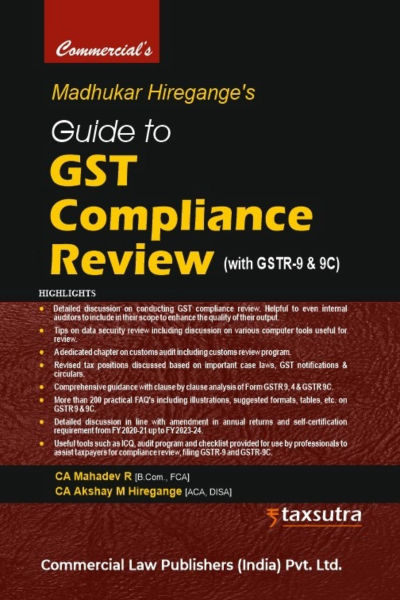

Guide to GST Compliance Review

by Madhukar HiregangeCONTENTS

| Preface | iii |

| About the Author | v |

| Table of Cases | vi |

| Chapter 1: Introduction to GST - Compliance Review | |

| 1.1 Introduction to Compliance Reviews | 1 |

| 1.2 Legislative Background of Audit in India | 2 |

| 1.3 Meaning of Audit in GST | 3 |

| 1.4 Importance of Compliance Review | 3 |

| 1.5 Advantages of Compliance Reviews | 4 |

|

4 |

|

5 |

|

6 |

| Chapter 2: Basic Concepts of GST Law | |

| 2.1 Background | 8 |

| 2.2 Scheme of GST | 10 |

|

10 |

|

11 |

|

11 |

|

12 |

|

12 |

|

12 |

|

14 |

|

14 |

|

15 |

|

16 |

|

16 |

|

17 |

|

18 |

|

18 |

|

19 |

|

19 |

|

20 |

|

20 |

|

|

|

22 |

|

23 |

|

24 |

|

25 |

|

26 |

|

26 |

|

28 |

|

30 |

|

31 |

|

32 |

|

32 |

|

33 |

|

34 |

|

34 |

|

35 |

|

36 |

|

37 |

| 2.3 State-Wise Threshold Limits for Obtaining Registration for Different Category of Suppliers Making Supply in Such States | 37 |

| Chapter 3: Professional Opportunities in GST | |

| 3.1 Background | 39 |

| 3.2 Professional's Advantage | 41 |

| 3.3 Professional's Role | 42 |

| 3.4 Types of Services | 46 |

|

46 |

|

47 |

|

48 |

|

49 |

|

49 |

|

50 |

|

51 |

|

51 |

|

52 |

|

53 |

|

54 |

| 3.5 Conclusion | 54 |

| Chapter 4: Relationship between Periodical Returns, Annual Returns and GST Reconciliation Statement | |

| 4.1 Introduction | 55 |

| 4.2 Relationship Between Periodical Returns (GSTR-9 & 9B) And Reconciliation Statement (GSTR-9C) | 55 |

|

56 |

|

56 |

|

57 |

|

58 |

|

59 |

| Chapter 5: Types of Audit and Reviews under GST | |

| 5.1 Introduction | 61 |

| 5.2 Audit By Department - Section 65 of the CGST/SGST Act | 62 |

| 5.3 Key Features of GST Audit by Department | 63 |

| 5.4 Special Audit - Section 66 of the CGST/SGST Act | 64 |

| 5.5 Procedure of Ordering Special Audit and Submission of Special Audit Report | 66 |

| 5.6 Preventive Management Reviews | 66 |

| 5.7 Area-Specific Reviews | 68 |

|

68 |

|

68 |

|

69 |

|

69 |

|

71 |

|

71 |

| Chapter 6: Review Process, Methodology and Approach in GSTR-9C Support | |

| 6.1 Introduction | 72 |

| 6.2 Methodology and Process for Conduct of Health Check Review | 72 |

| 6.3 Stage 1: Preliminary Discussion with Management | 72 |

|

73 |

| 6.4 Stage 2: Obtaining Information from the Client | 75 |

|

76 |

| 6.5 Stage 3: Desk Review | 77 |

|

77 |

|

78 |

| 6.6 Stage 4: Assessment of Risks | 79 |

|

79 |

|

79 |

|

80 |

|

81 |

|

82 |

|

83 |

|

83 |

|

83 |

|

83 |

|

83 |

|

84 |

| 6.7 Stage 5: Review Plan and Review Program | 84 |

|

84 |

|

85 |

|

85 |

|

85 |

| 6.8 Stage 6: Work at the Office of Client | 86 |

|

87 |

|

87 |

|

88 |

|

88 |

|

89 |

| 6.9 Stage 7: Tools and Techniques for Conducting a Review | 89 |

|

89 |

|

89 |

|

90 |

|

90 |

|

90 |

|

93 |

|

93 |

|

95 |

|

95 |

|

96 |

|

96 |

| 6.10 Stage 8: Review Documentation and Working Papers | 96 |

|

97 |

|

97 |

|

97 |

|

98 |

| 6.11 Stage 9: Draft Report and Obtaining Management Comments | 98 |

|

98 |

|

99 |

| 6.12 Stage 10: Preparation of Final Review Report | 100 |

| Chapter 7: Internal Controls | |

| 7.1 Introduction | 101 |

| 7.2 Standard on Internal Audit | 101 |

| 7.3 GST Internal Control Questionnaire (ICQ) | 103 |

|

103 |

|

103 |

|

104 |

|

104 |

|

105 |

|

106 |

|

106 |

|

106 |

|

107 |

|

107 |

|

107 |

|

108 |

|

108 |

|

108 |

|

109 |

|

109 |

|

111 |

|

111 |

|

112 |

|

113 |

|

113 |

|

115 |

|

115 |

|

116 |

|

117 |

|

118 |

|

118 |

|

118 |

|

119 |

|

119 |

|

120 |

|

120 |

|

120 |

|

121 |

|

121 |

|

121 |

|

122 |

|

123 |

|

123 |

|

123 |

| 7.4 Customs Related Internal Control Questionnaire | 124 |

|

124 |

|

124 |

|

124 |

|

125 |

|

125 |

|

126 |

| Chapter 8: Accounts, Records and Documents to be Maintained | |

| 8.1 Introduction | 127 |

| 8.2 Verification of Accounts and Records in Audit | 127 |

|

128 |

| 8.3 Various Accounts, Records and Documents to be Maintained | 129 |

|

129 |

|

131 |

|

132 |

|

133 |

|

134 |

| 8.4 Contravention of the above Requirement to Maintain Accounts, Records and Documents | 134 |

| 8.5 Checklist of Various Accounts, Records and Documents to be Verified while Compliance Review | 135 |

| 8.6 Key Checkpoints for Auditor in Various Accounts and Records Maintained | 136 |

|

136 |

|

137 |

|

139 |

|

139 |

| 8.7 Recommended Formats of Sales Register, ITC Register and RCM Register | 140 |

| Chapter 9: Outward Supply | |

| 9.1 Introduction | 142 |

| 9.2 Verification of Financial Statements | 142 |

|

142 |

|

143 |

|

143 |

|

144 |

|

144 |

|

145 |

|

146 |

|

146 |

|

147 |

|

147 |

|

148 |

|

150 |

|

153 |

|

155 |

|

156 |

|

157 |

|

157 |

|

158 |

|

159 |

|

160 |

|

161 |

|

161 |

|

162 |

|

163 |

|

164 |

| Chapter 10: Inward Supply - ITC | |

| 10.1 Eligibility and Conditions for Availing Input Tax Credit | 165 |

|

165 |

|

166 |

|

167 |

|

167 |

|

167 |

|

167 |

|

168 |

|

168 |

| 10.2 Manner of Utilizing Input Tax Credit | 169 |

| 10.3 Apportionment and Reversal of Input Tax Credit [Section 17 Read with Rules 42 & 43] | 169 |

|

169 |

|

170 |

|

170 |

|

171 |

|

171 |

| 10.4 Blocked Credits | 171 |

| 10.5 Availability of Credit in Special Circumstances [Section 18] | 176 |

|

176 |

|

176 |

|

176 |

|

176 |

| 10.6 Transfer of Credit on Obtaining Separate Registration for Multiple Places of Business [Section 25(2) Read with Rule 41A] | 177 |

| 10.7 Manner of Claiming Credit [Rule 40]. | 177 |

|

177 |

|

177 |

|

177 |

|

178 |

|

178 |

| 10.8 Transfer of Input Tax Credit in Case of Change in Constitution of Business [Section 18(3) R/W Rule 41]. | 178 |

|

178 |

|

178 |

|

179 |

|

179 |

| 10.9 Payment of Input Tax Credit in Case Regular Taxpayer Switching to Composition Scheme or Supplies Become wholly Exempt [Section 18(4) R/W Rule 44] | 179 |

|

179 |

| 10.10 Payment of Input Tax Credit on Supply of Capital Goods [Section 18(6)] | 180 |

|

180 |

|

180 |

|

181 |

| 10.11 Input Tax Credit in Respect of Inputs and Capital Goods Sent for Job-Work [Section 19 Read with Section 143 and Rule 45] | 181 |

|

182 |

| 10.12 Credit by Input Service Distributor | 182 |

|

182 |

|

183 |

|

183 |

|

185 |

| 10.13 Reversal of ITC on Non-Payment by Supplier [Rule 37A]. | 185 |

| 10.14 Electronic Credit Reversal and Reclaimed Statement (ECRRS). | 186 |

| 10.15 RCM Liability/ITC Statement | 186 |

| 10.16 Invoice Management System (IMS) | 186 |

| 10.17 Manner of Dealing with Doubtful ITC | 187 |

| 10.18 ITC Review Checkpoints | 188 |

| 10.19 ITC-Inputs/Input Services | 188 |

| 10.20 ITC - Capital Goods | 191 |

| 10.21 Input Service Distribution | 192 |

| 10.22 Imports of Goods / Services | 193 |

| 10.23 Employee Expenses | 194 |

| 10.24 Bank Statement | 195 |

| 10.25 Reconciliation | 195 |

| 10.26 Ratios and Management Information System (Mis) | 196 |

| Chapter 11: Reverse Charge | |

| 11.1 Introduction | 197 |

| 11.2 Forward Charge vs Reverse Charge | 197 |

| 11.3 Levy vs Liability | 198 |

| 11.4 Statutory Provisions | 198 |

| 11.5 Reverse Charge on Supply of Goods | 199 |

| 11.6 Reverse Charge on Supply of Services | 199 |

|

202 |

|

202 |

|

203 |

|

203 |

|

204 |

|

205 |

|

205 |

|

206 |

|

206 |

|

206 |

| 11.7 Documents to be Issued | 207 |

|

207 |

|

207 |

| 11.8 Disclosure in the Returns | 207 |

| 11.9 Delayed Payment of Reverse Charge Liability and ITC Eligibility | 208 |

| 11.10 Relevant Judicial Pronouncements | 208 |

|

208 |

|

209 |

|

209 |

|

209 |

|

209 |

|

209 |

|

210 |

|

210 |

|

210 |

|

210 |

| 11.11 Verification of Reverse Charge Mechanism | 210 |

| Chapter 12: Refunds | |

| 12.1 Introduction | 212 |

| 12.2 Types of Refund | 212 |

|

212 |

|

212 |

|

213 |

|

213 |

| 12.3 Verification of Refund During Review | 213 |

| Chapter 13: Procedural Aspects | |

| 13.1 Registration Under GST | 216 |

|

216 |

|

216 |

| 13.2 Returns Under GST | 218 |

|

218 |

|

221 |

|

223 |

|

223 |

|

224 |

|

224 |

|

224 |

|

224 |

|

225 |

|

225 |

|

225 |

| 13.3 Records Under GST | 226 |

|

226 |

|

229 |

|

229 |

|

230 |

|

231 |

| 13.4 Documentation Under GST | 231 |

|

231 |

|

232 |

|

236 |

|

237 |

| 13.5 Payment Under GST | 239 |

|

239 |

| 13.6 Payment Under Protest in GST Regime | 240 |

| Chapter 14: Reconciliations | |

| 14.1 Introduction | 243 |

| 14.2 Reconciliation of Supply (after Considering the Returns) on which Output Tax is Payable | 244 |

|

246 |

|

247 |

|

247 |

| 14.3 Reconciliation between GSTR-1 to GSTR-3B | 247 |

| 14.4 Identification of Disclosure Errors between GSTR-3B and GSTR -1 for Normal Registered Person (other than Person Registered as SEZ) | 250 |

|

250 |

|

251 |

| 14.5 ITC Review - GST | 251 |

|

253 |

|

256 |

| 14.6 Reconciliation of Expenses on which ITC is Available | 259 |

| 14.7 Reconciliation of ITC | 261 |

|

264 |

|

264 |

|

265 |

| 14.8 Reconciliation Between GSTR-2B and Books of Account | 265 |

| 14.9 Identification and Reverse Charge Reconciliation | 267 |

|

271 |

|

271 |

|

272 |

|

272 |

|

273 |

|

273 |

| 14.10 Job Work Reconciliation | 274 |

| 14.11 E-Way Bill Reconciliation | 275 |

| 14.12 E-Invoicing Reconciliation | 277 |

| 14.13 Exports Reconciliation | 278 |

|

278 |

|

278 |

|

278 |

|

279 |

|

279 |

| 14.14 Reconciliation with Scrip's Obtained under Foreign Trade Policy | 279. |

| 14.15 Refunds Reconciliation | 279 |

| 14.16 Reconciliation with Electronic Credit/ Liability Ledger | 280 |

| 14.17 Reconciliation with the Shipping Bill Data | 280 |

| 14.18 Other Reconciliations | 281 |

| Chapter 15: Common Errors to be Avoided in GST | |

| 15.1 Introduction | 283 |

| 15.2 Conceptual Errors | 283 |

| 15.3 System Errors | 290 |

| 15.4 Compliance Errors | 294 |

| 15.5 Errors in GST Annual Return | 295 |

| Chapter 16: Important Year End Action Points in GST | |

| 16.1 Introduction | 298 |

| 16.2 Cross Charge to Related/Distinct Persons & ISD | 298 |

| 16.3 Review of ITC Ledger and Vendor Invoices | 299 |

| 16.4 E-Way Bill Compliance and Reconciliation | 300 |

| 16.5 ITC Reversal and Year-End Adjustments | 301 |

| 16.6 Reconciliation | 302 |

| 16.7 GST Payment Under Reverse Charge | 302 |

| 16.8 Issue of Debit/Credit Note | 302 |

| 16.9 Return Filing for the Month of October | 303 |

| 16.10 Track of Goods Sent for Job Work | 305 |

| 16.11 GST Payment by Builders/Promoters under Reverse Charge Mechanism for Shortfall from 80% | 305 |

| 16.12 Other Aspects | 305 |

| Chapter 17: Sample Review Report | |

| 17.1 Introduction | 308 |

| 17.2 Different Heads of Report | 308 |

|

308 |

|

308 |

|

308 |

|

308 |

|

308 |

|

309 |

|

309 |

| 17.3 Sample GST Compliance Review Report Template | 309 |

| Chapter 18: Customs Audit | |

| 18.1 Introduction | 316 |

|

316 |

|

317 |

|

318 |

|

319 |

|

319 |

| 18.2 Customs Review Programme | 320 |

|

321 |

|

329 |

|

330 |

| Chapter 19: Certifications under GST | |

| 19.1 Introduction | 332 |

| 19.2 Authenticity and Reliability of the Certificates Issued by the Professionals | 333 |

| 19.3 Certification of the ITC Claimed Under Special Circumstances | 335 |

| 19.4 Certification on Transfer of Credit on Sale, Merger, Amalgamation, Lease or Transfer of a Business (Rule 41(2)) | 337 |

| 19.5 Certification on Reversal of Credit Under Special Circumstances (Section 18(4) read with Rule 44) | 337 |

| 19.6 Application for Refund of Tax, Interest, Penalty, Fees or any other Amount (Rule 89(2)) | 339 |

| 19.7 Certification for Claiming of Reimbursement of Tax Paid Under 'Seva Bhoj Yojana' (C.B.I. & C. Circular No. 75/49/2018-GST, Dated 27-12-2018) | 340 |

| 19.8 Certification in Case of Mismatch of ITC Between GSTR-3B and GSTR-2A | 341 |

| 19.9 Certification to Claim GST Deduction Towards Credit notes Issued to Recipients | 344 |

| Chapter 20: Departmental Audit | |

| 20.1 Introduction | 346 |

| 20.2 Statutory Powers and Obligations | 347 |

|

347 |

|

348 |

| 20.3 Preparations for Audit | 348 |

| 20.4 Tips to Taxpayers/Professionals before, During and follow up of ahe Audit | 350 |

| Chapter 21: Important Judgements Relevant for GST | |

| 21.1 Introduction | 353 |

| 21.2 General | 353 |

|

353 |

|

353 |

|

354 |

| 21.3 Levy of GST | 354 |

|

354 |

|

354 |

|

354 |

|

355 |

|

355 |

|

355 |

|

356 |

|

356 |

|

356 |

|

356 |

|

357 |

|

357 |

|

357 |

|

358 |

|

358 |

|

358 |

|

358 |

|

358 |

| 21.4 Valuation | 359 |

|

359 |

|

359 |

|

359 |

|

360 |

| 21.5 Place of Supply | 360 |

|

360 |

|

360 |

| 21.6 Input Tax Credit | 361 |

|

361 |

|

361 |

|

361 |

|

361 |

|

361 |

|

362 |

|

362 |

|

368 |

| 21.7 Procedure Related Judgements | 363 |

|

363 |

|

363 |

|

363 |

|

363 |

|

364 |

|

364 |

| 21.8 Royalty is not in the Nature of Tax | 364 |

| 21.9 Ambulance Service Cannot be Called as Rent-A-Cab Service | 364 |

| 21.10 Aspect Theory | 365 |

| 21.11 Parallel Proceedings (Principles of Comity) | 365 |

| Chapter 22: Introduction to Annual Returns | |

| 22.1 Introduction | 366 |

| 22.2 Persons Required to File Annual Return | 368 |

| 22.3 Manner of Filing the Annual Return | 369 |

| 22.4 Impact of Annual Return on Reconciliation Statement | 370 |

| 22.5 Consequences of non-Compliance | 371 |

| 22.6 Revision of Annual Return | 371 |

| Chapter 23: Role of Assessees and Professionals in filing Annual Return | |

| 23.1 Role of Assessee in Filing the Annual Return | 372 |

| 23.2 Role of Professionals in Filing Annual Return | 374 |

| Chapter 24: Good Accounting Practices for ease in Preparation & Filing of Annual Returns and Reconciliation Statement | |

| 24.1 Introduction | 376 |

|

376 |

|

377 |

|

378 |

|

378 |

|

379 |

|

379 |

| 24.2 Good Accounting Practices for Recording of the GST Transactions | 379 |

| 24.3 Performance of Key Reconciliations at Periodic Intervals. | 380 |

| 24.4 Tax Efficient Accounting | 381 |

| Chapter 25: Clause by Clause Analysis of Annual Return - Form GSTR-9 | |

| 25.1 Source Data for Filing Annual Return | 387 |

| 25.2 Basic Steps before Filling Annual Return for Filing | 387 |

| 25.3 Broad Structure of Annual Return | 391 |

| 25.4 Details Required in the Annual Return | 394 |

| 25.5 Clause by Clause Analysis of GSTR-9 Form | 394 |

| 25.6 Details not Required to be Furnished in the Annual Return | 459 |

| Chapter 26: Clause by Clause Analysis of Annual Return - Form GSTR-4 | |

| 26.1 Details Required In The Annual Return | 461 |

| Chapter 27: Annual Return - Form GSTR-9B | 464 |

| Chapter 28: Steps in Filing of Annual Returns on GST Common Portal | |

| 28.1 Steps in Filing the Annual Return Directly on Portal | 465 |

|

465 |

|

466 |

|

467 |

|

467 |

|

467 |

|

468 |

| 28.2 Introduction to Excel Based GSTR-9 Offline Tool | 468 |

|

469 |

|

469 |

| Chapter 29: Important Tips and Formats for Preparation of Annual Return | |

| 29.1 Some Common Checkpoints within GSTR-9 | 471 |

| 29.2 Important Formats | 474 |

| Chapter 30: Checklist for Annual Returns for Professionals | 478 |

| Chapter 31: Practical FAQ's in Filing of Annual Returns | |

| 31.1 FAQS on Basics in Annual Return | 484 |

| 31.2 FAQS on Disclosure of Outward Supplies in Annual Return | 487 |

| 31.3 FAQS on Outward Supplies | 488 |

| 31.4 FAQS on Input Tax Credits | 499 |

| 31.5 Other Miscellaneous FAQS | 508 |

| Chapter 32: Role of Client and Reviewer in GST Review & Self-Certification | |

| 32.1 Introduction | 513 |

| 32.2 Role of the Client in GST Review | 513 |

| 32.3 Role of Professionals in a Review Engagement | 513 |

|

|

| Chapter 33: Clause by Clause Analysis of GSTR-9C | |

| 33.1 Introduction | 515 |

| 33.2 Need for Reconciliation | 515 |

| 33.3 Structure of Reconciliation Statement in Form GSTR-9C | 516 |

| 33.4 Detailed Step by Step Understanding of Form GSTR-9C | 518 |

|

518 |

|

522 |

|

598 |

|

616 |

| Chapter 34: Steps In Filing of GSTR-9C On GST Common Portal | |

| 34.1 Introduction | 620 |

| 34.2 Filing of GSTR-9C on GST Portal | 620 |

| 34.3 Procedure for Filing GSTR-9C | 620 |

| Chapter 35: Documentation and Work Papers in GST Review - Best Practices | |

| 35.1 Introduction | 642 |

| 35.2 Purpose of Review Documentation | 642 |

| 35.3 Form & Contents of Documentation | 643 |

|

643 |

|

645 |

|

648 |

| 35.4 Contents of Review Working Papers | 652 |

| 35.5 Documentation in an A-I Environment | 652 |

| 35.6 Ownership of Review Documentation | 655 |

| 35.7 Points to be Noted for Effective Documentation | 655 |

| Chapter 36: Review Program and Checklist on GST Review for use by Professionals | |

| 36.1 Introduction | 657 |

| 36.2 Sample Review Program | 657 |

| 36.3 Checklist for Conducting GST Review | 659 |

| Chapter 37: Ethical Standards and Independence of Auditor | |

| 37.1 Introduction | 667 |

| 37.2 Fundamental Principles | 667 |

| 37.3 Identification and Evaluation of Various Threats | 668 |

| 37.4 Conflict of Interest | 669 |

| 37.5 Other Factors which could Pose Threat | 670 |

| 37.6 Independence of the Auditor | 671 |

| 37.7 Tax Services to GST Review Clients | 672 |

| 37.8 Impact of Other Provisions | 674 |

| 37.9 Ensuring Independence in an AI Environment | 674 |

| 37.10 Important Case Studies on Professional Misconduct | 676 |

| Annexure 1 - FAQs On Ethical issue relating to GST - Announcement 15.11.20171 | 682 |

| Appendices | 684 |

| Appendix 1: Annual Returns in Form GSTR-9 and GSTR-4 | 685 |

| Appendix 2: Reconciliation Statement and Certification in Form 9C | 706 |

| Appendix 3: Abstract of Provisions of Annual Return under Goods and Services Tax Act, 2017 | 719 |

| Appendix 4: Procedure of Audit in GST Rules, 2017 | 720 |

| Appendix 5: Accounting Entries of GST | 721 |

| Appendix 6: Audit Report under the Companies (Auditor's Report) Order, 2016 in relation to Indirect Taxes | 727 |

| Appendix 7: Engagement and Quality Control Standards of ICAI | 728 |

| Appendix 8: List of Important Publications of the Institute of Chartered Accountants of India, ICAI, New Delhi | 729 |

| Appendix 9: Statutory Provisions in Customs Law Relating to Customs Audit | 731 |

| Bibliography/Webliography/References 735 |

About the Author

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

CA Aarish Khan

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

CA Arpita Tulsyan

AUDIT MCQ BOOK NEW SYLLABUS

CA Aarti Lahoti

Strategic Management (SM) Book May 26 & Sept 26 onwards

CA Aarti Lahoti

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

CA Aarti Lahoti

Join Us !!

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia