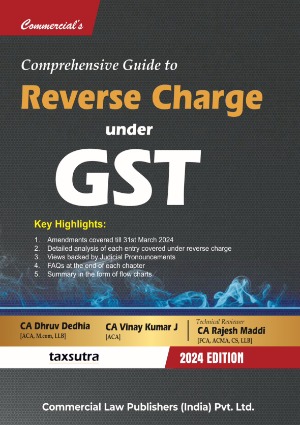

Comprehensive Guide to Reverse Charge under GST(Pre-order Book Launch)

by Dhruv Dedhia, Vinay Kumar J, Rajesh MaddiCONTENTS

Chapter 1— Reverse Charge under GST – An Introduction

| 1.1 What is Reverse Charge Mechanism? | 1 |

| 1.2 Need for Reverse Charge Mechanism | 1 |

| 1.3 A wrong step towards the Reverse Charge | 2 |

| 1.4 Reintroducing the Reverse Charge Properly | 3 |

| 1.5 A Paramount Implementation of Reverse Charge: | 5 |

| 1.6 Revamping the Reverse Charge in GST | 6 |

| 1.7 Advantages of Reverse Charge | 6 |

| 1.8 Types of Levies under Indirect Taxes | 7 |

|

7 |

|

8 |

|

8 |

|

8 |

| 1.9 Sections 9(3) vs 9(4) vs 9(5) | 8 |

| 1.10 Concept of Composite Supplies & Mixed Supplies | 9 |

|

9 |

|

11 |

| 1.11 RCM Supplies made to SEZ Unit or SEZ Developer | 11 |

| 1.12 Transitional Provisions | 13 |

| 1.13 Exemptions under GST – Whether applicable to Recipient?. | 13 |

| 1.14 Supplier deposits the GST on supplies taxable under RCM | 14 |

| 1.15 Reverse Charge for Casual Taxable Persons | 14 |

Chapter 2— Time of Supply for Services under Reverse Charge

| 2.1 Introduction | 16 |

| 2.2 Point of taxation under Erstwhile Regime | 16 |

| 2.3 Time of Supply in GST | 17 |

| 2.4 Issuance of invoice for time of supply. | 19 |

| 2.5 Timeline for issuance of invoice | 19 |

| 2.6 Date of payment for time of supply | 20 |

| 2.7 Associated Enterprises | 20 |

| 2.8 Provision of service – Time of Supply? | 22 |

| 2.9 Residual Time of Supply | 23 |

| 2.10 Conclusion | 24 |

Chapter 3— List of Goods and Services under RCM in GST

| 3.1 Extract of Notification No. 13/2017 – CT (Rate) as amended from time to time | 25 |

| 3.2 Extract of Notification No. 07/2019 – CT (Rate) as amended from time to time | 36 |

| 3.3 Extract of Notification No. 04/2017 – CT (Rate) as amended from time to time | 37 |

| 3.4 List of Services covered under Reverse Charge under Service Tax Regime (Extract of Notification No. 30/2012 – Service Tax as amended from time to time) | 39 |

Chapter 4— Goods Transport Agency Services

| 4.1 Introduction | 44 |

| 4.2 Under Earlier Regime | 44 |

| 4.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 45 |

| 4.4 Exemptions | 47 |

| 4.5 Analysis of Service | 48 |

|

48 |

|

49 |

|

50 |

|

51 |

| 4.6 Supplier of service | 53 |

| 4.7 Recipient of Service | 56 |

|

56 |

|

57 |

|

61 |

| 4.8 Exemptions for GTA | 64 |

|

64 |

|

65 |

|

65 |

|

67 |

|

67 |

|

69 |

| 4.9 Valuation | 69 |

|

69 |

|

70 |

| 4.10 Flow Chart | 70 |

| 4.11 Place of Supply | 70 |

| 4.12 Some Important Aspects | 72 |

|

72 |

| 4.13 Issues and Solutions | 72 |

| 4.14 Judicial Pronouncements | 74 |

Chapter 5— Legal Services by an Advocate

| 5.1 Introduction | 78 |

| 5.2 Under Earlier Regime | 78 |

| 5.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 80 |

| 5.4 Exemptions | 81 |

| 5.5 Analysis of Service | 81 |

|

82 |

|

82 |

|

82 |

|

83 |

|

83 |

|

85 |

|

86 |

|

87 |

|

87 |

|

87 |

|

88 |

|

89 |

| 5.6 Flow chart | 90 |

| 5.7 Valuation | 90 |

| 5.8 Place of Supply | 91 |

| 5.9 Judicial Pronouncements | 91 |

| 5.10 FAQs Answered | 92 |

Chapter 6— Arbitral Tribunal Services

| 6.1 Introduction | 94 |

| 6.2 Under Earlier Regime | 94 |

| 6.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 94 |

| 6.4 Exemptions | 95 |

| 6.5 Analysis of Service | 95 |

|

95 |

|

97 |

|

97 |

| 6.6 Flow Chart | 98 |

| 6.7 Valuation | 99 |

| 6.8 Place of Supply | 99 |

| 6.9 FAQs Answered | 99 |

Chapter 7— Sponsorship Services

| 7.1 Introduction | 100 |

| 7.2 Under Earlier Regime | 100 |

| 7.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 101 |

| 7.4 Exemptions | 102 |

| 7.5 Analysis of Service | 102 |

|

102 |

|

103 |

|

104 |

| 7.6 Supplier of Service | 105 |

| 7.7 Recipient of Service | 106 |

|

106 |

|

107 |

| 7.8 Valuation | 107 |

| 7.9 Place of Supply | 108 |

| 7.10 Judicial Pronouncements | 109 |

| 7.11 FAQs Answered | 109 |

Chapter 8— Government Services

| 8.1 Introduction | 111 |

| 8.2 Under Earlier Regime | 111 |

| 8.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 112 |

| 8.4 Exemptions | 113 |

| 8.5 Analysis of Service | 115 |

|

115 |

|

115 |

|

116 |

|

117 |

|

118 |

|

119 |

|

121 |

|

122 |

| 8.6 Supplier of Service | 123 |

|

123 |

|

124 |

|

125 |

|

125 |

| 8.7 Exemption to Suppliers engaged exclusively in making Exempt Supplies | 126 |

| 8.8 Flow Chart | 127 |

| 8.9 Sovereign Functions | 127 |

|

128 |

|

128 |

|

130 |

| 8.10 Tax on Royalty – Tax or Tax on Tax? | 131 |

|

131 |

|

133 |

|

133 |

|

134 |

| 8.11 Valuation | 134 |

| 8.12 Place of Supply | 135 |

| 8.13 Judicial Pronouncements | 135 |

| 8.14 Advance Rulings | 136 |

Chapter 9— Renting of Immovable Property by the Government

| 9.1 Introduction | 139 |

| 9.2 Under Earlier Regime | 139 |

| 9.3 Entry under GST Regime (w.e.f. 01st Feb, 2018) | 141 |

| 9.4 Exemption | 142 |

| 9.5 Analysis of Service | 142 |

|

143 |

|

145 |

|

145 |

|

146 |

|

147 |

|

147 |

|

|

|

149 |

|

149 |

|

149 |

|

150 |

| 9.6 Flow Chart | 151 |

| 9.7 Valuation | 151 |

|

151 |

|

152 |

| 9.8 Place of Supply | 152 |

| 9.9 Judicial Pronouncements | 153 |

| 9.10 Advance Rulings | 154 |

| 9.11 FAQs Answered | 155 |

Chapter 10— Transfer of Development Rights or Floor Space Index

| 10.1 Introduction | 156 |

| 10.2 Under Service Tax Regime | 156 |

| 10.3 GST Implications Prior to 01.04.2019 | 157 |

| 10.4 Under GST Regime (w.e.f. 01st April, 2019) | 158 |

| 10.5 Exemptions | 158 |

| 10.6 Analysis of Service | 159 |

|

159 |

|

159 |

|

160 |

|

161 |

|

161 |

|

162 |

|

163 |

|

164 |

| 10.7 Supplier of Service | 166 |

| 10.8 Recipient of Service | 166 |

| 10.9 Valuation | 167 |

| 10.10 Place of Supply | 168 |

| 10.11 Time of Supply | 169 |

| 10.12 ITC Eligibility of Tax paid under RCM | 170 |

Chapter 11— Long-Term Lease of Land

| 11.1 Introduction | 171 |

| 11.2 Under Earlier Regime | 171 |

| 11.3 Entry under GST Regime | 172 |

| 11.4 Exemptions | 172 |

| 11.5 Analysis of Service | 173 |

|

174 |

|

175 |

|

176 |

|

177 |

|

178 |

| 11.6 Supplier of Service | 178 |

| 11.7 Recipient of Servic | 179 |

| 11.8 Valuation | 180 |

| 11.9 Place of Supply | 180 |

Chapter 12— Director Services

| 12.1 Introduction | 182 |

| 12.2 Under Earlier Regime | 182 |

| 12.3 Entry under GST Regime | 183 |

| 12.4 Analysis of Service | 183 |

|

183 |

|

184 |

|

184 |

|

185 |

|

185 |

|

186 |

|

187 |

|

187 |

|

188 |

| 12.5 Flow Chart | 189 |

| 12.6 Valuation | 189 |

|

190 |

| 12.7 Place of Supply | 190 |

| 12.8 Judicial Pronouncements | 191 |

| 12.9 FAQs Answered | 191 |

Chapter 13— Supply of Security Personnel

| 13.1 Introduction | 193 |

| 13.2 Under Earlier Regime | 193 |

| 13.3 Entry under GST Regime (w.e.f. 01st January, 2019) | 194 |

| 13.4 Exemptions | 194 |

| 13.5 Analysis of Service | 195 |

|

195 |

| 13.6 Supplier of Service | 196 |

| 13.7 Recipient of Service | 197 |

|

198 |

|

200 |

|

200 |

| 13.8 Flow chart | 200 |

| 13.9 Valuation | 200 |

|

201 |

|

202 |

| 13.10 Place of Supply | 203 |

| 13.11 Judicial Pronouncements | 205 |

| 13.12 Advance Rulings | 206 |

| 13.13 FAQs Answered | 206 |

Chapter 14— Renting of Motor Vehicle

| 14.1 Introduction | 209 |

| 14.2 Under Earlier Regime | 209 |

| 14.3 Exemptions | 210 |

| 14.4 Analysis of Service | 211 |

|

211 |

|

212 |

|

213 |

|

214 |

|

215 |

| 14.5 Supplier of service | 217 |

| 14.6 Recipient of Service | 218 |

| 14.7 Important Aspects | 220 |

|

220 |

|

221 |

|

222 |

| 14.8 Exemption Analysis | 222 |

|

222 |

|

223 |

|

224 |

| 14.9 Flow Chart | 224 |

| 14.10 Valuation | 225 |

| 14.11 Place of Supply | 225 |

| 14.12 Advance Rulings | 226 |

| 14.13 FAQs Answered | 226 |

Chapter 15— GST on Import of Services

| 15.1 Introduction | 228 |

| 15.2 Under Earlier Regime | 228 |

| 15.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 229 |

| 15.4 Exemptions | 229 |

| 15.5 Analysis of Service | 230 |

|

230 |

|

232 |

|

233 |

|

.235 |

|

236 |

| 15.6 Supplier of Service | 236 |

| 15.7 Recipient of Service | 237 |

| 15.8 Analysis of Exemptions | 237 |

|

238 |

|

238 |

|

239 |

| 15.9 Valuation | 239 |

| 15.10 An Insight on Different Services | 241 |

|

241 |

|

241 |

|

242 |

|

242 |

|

243 |

|

244 |

|

245 |

|

245 |

|

246 |

|

246 |

|

247 |

|

248 |

| 15.11 Online Information Database Access or Retrieval Services | 248 |

|

248 |

|

250 |

|

251 |

| 15.12 FAQs Answered | 251 |

| 15.13 Conclusion | 252 |

Chapter 16— Transportation of Goods by Vessel – Ocean Freight

| 16.1 Introduction | 253 |

| 16.2 Under Earlier Regime | 253 |

| 16.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 255 |

| 16.4 Exemptions | 255 |

| 16.5 Analysis of Service | 255 |

|

256 |

|

256 |

|

259 |

|

259 |

|

259 |

|

260 |

|

260 |

|

260 |

| 16.6 Supplier of Service | 261 |

| 16.7 Recipient of Service | 262 |

| 16.8 Flow Chart | 263 |

| 16.9 Valuation | 263 |

| 16.10 Place of Supply | 264 |

Chapter 17— Renting of Residential Dwelling Services

| 17.1 Introduction | 266 |

| 17.2 Under Earlier Regime | 266 |

| 17.3 Entry under GST Regime (w.e.f. 18th July, 2022) | 267 |

| 17.4 Exemptions | 267 |

| 17.5 Analysis of Service | 267 |

|

268 |

|

268 |

|

269 |

|

270 |

|

270 |

| 17.6 Supplier of Service | 271 |

| 17.7 Recipient of Service | 271 |

| 17.8 Flow Chart | 272 |

| 17.9 Valuation | 272 |

| 17.10 Place of Supply | 272 |

| 17.11 FAQs Answered | 273 |

Chapter 18— Insurance Agent Services

| 18.1 Introduction | 276 |

| 18.2 Under Earlier Regime | 277 |

| 18.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 278 |

| 18.4 Analysis of Service | 278 |

|

278 |

|

|

| 18.5 Supplier of Service | 281 |

|

281 |

| 18.6 Recipient of Service | 282 |

| 18.7 Valuation | 282 |

|

283 |

| 18.8 Place of Supply | 283 |

| 18.9 Judicial Pronouncements | 284 |

| 18.10 FAQs Answered | 285 |

Chapter 19— Recovery Agent Services

| 19.1 Introduction | 286 |

| 19.2 Under Earlier Regime | 286 |

| 19.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 287 |

| 19.4 Analysis of Service | 287 |

|

287 |

|

288 |

|

288 |

|

289 |

|

290 |

|

290 |

| 19.5 Valuation | 290 |

| 19.6 Place of Supply | 290 |

| 19.7 Judicial Pronouncements | 291 |

| 19.8 FAQs Answered | 291 |

Chapter 20— Transfer or Permitting Use of Copyright

| 20.1 Introduction | 293 |

| 20.2 Under Earlier Regime | 293 |

| 20.3 Entry under GST Regime (w.e.f. 01st July, 2017) | 295 |

| 20.4 Analysis of Service | 295 |

|

295 |

|

296 |

|

296 |

|

297 |

|

298 |

|

.299 |

|

300 |

|

300 |

|

301 |

|

302 |

|

302 |

| 20.5 Supplier of Service | 303 |

| 20.6 Recipient of Service | 304 |

| 20.7 Valuation | 304 |

| 20.8 Place of Supply | 304 |

| 20.9 Conclusion | 305 |

| 20.10 FAQ’s Answered | 305 |

Chapter 21— Services of an Author

| 21.1 Introduction | 307 |

| 21.2 Under Earlier Regime | 307 |

| 21.3 Entry under GST Regime (Till 30th September, 2019) | 308 |

| 21.4 Entry under GST Regime (w.e.f. 01st October, 2019) | 308 |

| 21.5 Analysis of Service | 309 |

|

309 |

|

310 |

|

311 |

|

312 |

|

313 |

|

313 |

|

314 |

|

315 |

|

315 |

|

316 |

| 21.6 Valuation | 317 |

| 21.7 Place of Supply | 317 |

| 21.8 Conclusion | 318 |

| 21.9 FAQs Answered | 318 |

Chapter 22— Overseeing Committee Services

| 22.1 Introduction | 322 |

| 22.2 Entry under GST Regime (w.e.f. 13th October, 2017) | 322 |

| 22.3 Analysis of Service | 322 |

|

323 |

|

323 |

|

324 |

|

324 |

| 22.4 Valuation | 325 |

| 22.5 Place of Supply | 325 |

Chapter 23— Direct Selling Agent Services

| 23.1 Introduction | 327 |

| 23.2 Under Earlier Regime | 327 |

| 23.3 Entry under GST Regime (w.e.f. 27th July, 2018) | 327 |

| 23.4 Analysis of Service | 328 |

|

328 |

|

328 |

|

329 |

|

329 |

| 23.5 Valuation | 329 |

| 23.6 Place of Supply & Type of Tax | 330 |

| 23.7 FAQs Answered | 331 |

Chapter 24— Business Facilitator Services

| 24.1 Introduction | 333 |

| 24.2 Under Earlier Regime | 333 |

| 24.3 Entry under GST Regime (w.e.f. 01st January, 2019) | 334 |

| 24.4 Exemptions | 334 |

| 24.5 Analysis of Service | 334 |

|

334 |

|

335 |

|

335 |

|

336 |

|

336 |

|

336 |

|

337 |

| 24.6 Services provided to Insurance Company | 337 |

| 24.7 Flowchart | 338 |

| 24.8 Valuation | 338 |

| 24.9 Place of Supply | 338 |

Chapter 25— Business Correspondent Agent Services

| 25.1 Introduction | 340 |

| 25.2 Under Earlier Regime | 340 |

| 25.3 Entry under GST Regime (w.e.f. 01st January, 2019) | 341 |

| 25.4 Exemptions | 341 |

| 25.5 Analysis | 341 |

|

342 |

|

342 |

|

343 |

|

343 |

|

343 |

|

344 |

|

344 |

|

344 |

| 25.6 Flow Chart | 345 |

| 25.7 Valuation | 345 |

| 25.8 Place of Supply | 345 |

Chapter 26— Lending of Securities

| 26.1 Introduction | 347 |

| 26.2 Entry under GST Regime (w.e.f. 01st October, 2019) | 347 |

| 26.3 Analysis of Service | 348 |

|

348 |

|

349 |

|

349 |

|

350 |

| 26.4 Supplier of Service | 351 |

| 26.5 Recipient of Service | 351 |

| 26.6 Flow Chart | 352 |

| 26.7 Place of Supply | 352 |

Chapter 27— Reverse Charge on Goods

| 27.1 Introduction | 354 |

| 27.2 Under Earlier Regime | 354 |

| 27.3 Entries under GST | 354 |

| 27.4 Exemptions under Notification No. 02/2017 – CT (Rate) | 356 |

| 27.5 Analysis | 356 |

|

357 |

|

357 |

|

358 |

|

359 |

|

361 |

|

362 |

|

363 |

|

363 |

|

363 |

|

365 |

|

367 |

|

368 |

|

368 |

|

369 |

|

370 |

|

371 |

|

371 |

|

372 |

|

373 |

|

375 |

| 27.6 Valuation | 375 |

| 27.7 Time of Supply | 376 |

|

376 |

| 27.8 Place of Supply | 377 |

|

378 |

|

379 |

| 27.9 Advance Rulings | 380 |

Chapter 28— Procurement from Unregistered Suppliers

| 28.1 Introduction | 381 |

| 28.2 Under Earlier Regime | 381 |

| 28.3 A Brief Background under GST | 382 |

|

382 |

|

388 |

| 28.4 Entry under Notification No. 07/2019 – CT (Rate) (w.e.f. 01st April, 2019) | 389 |

| 28.5 Analysis of Supplies | 390 |

|

390 |

|

394 |

|

395 |

| 28.6 Valuation | 395 |

| 28.7 Place of Supply | 395 |

| 28.8 FAQs Answered | 397 |

| Annexure-1: A Brief on Types of Real Estate Projects | 398 |

Chapter 29— Compulsory Registration – Whom does it Impact?

| 29.1 Introduction . | 401 |

| 29.2 Advantages of Registration | 401 |

| 29.3 Registration Under GST | 402 |

| 29.4 Compulsory Registration under GST | 403 |

| 29.5 Compulsory Registration for an Individual | 403 |

| 29.6 Compulsory Registration for Unregistered Small Business | 405 |

| 29.7 Registration effect on Supplier suppling RCM supplies | 406 |

| 29.8 Recipient engaged in making only Exempt Supplies | 406 |

| 29.9 Supplier engaged in RCM Supplies & FCM Supplies | 407 |

Chapter 30— Input Tax Credit

| 30.1 A brief History on ITC | 408 |

| 30.2 What is ITC? | 408 |

| 30.3 Eligibility for claiming ITC | 409 |

| 30.4 General conditions for claiming ITC | 409 |

| 30.5 Analysis of Condition of Claiming ITC under RCM | 410 |

| 30.6 Blocked ITC | 413 |

|

413 |

|

415 |

|

415 |

|

415 |

|

|

|

416 |

|

418 |

| 30.7 Rules 42 & 43 Reversal – Relevant for Supplier | 419 |

| 30.8 Revenue Neutrality | 420 |

| 30.9 Some Issues under ITC | 421 |

|

421 |

|

421 |

Chapter 31— Procedural Aspects of Reverse Charge

| 31.1 Documentation for Recipient | 423 |

|

423 |

|

424 |

|

425 |

| 31.2 Documentation for Supplier | 425 |

|

425 |

|

426 |

| 31.3 Payment of Taxes | 426 |

|

427 |

|

427 |

| 31.4 Interest of delayed payment of taxes | 428 |

| 31.5 GST Returns | 429 |

|

429 |

|

430 |

| Chapter 32— Bibliography | 431 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia