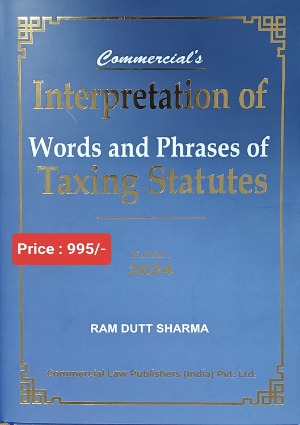

Interpretation of Words and Phrases of Taxing Statutes

by Ram Dutt SharmaCONTENTS

| Chapter 1. Introduction | |

| Foundational principle for a charge under Tax Statutes: | 1 |

| Purpose of Interpretation | 1 |

| Statute must be read as a whole | 2 |

| Sources of Rules | 2 |

| Particulars in a Statute | 3 |

| Tools in interpretation | 4 |

| Internal aids to construction vis-a-vis External aids to construction | 7 |

| Preliminary Steps before attempting to interpret a given statute: | 8 |

| Special Law Overrides General Law | 9 |

| Principles of Statutory Interpretation | 10 |

| A statute is either perpetual or temporary | 17 |

| Undefined words | 19 |

| Definitions in other statute | 19 |

| Plain Meaning Rule | 20 |

| Rules of Language | 20 |

| Judicially defined words | 21 |

| Chapter 2. Act | |

| Which can we Regard as the special Act and which the General ? | 23 |

| When both the Acts show non-obstante clauses; therefore, the question which arises for consideration is which Act will prevail | 24 |

| Chapter 3. Amendment | 26 |

| Chapter 4. An Act to Amend and Consolidate the Law | |

| Meaning of consolidation of the law | 28 |

| Objective of Income-tax Act, 1961 | 28 |

| Chapter 5. Annul | 29 |

| Chapter 6. Bare Act | |

| Literal Interpretation | 32 |

| Contents of Bare Act | 32 |

| Role of ‘Preamble’ in interpretation of statute | 32 |

| Examples of Bare Act | 33 |

| Chapter 7. Casus Omissus | |

| The casus omissus cannot be supplied by the Courts | 35 |

| Supplying ‘casus omissus’ which was not permissible and could only have been done by the Supreme Court in an appropriate case | 36 |

| Casus omissus broadly refers to the principle that a matter which has not been provided in the statute but should have been there,cannot be supplied | 36 |

| Chapter 8. Caveat | |

| Meaning of a Caveat | 37 |

| Content to Be included in a Caveat | 37 |

| Purpose of a Caveat | 38 |

| Where can a Caveat be Lodged? | 38 |

| Chapter 9. Charging Provision | |

| Charging section should be strictly construed while the procedural sections should be liberally interpreted | 40 |

| Chapter 10. Circulars or Instructions | |

| Nature of a CBDT circular can be summarised in the words of Hon’ble Supreme Court | 42 |

| Binding Nature of Circular/Instruction | 43 |

| Chapter 11. Clause | |

| Clue to Identify whether a part of section is Clause or Sub-section | 47 |

| Chapter 12. Code | 48 |

| Chapter 13. Collegium | |

| Dispute Resolution Panel (DRP) is an income-tax authority | 50 |

| Chapter 14. Cross-Examination | |

| What is Cross-Examination? | 51 |

| Requests for cross-examination may be denied | 51 |

| Types of Evidence | 52 |

| Technical Rules of Evidence do not Apply to Income Tax Proceedings | 52 |

| Lack of cross-examination & violation of principle of natural justice | 52 |

| Chapter 15. Definition Clause (Interpretation) | |

| Definitions in other statutes | 68 |

| Chapter 16. Deletion | 69 |

| Chapter 17. De Novo | 70 |

| Chapter 18. Derived From | 72 |

| Chapter 19. Dismiss | |

| ‘Appeal is Dismissed’ | 74 |

| Dismissal of Appeal by Appellate Commissioner | 74 |

| “SLP Dismissed� : | 74 |

| SLP is Dismissed, however, the question of law is kept open | 75 |

| Chapter 20. Ejusdem Generis | |

| Need for the Doctrine | 77 |

| Essentials of the Doctrine of Ejusdem Generis | 78 |

| Chapter 21. Error of Jurisdiction or Lack of Jurisdiction(Excessive Jurisdiction) | |

| Nullity when occurs | 80 |

| Jurisdictional Error | 81 |

| Few Instances: Jurisdictional Error | 81 |

| Lack of Jurisdiction (Excessive Jurisdiction) | 81 |

| Few Instances: Lack of jurisdiction (excessive jurisdiction) | 82 |

| Chapter 22. Estoppels | |

| Requirements of Promissory Estoppel | 95 |

| Conditions for application of Doctrine of Estoppel | 96 |

| Exceptions to Estoppel | 96 |

| Principles of estoppel not apply to Income Tax proceedings | 96 |

| Doctrine of Promissory Estoppel is not Applicable Against the State while Exercising its Legislative Power | 97 |

| Chapter 23. Exception | |

| Exceptions & saving clauses | 100 |

| Chapter 24. Exemptions | |

| Exemption Clause - Strict Construction | 101 |

| Chapter 25. Explanation | |

| Object of an Explanation to a statutory provision | 106 |

| Chapter 26. For the Removal of Doubts | |

| Clarificatory or Retrospective – who decides | 110 |

| Chapter 27. Full and True Disclosures | |

| What is full and true Disclosure | 111 |

| What does full and true Disclosure mean | 111 |

| Chapter 28. Includes | 113 |

| Chapter 29. Income | |

| Inclusion of all sorts of subsidies within ambit of ‘Income’ under Section 2(24) is not unconstitutional | 115 |

| Term “income� as defined in section 2(24) does not include “interest� referred to in section 56(2)(viii) or interest received in MACT award | 116 |

| Chapter 30. Income Tax Law | 119 |

| Chapter 31. Judicial Discipline | |

| Assessing Officer is bound to follow High Court ruling given in assessee’s favour even if Department has filed SLP against the decision to Supreme Court | 121 |

| An order of High Court does not become inoperative merely because Department filed an appeal or SLP against it | 121 |

| Binding nature of order of another bench - Judicial discipline[Article 226] | 122 |

| Judicial discipline demands that subordinate authorities shall accept the decisions of Tribunal as binding precedent | 122 |

| Chapter 32. Judicial Precedents | |

| Meaning of Precedent | 124 |

| Definition of Precedent | 125 |

| Origin of Precedent | 125 |

| Object of Doctrine of Precedent | 125 |

| Binding nature of Precedents | 126 |

| General Principles | 126 |

| Exception to the doctrine of Precedents, i.e., when Precedent ceases to be Binding | 126 |

| Legislative Amendment 128 | |

| Chapter 33. Law | |

| Judges to Apply the Law | 157 |

| Meaning of Law | 157 |

| “LAW� Defined | 158 |

| Generally the term “law� is used to mean three things: | 159 |

| Origin of Law | 159 |

| Nature of Law | 160 |

| Functions of law | 160 |

| Rule of Law | 161 |

| Role of law in Business | 161 |

| Role of law in Society | 161 |

| Forbidden by Law mean: | 162 |

| Chapter 34. Literal Rule | 158 |

| Advantages of the Literal Rule | 165 |

| Dis-advantages of the Literal Rule | 165 |

| Chapter 35. Machinery Provision | |

| While interpreting machinery provisions of a Taxing Statute Court should give effect to its Manifest purpose: | SC 167 |

| Chapter 36. Mandatory or Directory | |

| Difference between Mandatory and Directory provisions | 170 |

| Rules for determination of Mandatory and Directory Statute | 172 |

| Intention of the legislature: | 172 |

| Purpose behind the Statute: | 172 |

| Chapter 37. Marginal Notes | |

| Definition of Marginal Notes: | 176 |

| Limitations of Marginal notes as internal aid to construction: | 176 |

| Chapter 38. May or Shall | 179 |

| Chapter 39. Means | 181 |

| Chapter 40. Mutatis Mutandis | 183 |

| Chapter 41. Natural Justice | |

| Adjournments | 185 |

| Situations of violation of principles of natural justice in taxation laws | 185 |

| Rule against Bias | 187 |

| “Justice must not only be done, but must be seen to be done� | 187 |

| Right to Fair Hearing | 188 |

| Chapter 42. Non - Obstante Clauses | |

| Non-obstante clause in Section 153A does not exclude Applicability of Reassessment Proceedings | 204 |

| Bombay High Court decodes Non Obstante Clause | 204 |

| Non-obstante clauses are not always to be regarded as Repealing Clauses nor as clauses which expressly or completely supersede any other Provision of the Law | 207 |

| Chapter 43. Nothing Contained In | 208 |

| Chapter 44. Notwithstanding Anything Contained In... | |

| Distinction between the Expression ‘Subject to other provisions’ and the expression “Notwithstanding anything Contained in..� | 211 |

| Chapter 45. Obiter Dicta | 212 |

| Chapter 46. Omission | 214 |

| Chapter 47. Oral Order or Judgment | |

| Oral and Written Judgments | 218 |

| What is a Judgment? | 218 |

| The term ‘Judgment’ has been defined under section 2(9) of the Civil Procedure Code as under: | 218 |

| Judges should speak through Judgements and Orders, not issue oral directions: Supreme Court | 218 |

| Chapter 48. Per Incuriam | |

| A Decision is given per Incuriam when the Court has Acted | 220 |

| Tribunal has no Jurisdiction to hold that a Particular Decision of Jurisdictional High Court has been rendered per Incuriam or sub Silentio | 222 |

| The Proposition that a decision per Incuriam need not be followed as a Binding Precedent is Well-established | 224 |

| Chapter 49. Perversity | |

| Perverse 225 | |

| Test and Benchmark of Perversity is Far Stringent and Strict | 225 |

| Chapter 50. Precedent | |

| Doctrine of Precedent in India – a British Legacy | 238 |

| Pre-Independence | 238 |

| Post-Independence | 238 |

| Supreme Court | 238 |

| High Courts | 238 |

| Lower Courts | 239 |

| Precedents | 239 |

| Rules for Reading the Precedents | 239 |

| Circumstances that Weaken the Binding force of a Precedent | 239 |

| Precedent ceases to be a Binding Precedent | 239 |

| Circumstances Weakening the Binding force of Precedents | 240 |

| Constitutional provisions regarding precedents of the Supreme Court – Scope of Article 141 | 240 |

| Use of Foreign Decisions | 242 |

About the Author

Ram Dutt Sharma

Ram Dutt Sharma was born on 27th June, 1958 in Narnaul, Haryana. He got his post-graduation from M.D. University, Rohtak in 1980. He joined the Income-tax Department in the year 1983 and retired as Income Tax Officer on 30.06.2018. He worked at various stations of North-West Region of Income-tax Department. He has wide experience of all wings of Income-tax Department such as Assessment Unit, Special Range, TDS Wing, Investigation Wing, etc. He has been Contributing articles and addressing on topics relating to Income Tax at NADT Regional Campus, Chandigarh & Bhopal. He has also addressed number of seminars organized by the Income-tax Department, Chartered Accountants, Advocates and various Trade Associations.

He is recipient of first-ever Finance Minister's Award 2017, the Income Tax Departments highest honour for sustained devotion, commitment to duty & promoting excellence in the field of Direct Taxation at National Level. The Hon'ble Union Finance Minister, Shri ArunJaitley conferred this Finance Ministers Award for Excellence for his meritorious services at VigyanBhawan, New Delhi on 24.07.2017.

Awarded by Hon'ble Member (Revenue& TPS), CBT, Special Secretary to the Government of India Certificate of Appreciation for his contribution recognized and included in the chapter Miscellaneous Orders in Let Us Share A compilation of Best Practices & Orders Vol. VIII released on 31stOctober, 2016.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia