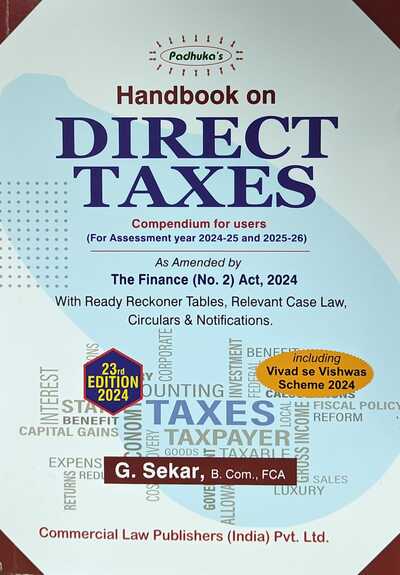

Handbook on Direct Taxes

by CA G. SekarCONTENTS

FAST TRACK REFERENCER

| FTR 1 Tax Rates for Last Ten Assessment Years F | 1.1 |

| FTR 2 Amendments by Finance (No. 2) Act, 2024 F | 2.1 |

| FTR 3 Due Dates for Direct Taxes F | 3.1 |

| FTR 4 Special Rates under the Income Tax Act, 1961 F | 4.1 |

| FTR 5 TDS & TCS Rates for Financial Year 2024–2025 F | 5.1 |

| FTR 6 Investment Planner for Financial Year 2024–2025 F | 6.1 |

| FTR 7 Forms under Income Tax Rules, 1962 F | 7.1 |

| FTR 8 Heads of Income and Deductions F | 8.1 |

| FTR 9 Limitation of Time F | 9.1 |

| FTR 10 Depreciation Rates under Income Tax Rules, 1962 F | 10.1 |

| FTR 11 Depreciation Rates under Schedule II of The Companies Act, 2013 F | 11.1 |

| FTR 12 Gold and Silver Rates F | 12.1 |

CHAPTERS

| 1 Basic Concepts in Income Tax Law | 1.1 to 1.14 |

| 2 Residential Status | 2.1 to 2.22 |

| 3 Exemptions under the Income Tax Act, 1961 | 3.1 to 3.60 |

| 4 Salaries | 4.1 to 4.38 |

| 5 Income from House Property | 5.1 to 5.10 |

| 6 Profits and Gains of Business or Profession | 6.1 to 6.92 |

| 7 Capital Gains | 7.1 to 7.58 |

| 8 Income from Other Sources | 8.1 to 8.26 |

| 9 Income of Other Persons included in Assessee’s Total Income | 9.1 to 9.4 |

| 10 Set off and Carry Forward of Losses | 10.1 to 10.8 |

| 11 Deductions under Chapter VI–A | 11.1 to 11.50 |

| 12 Rebates from Tax Payable | 12.1 to 12.6 |

| 13 Agricultural Income | 13.1 to 13.6 |

| 14 Taxation of Individuals | 14.1 to 14.8 |

| 15 Taxation of HUF | 15.1 to 15.6 |

| 16 Taxation of Partnership Firm | 16.1 to 16.10 |

| 17 Taxation of LLP | 17.1 to 17.4 |

| 18 Taxation of Companies | 18.1 to 18.42 |

| 19 Taxation of AOP | 19.1 to 19.6 |

| 20 Taxation of Co–operative Society | 20.1 to 20.10 |

| 21 Taxation of Charitable Trust | 21.1 to 21.30 |

| 22 Taxation of Private Trust | 22.1 to 22.2 |

| 23 Taxation of Non–Residents | 23.1 to 23.26 |

| 24 Taxation of International Transactions – Transfer Pricing | 24.1 to 24.28 |

| 25 Double Taxation Avoidance Agreement | 25.1 to 25.12 |

| 26 Taxation of Mutual Associations | 26.1 to 26.2 |

| 27 Special Provisions relating to Avoidance of Tax | 27.1 to 27.12 |

| 28 Tax Deduction at Source | 28.1 to 28.96 |

| 29 Advance Tax, Collection and Recovery of Tax. | 29.1 to 29.12 |

| 30 Interest | 30.1 to 30.8 |

| 31 Refunds | 31.1 to 31.6 |

| 32 Penalties and Prosecutions | 32.1 to 32.34 |

| 33 Income Tax Authorities | 33.1 to 33.10 |

| 34 Assessment Procedure – Duties of Assessee | 34.1 to 34.42 |

| 35 Assessment Procedure – Powers of the Department | 35.1 to 35.20 |

| 36 Assessment Procedure – Various Assessments | 36.1 to 36.26 |

| 37 Assessment Procedure – Income Escaping Assessment | 37.1 to 37.14 |

| 38 Assessment Procedure – Search Assessment | 38.1 to 38.20 |

| 39 Faceless Assessment, Appeals, Penalty | 39.1 to 39.52 |

| 40 Liability in Special Cases | 40.1 to 40.6 |

| 41 Settlement Commission & Vivad Se Viswas Scheme,2024 | 41.1 to 41.38 |

| 42 Rectification and Revision | 42.1 to 42.10 |

| 43 Appeals to Various Authorities | 43.1 to 43.20 |

| 44 Authority for Advanced Rulings | 44.1 to 44.20 |

| 45 The Wealth Tax Act, 1957 | 45.1 to 45.22 |

QUICK REFERENCER ON ALLIED LAW

| Allied Law 1 Securities Transactions Tax | A.1 |

| Allied Law 2 Commodities Transaction Tax [As per Finance Act, 2013] | A.7 |

| Allied Law 3 Fees Payable under Companies Act, 2013 | A.12 |

| Allied Law 4 Forms under the Companies Act, 2013 | A.20 |

| Allied Law 5 AS & Ind AS Referencer | A.27 |

| Allied Law 6 Income Computation and Disclosure Standards (ICDS) | A.33 |

About the Author

CA G. Sekar

G. Sekar is a Chartered Accountant in practice for the last 35 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa's Institute of Management, an Institution providing education for all

levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member Central Council of ICAI 2013-16, 2016-19 & 2019-22.

Chairman Direct Taxes Committee of ICAI - 2014.

Chairman Auditing And Assurance Standards Board of ICAI 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their 150 years of Income Tax in India Celebrations, for his contribution

and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB). It is worthy to note

that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions,

for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals GST Manual, GST Self Learning, GST Ready Reckoner

(j) Company Law Ready Reckoner

(k) Practitioner's Manual on Direct Taxes Vivad Se Vishwas Act, 2020

(l) Professional's Handbook on Faceless Assessment

9. Author of Books for CA Students Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa's Institute of Management

is the First and Only Educational Institution in India to accomplish this feat

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia