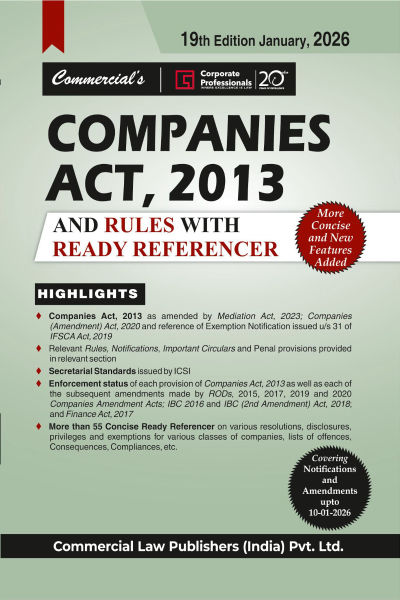

Companies Act, 2013 and Rules with Ready Referencer

by Pavan Kumar VijayContents at a glance

| About Corporate Professionals | iii |

| Brief Profile of Experts who have contributed to this Book | vii |

| How to read the Book/ Some unique features of the Book. | xvii |

| Section-wise Analysis of the Companies (Amendment) Act, 2017 | xix |

| Analysis of the Companies (Amendment) Act, 2019 | xlix |

| Analysis of the Companies (Amendment) Act, 2020 | lxiii |

Division I

Enforcement Status of the Companies Act, 2013

| Enforcement status of Sections of the Companies Act, 2013 and subsequent amendments | 1.1.3 |

| Sections of the Companies Act, 2013 Not Yet Enforced | 1.2.1 |

| Sections Subsequently Inserted in the Companies Act, 2013 | 1.3.1 |

| Sections Subsequently Omitted in the Companies Act, 2013 | 1.4.1 |

Division II

Companies Act, 2013

| Arrangement of Sections | 2.1.iii |

| The Companies Act, 2013 | 2.2.1 |

| Schedule I (MOA & AOA) | Sch.1 |

| Schedule II Useful Lives to Compute Depreciation | Sch.25 |

| Schedule III General Instructions for Preparation of Balance Sheet and Statement of Profit and Loss of a Company | Sch.33 |

| Schedule IV Code for Independent Directors | Sch.135 |

| Schedule V (Managerial Remuneration: Sections 196 & 197) | Sch.139 |

| Schedule VI (Infrastructural Projects) | Sch.149 |

| Schedule VII (Activities relating to Corporate Social Responsibility) | Sch.151 |

Division III

Circulars/Orders/ Notifications

| Table of Circulars | 3.C.3 |

| Circulars | 3.C.21 |

| Table of Orders | 3.O.1 |

| Orders | 3.O.3 |

| Table of Notifications | 3.N.1 |

| Notifications 3.N.4 | 3.N.4 |

Division IV

Secretarial Standards

| Secretarial Standard on Meetings of the Board of Directors | 4.3 |

| Secretarial Standard on General Meetings | 4.22 |

| Secretarial Standard on Dividend | 4.50 |

| Secretarial Standard on Report of The Board of Directors | 4.63 |

Division V

Concise Referencer

| List of Ready Referencer | 5.3 |

A: Companies Act, 2013 & 1956

| 01. Provisions of the Companies Act, 1956 and Corresponding Provisions of the Companies Act, 2013 | 5.7 |

| 02. Provisions of the Companies Act, 2013 and Corresponding Provisions of the Companies Act, 1956 | 5.55 |

B: Resolutions and Approvals under the Companies Act, 2013

| 03. Matters Requiring Approval of Members by Ordinary Resolution | 5.95 |

| 04. Matters Requiring Approval of Members by Special Resolution | 5.101 |

| 05. Matters Requiring Special Notice | 5.111 |

| 06. Rights which can be Exercised by Members having at least 10% Voting Power | 5.112 |

| 07. Matters to be Passed by Postal Ballot | 5.116 |

| 08. Matters Requiring Unanimous Resolutions by Board of Directors | 5.118 |

| 09. Matters Required to be Agreed to by All Members (Unanimous) | 5.119 |

| 10. Matters Requiring Resolutions to be Passed by Board of Directors in Board Meeting Only | 5.121 |

C: Privileges and Exemptions under the Companies Act, 2013

| 11. Privileges and Exemptions for Private Company | 5.125 |

| 12. Privileges and Exemptions for Specified IFSC Private Company | 5.130 |

| 13. Privileges and Exemptions for Specified IFSC Public Company | 5.136 |

| 14. Privileges and Exemptions for Government Companies | 5.143 |

| 15. Privileges and Exemptions for Nidhi Company | 5.151 |

| 16. Privileges and Exemptions for Section 8 Company | 5.154 |

| 17. Privileges and Exemptions for One Person Company (OPC) | 5.158 |

| 18. Privileges and Exemptions for Start-Up Companies | 5.161 |

| 19. Privileges and Exemptions for Small Company | 5.164 |

| 20. Privileges and Exemptions for Dormant Company | 5.167 |

D: Disclosures under the Companies Act, 2013

| 21. Disclosures in Director's Report by One Person Company (OPC) and Small Company | 5.171 |

| 22. Disclosures in Director's Report by Private Company | 5.175 |

| 23. Disclosures in Director's Report by Unlisted Public Company | 5.182 |

| 24. Disclosures in Director's Report by Listed Company | 5.192 |

| 25. Matters Required to be Posted on Website of the Company | 5.202 |

| 26. Disclosures in Explanatory Statement | 5.209 |

| 27. Matters Required to be Published in Newspapers | 5.221 |

| 28. Disclosures by Director to the Board/Company | 5.232 |

E: Punishment and Penalties under the Companies Act, 2013

| 29. Offences Liable for Punishment for Fraud under Section 447 (Cognizable Offence) | 5.237 |

| 30. Offences Liable to Penalty (Adjudication under Section 454) | 5.243 |

| 31. Offences Liable to Punishment with Fine Only (Compoundable Offences) | 5.259 |

| 32. Offences Liable to Punishment with Imprisonment or with Fine or with Both(Compoundable Offences) | 5.268 |

| 33. Offences Liable to Punishment with Imprisonment and with Fine (Non-Compoundable Offence) | 5.272 |

F: Consequences

| 34. Consequences for Default in Repayment of Deposit or Interest Therein | 5.281 |

| 35. Consequences for Default in Repayment of Debenture or Interest Therein | 5.285 |

| 36. Consequences for Default in Redemption of Preference Shares or Payment of Dividend Thereon | 5.287 |

| 37. Consequences for Default in Payment of Declared Dividend | 5.288 |

| 38. Consequences for Default in Repayment of Term Loan from Public Financial Institutions or State Level Financial Institution or Scheduled Bank or Interest Payable Thereon | 5.290 |

| 39. Consequences for Default in Filing of 'Annual Return' or 'Financial Statements' with the Registrar | 5.291 |

| 40. Consequences for Initiation of any Inquiry, Inspection or Investigation Against the Company or any Prosecution is Pending Against the Compan | 5.294 |

G: Documents and Inspection

| 41. Documents and Registers Required to be Maintained at the Registered Office of the Company | 5.297 |

| 42. Documents Available for Inspection | 5.302 |

| 43. Documents Available for Inspection by Director of Company | 5.312 |

| 44. Documents Available for Inspection by Shareholder/Member of Company | 5.313 |

| 45. Registers Required to be Kept open at AGM For Inspection | 5.317 |

| 46. Powers of Inspection, Inquiry and Investigation | 5.318 |

| 47. Circumstances for Inspection, Inquiry and Investigation | 5.319 |

H: Compliances under the Companies Act, 2013

| 48. Annual Compliances Under the Companies Act, 2013 | 5.325 |

| 49. Post-Incorporation Compliances | 5.332 |

| 50. Parameters Based Additional Compliances for Private Company | 5.333 |

| 51. Parameters Based Additional Compliances for 'Unlisted Public Company' Under the Companies Act, 2013 | 5.337 |

| 52. Parameters Based Additional Compliances for 'Listed Company' Under the Companies Act, 2013 | 5.345 |

| 53. Resolutions Required to be Filed with the Registrar of Companies | 5.350 |

| 54. Types of Debentures which shall not be Treated as Deposits | 5.351 |

| 55. Tenure & Limits for Acceptance of Deposits | 5.352 |

I: Others

| 56. Specific Provisions which Require Valuation Report from a Registered Valuer | 5.357 |

| 57. List of Forms under the Companies Act, 2013 | 5.359 |

| 58. List of Formats under the Companies Act, 2013 | 5.369 |

About the Author

Pavan Kumar Vijay

G. Sekar is a Chartered Accountant in practice for the last 35 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa's Institute of Management, an Institution providing education for all

levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member Central Council of ICAI 2013-16, 2016-19 & 2019-22.

Chairman Direct Taxes Committee of ICAI - 2014.

Chairman Auditing And Assurance Standards Board of ICAI 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their 150 years of Income Tax in India Celebrations, for his contribution

and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB). It is worthy to note

that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions,

for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals GST Manual, GST Self Learning, GST Ready Reckoner

(j) Company Law Ready Reckoner

(k) Practitioner's Manual on Direct Taxes Vivad Se Vishwas Act, 2020

(l) Professional's Handbook on Faceless Assessment

9. Author of Books for CA Students Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa's Institute of Management

is the First and Only Educational Institution in India to accomplish this feat

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia