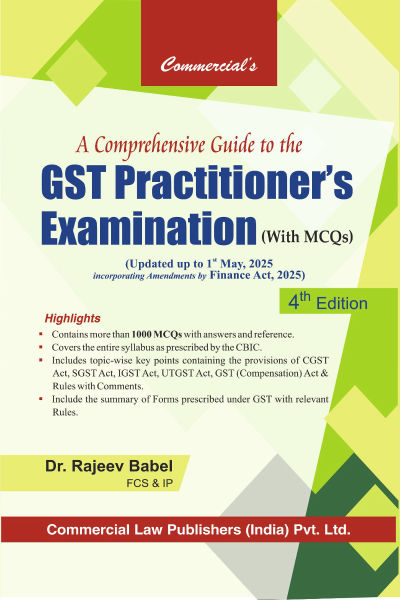

A Comprehensive Guide to the GST Practiotioner's Examination ( with MCQs )

by CA Kamal GargCONTENTS AT A GLANCE

| About the Author | iii |

| Preface to the Fourth Edition | iv |

| Detailed Contents | x |

| Provisions Relating to a Goods and Services Tax Practitioner | xxxiii |

| Examination of Goods and Services Tax Practitioner | xxxvi |

| Abbreviations used in this book | xxxix |

| Sections and Rules � At a Glance | xli |

| Forms Prescribed under CGST | lxi |

PART I

Section A: The Central Goods and Services Tax Act, 2017

| 1. Preliminary -Chapter I (Sections 1 to 2) | 3 |

| 2. Administration � Chapter II (Sections 3 to 6 of the CGST Act, 2017) | 56 |

| 3. Levy and Collection of Tax � Chapter III (Sections 7 to 11A) | 60 |

| 4. Time and Value of Supply � Chapter IV (Sections 12 to 15) | 85 |

| 5. Input Tax Credit � Chapter V (Sections 16 to 21) | 98 |

| 6. Registration � Chapter VI (Sections 22 to 30) | 117 |

| 7. Tax Invoice, Debit and Credit Notes � Chapter VII (Sections 31 to 34) | 134 |

| 8. Accounts and Records � Chapter VIII (Sections 35 to 36) | 144 |

| 9. Returns � Chapter IX (Sections 37 to 48) | 148 |

| 10. Payment of Tax � Chapter X (Sections 49 to 53A) | 162 |

| 11. Refunds � Chapter XI (Sections 54 to 58) | 178 |

| 12. Assessment � Chapter XII (Sections 59 to 64) | 187 |

| 13. Audit � Chapter XIII (Sections 65 to 66) | 193 |

| 14. Inspection, Search, Seizure and Arrest � Chapter XIV (Sections 67 to 72) | 198 |

| 15. Demands and Recovery � Chapter XV (Sections 73 to 84) | 204 |

| 16. Liability to pay in Certain Cases � Chapter XVI (Sections 85 to 94) | 224 |

| 17. Advance Ruling � Chapter XVII (Sections 95 to 106) | 234 |

| 18. Appeals and Revision � Chapter XVIII (Sections 107 to 121) | 245 |

| 19. Offences and Penalties � Chapter XIX (Sections 122 to 138) | 272 |

| 20. Transitional Provisions � Chapter XX (Sections 139 to 142) | 293 |

| 21. Miscellaneous � Chapter XXI (Sections 143 to 174) | 304 |

Section B: The Central Goods and Services Tax Rules, 2017

| 1. Preliminary� Chapter I (Rules 1 & 2) | 325 |

| 2. Composition (Levy) � Chapter II (Rules 3 to 7) | 326 |

| 3. Registration � Chapter III (Rules 8 to 26) | 338 |

| 4. Determination of Value of Supply � Chapter IV (Rules 27 to 35) | 374 |

| 5. Input Tax Credit � Chapter V (Rules 36 to 45) | 385 |

| 6. Tax Invoice, Credit and Debit Notes � Chapter VI (Rules 46 to 55A) | 409 |

| 7. Accounts and Records � Chapter VII (Rules 56 to 58) | 427 |

| 8. Returns � Chapter VIII (Rules 59 to 84) | 432 |

| 9. Payment of Tax � Chapter IX (Rules 85 to 88D) | 458 |

| 10. Refund � Chapter XX (Rules 89 to 97A) | 470 |

| 11. Assessment and Audit � Chapter XI (Rules 98 to 102) | 494 |

| 12. Advance Ruling � Chapter XII (Rules 103 to 107A) | 503 |

| 13. Appeals and Revision � Chapter XIII (Rules 108 to 116) | 506 |

| 14. Transitional Provisions � Chapter XIV (Rules 117 to 121) | 518 |

| 15. Anti-Profiteering � Chapter XV (Rules 122 to 137) | 523 |

| 16. E-Way Rules � Chapter XVI (Rules 138 to 138F) | 530 |

| 17. Inspection, Search and Seizure � Chapter XVII (Rules 139 to 141) | 548 |

| 18. Demands and Recovery � Chapter XVIII (Rules 142 to 161) | 552 |

| 19. Offences and Penalties � Chapter XIX (Rules 162 to 164) | 570 |

PART II

Section A: The Integrated Goods and Services Tax Act, 2017

| 1. Preliminary � Chapter I (Sections 1 to 2) | 579 |

| 2. Administration � Chapter II (Sections 3 to 4) | 588 |

| 3. Levy and Collection of Tax � Chapter III (Sections 5 to 6A) | 589 |

| 4. Determination of Nature of Supply � Chapter IV (Sections 7 to 9) | 594 |

| 5. Place of Supply of Goods or Service or Both � Chapter V (Sections 10 to 14A) | 599 |

| 6. Refund of Integrated Tax to International Tourist � Chapter VI (Sections 15) | 614 |

| 7. Zero Rated Supply � Chapter VII (Sections 16) | 615 |

| 8. Apportionment of Tax and Settlement of Funds � Chapter VIII (Sections 17 to 19) | 617 |

| 9. Miscellaneous Chapter IX (Sections 20 to 25) | 621 |

| Section B: The Integrated Goods and Services Tax Rules, 2017 | 629 |

PART III

| State Goods and Services Tax Act, 2017 | 643 | ? |

PART IV

The Union Territory Goods and Services Tax Act, 2017 647

| 1. Preliminary�Chapter I (Sections 1 & 2) | 649 |

| 2. Administration�Chapter II (Sections 3 & 6) | 652 |

| 3. Levy and Collection of Tax�Chapter III (Sections 7 & 8A) | 655 |

| 4. Payment of Tax�Chapter IV (Sections 9 & 10) | 660 |

| 5. Inspection, Search, Seizure and Arrest�Chapter V (Section 11) | 662 |

| 6. Demands and Recovery�Chapter VI (Sections 12 & 13) | 663 |

| 7. Advance Ruling�Chapter VII (Sections 14 & 16) | 665 |

| 8. Transitional Provisions�Chapter VIII (Sections 17 & 20) | 667 |

| 9. Miscellaneous�Chapter IX (Sections 21 & 26) | 675 |

PART V

Section A: The Central Goods and Services Tax Act, 2017

| The Goods and Services Tax Compensation to States Act, 2017 | 681 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA Aarish Khan

CA/CMA INTER EASY NOTES COLOURED

CA Aarish Khan

CA/CMA INTER INCOME TAX QUESTION BANK

CA Aarish Khan

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

CA Arpita Tulsyan

Join Us !!

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia