountant qualified in year 2012. He has been a brilliant student in his academic life. He has been a visiting faculty of ICAI and has diverse experience of teaching students as well as professionals. He has very friendly behavior with students.He conducted a lots of seminar in Delhi for CA Students/Professionals and also delivered a lots of SEMINAR/ WEBINAR for industry out of Delhi also. He conducts MEMBERSHIP Program for GST Queries in which more than 700 members are enrolled all over India. His YouTube Channel "KJCLASSES" has helped many people in staying updated with the regular changes in the GST laws. The channel is religiously followed by more than 1.78 Lakhs Subscriber.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia