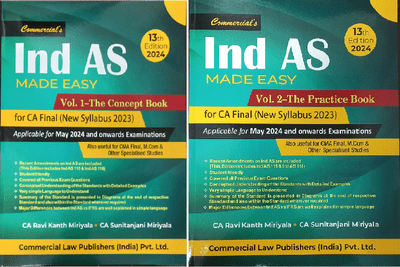

Ind AS Made Easy

by Ravi Kanth Miriyala, Sunitanjani Miriyala| Vol 1 Pages | 804 |

| Vol 2 Pages | 584 |

CONTENTS

VOL-1

| Preface | v |

| Acknowledgment | vii |

| Part A Introduction | 1 |

| Part B Conceptual Framework for Financial Reporting under Ind AS (Conceptual Framework) | 7 |

| Part C Important Basics of Ind AS | 21 |

| Chapter 1 Ind AS 1 — Presentation of Financial Statements | 26 |

| Chapter 2 Ind AS 2 — Inventories | 50 |

| Chapter 3 Ind AS 7 — Statement of Cash Flow | 64 |

| Chapter 4 Ind AS 8 — Accounting Policies, Change in Accounting Estimate and Errors | 78 |

| Chapter 5 Ind AS 10 — Events after the Reporting Period | 92 |

| Chapter 6 Ind AS 12 — Income Taxes | 101 |

| Chapter 7 Ind AS 16 — Property, Plant and Equipment (PPE) | 124 |

| Chapter 8 Ind AS 19 — Employee Benefits | 144 |

| Chapter 9 Ind AS 20 — Accounting for Government Grants | 163 |

| Chapter 10 Ind AS 21 — The Effects of Changes in Foreign Exchange Rates | 179 |

| Chapter 11 Ind AS 23 — Borrowing Costs | 196 |

| Chapter 12 Ind AS 24 — Related Party Disclosures | 209 |

| Chapter 13 Ind AS 27 — Separate Financial Statements | 223 |

| Chapter 14 Ind AS 28 — Investments in Associates and Joint Venture in | 229 |

| Chapter 15 Ind AS 33 — Earnings Per Share | 245 |

| Chapter 16 Ind AS 34 — Interim Financial Reporting | 262 |

| Chapter 17 Ind AS 36 — Impairment of Assets | 273 |

| Chapter 18 Ind AS 37 — Provisions, Contingent Liabilities and Contingent Assets | 296 |

| Chapter 19 Ind AS 38 — Intangible Assets | 309 |

| Chapter 20 Ind AS 40 — Investment Property | 325 |

| Chapter 21 Ind AS 41 — Agriculture | 335 |

| Chapter 22 Ind AS 101 — First-time Adoption of Indian Accounting Standards | 342 |

| Chapter 23 Ind AS 102 — Share Based Payments | 351 |

| Chapter 24 Ind AS 103 — Business Combinations | 378 |

| Chapter 25 Ind AS 105 — Non-current Assets Held for Sale and Discontinued Operations | 430 |

| Chapter 26 Ind AS 108 — Operating Segments | 440 |

| Chapter 27 Ind AS 109, 107 & 32 — Financial Instruments | 450 |

| Chapter 28 Ind AS 110 — Consolidated Financial Statements | 523 |

| Chapter 29 Ind AS 111 — Joint Arrangements | 605 |

| Chapter 30 Ind AS 112 — Disclosure of Interests in Other Entities | 617 |

| Chapter 31 Ind AS 113 — Fair Value Measurement | 623 |

| Chapter 32 Ind AS 115 —Revenue from Contracts with Customers | 640 |

| Chapter 33 Ind AS 116— Leases | 682 |

| Chapter 34 Differences between Ind AS and IFRS | 717 |

| Chapter 35 Schedule III — Division II – Ind AS Financial Statements | 725 |

| Chapter 36 Analysis of Financial Statements | 749 |

| Chapter 37 Professional and Ethical duty of a Chartered Accountant | 753 |

| Chapter 38 Accounting and Technology | 774 |

CONTENTS

VOL-2

| Preface | v |

| Acknowledgment | vii |

| Chapter 1 Ind AS 1 — Presentation of Financial Statements | 1 |

| Chapter 2 Ind AS 2 — Inventories | 9 |

| Chapter 3 Ind AS 7 — Statement of Cash Flow | 19 |

| Chapter 4 Ind AS 8 — Accounting Policies, Change in Accounting Estimate and Errors | 29 |

| Chapter 5 Ind AS 10 — Events after the Reporting Period | 34 |

| Chapter 6 Ind AS 12 — Income Taxes | 39 |

| Chapter 7 Ind AS 16 — Property, Plant and Equipment (PPE) | 59 |

| Chapter 8 Ind AS 19 — Employee Benefits | 79 |

| Chapter 9 Ind AS 20 — Accounting for Government Grants | 94 |

| Chapter 10 Ind AS 21 — The Effects of Changes in Foreign Exchange Rates | 101 |

| Chapter 11 Ind AS 23 — Borrowing Costs | 113 |

| Chapter 12 Ind AS 24 — Related Party Disclosures | 122 |

| Chapter 13 Ind AS 28 – Investments in Associates and Joint Venture in | 128 |

| Chapter 14 Ind AS 33 — Earnings Per Share | 142 |

| Chapter 15 Ind AS 34 — Interim Financial Reporting | 158 |

| Chapter 16 Ind AS 36 — Impairment of Assets | 167 |

| Chapter 17 Ind AS 37 — Provisions, Contingent Liabilities and Contingent Assets | 182 |

| Chapter 18 Ind AS 38 — Intangible Assets | 192 |

| Chapter 19 Ind AS 40 — Investment Property | 202 |

| Chapter 20 Ind AS 41 — Agriculture | 210 |

| Chapter 21 Ind AS 101 — First-time Adoption of Indian Accounting Standards | 216 |

| Chapter 22 Ind AS 102 – Share Based Payments | 228 |

| Chapter 23 Ind AS 103 – Business Combinations | 257 |

| Chapter 24 Ind AS 105 — Non-current Assets Held for Sale and Discontinued Operations | 328 |

| Chapter 25 Ind AS 108 – Operating Segments | 337 |

| Chapter 26 Ind AS 109, 107 & 32 — Financial Instruments | 342 |

| Chapter 27 Ind AS 110 – Consolidated Financial Statements | 383 |

| Chapter 28 Ind AS 111 –Joint Arrangements | 477 |

| Chapter 29 Ind AS 113 — Fair Value Measurement | 487 |

| Chapter 30 Ind AS 115 —Revenue from Contracts with Customers | 617 |

| Chapter 31 Ind AS 116— Leases | 511 |

| Chapter 32 Analysis of Financial Statements | 536 |

About the Author

Ravi Kanth Miriyala, Sunitanjani Miriyala

Ravi Kanth Miriyala-CA Ravi Kanth Miriyala is a practising Chartered Accountant with over fourteen years of professional experience in Accounting and Auditing. He has worked with Deloitte & PwC for more than six years and accomplished audits both in Indian and US GAAP.In this role of Principal Consultant (Ind AS Projects), he has advised companies on issues related to identification of differences between Ind AS and their existing accounting policies, impact assessment on the transition to Ind AS, evaluation of policy options available under Ind AS, finalization of Ind AS accounting policies, preparation of Ind AS opening balance sheet on the transition date and various disclosure requirement as per the new standard.A prolific writer and authored academic books for CA Inter & Final students on Accounting Standards and Ind AS.

Sunitanjani Miriyala-CA Sunitanjani Miriyala is a practising Chartered Accountant with eleven years of professional experience in Accounting and Auditing.She actively participated in Ind AS Convergence projects and authored academic books for CA Inter & Final students on Accounting Standards and Ind AS

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia