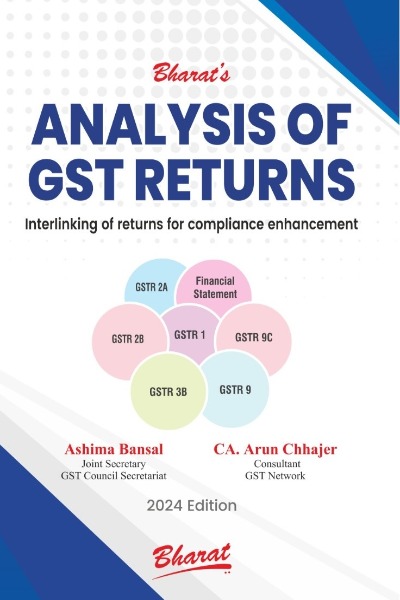

ANALYSIS OF GST RETURNS

by Ashima Bansal & CA Arun ChhajerBook Currently Unavailable

This book is no longer available and has been discontinued

Browse Other BooksCONTENTS AT A GLANCE

| Bharat? | 5 |

| Detailed Contents | 13 |

| Chapter 1 Analysis of GSTR 1 and its Interlinking with GSTR 3B, 9 and 9C | 1 |

| Chapter 2 Analysis of GSTR 1A | 72 |

| Chapter 3 GSTR 3B and its interlinking with GSTR 1/9/9C | 74 |

| Chapter 4 Analysis of GSTR 9 and its Interlinking with GSTR 3B, 1 and 9C | 140 |

| Chapter 5 Analysis of GSTR 9C and its interlinking with GSTR 1, 3B and 9 | 200 |

| Chapter 6 GSTR 2A and GSTR 2B | 236 |

| Chapter 7 Explore the Financial Position: Understanding the Balance Sheet Assets | 266 |

CAclubindia

CAclubindia