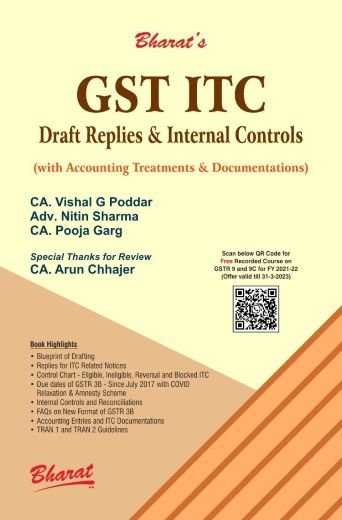

GST ITC Draft Replies & Internal Controls

by CA Vishal G Poddar,Adv Nitin Sharma, CA Pooja GargBook Currently Unavailable

This book is no longer available and has been discontinued

Browse Other BooksHighlights of the book

- Chapter 1: Introduction

- Chapter 2: Blueprint of Drafting

- Chapter 3: ITC-related notices and draft replies

- Chapter 4: Control Chart - Eligible/Ineligible with Reversal and Blocked ITC

- Chapter 5: Due dates of GSTR 3B and Relaxation in late Fees and Interest during COVID

- Chapter 6: Internal Control and Reconciliations

- Chapter 7: FAQ on New Format of GSTR 3B

- Chapter 8: Accounting Entries and ITC Documentations

- Chapter 9: TRAN 1/TRAN 2 Guidelines

- Chapter 10: CGST Act, Rules and Circulars on ITC

Authors

CA Vishal Poddar , is Fellow Chartered Accountant, completed his CA at the early age of 21 years, was awarded a Silver Trophy in TIOL National Taxation Award 2022 and National Award for being Distinguished GST Trainer 2018, Tejas Puraskar in Finance 2020, Best Paper Writer Award 2021-22 GSTPAM's NRRC.' having Masters in Commerce and Diploma in Information System Audit (DISA).

CA Vishal Poddar , is Fellow Chartered Accountant, completed his CA at the early age of 21 years, was awarded a Silver Trophy in TIOL National Taxation Award 2022 and National Award for being Distinguished GST Trainer 2018, Tejas Puraskar in Finance 2020, Best Paper Writer Award 2021-22 GSTPAM's NRRC.' having Masters in Commerce and Diploma in Information System Audit (DISA).

Adv. Nitin Sharma , has a Master's in Commerce and Bachelor's in Law, is a full-time practicing Advocate in the field of GST with experience of 19 years in Manufacturing Industries with detailed exposure to sales Tax, VAT, Excise, Service Tax, Export-Import and Income Tax. Presently, he is a Managing Partner in a Law Firm V & C Law Associates situated at Sikri, Faridabad rendering Consultancy and legal services to Businesses from the very first stage of Incorporation to setting up of internal control and System in order to boost growth for Organisations.

Adv. Nitin Sharma , has a Master's in Commerce and Bachelor's in Law, is a full-time practicing Advocate in the field of GST with experience of 19 years in Manufacturing Industries with detailed exposure to sales Tax, VAT, Excise, Service Tax, Export-Import and Income Tax. Presently, he is a Managing Partner in a Law Firm V & C Law Associates situated at Sikri, Faridabad rendering Consultancy and legal services to Businesses from the very first stage of Incorporation to setting up of internal control and System in order to boost growth for Organisations.

CA Pooja Garg , is a Chartered Accountant and a 1st Gen entrepreneur having 16 years of professional experience in F&A & Taxation. She is co-founder of Edukating, an EdTech startup, which is into providing Skill-based Training in GST, F&A, Taxation, and other finance-related courses. She also has experience in providing Training to students, Corporates and professionals in Accounting and Taxation.

CA Pooja Garg , is a Chartered Accountant and a 1st Gen entrepreneur having 16 years of professional experience in F&A & Taxation. She is co-founder of Edukating, an EdTech startup, which is into providing Skill-based Training in GST, F&A, Taxation, and other finance-related courses. She also has experience in providing Training to students, Corporates and professionals in Accounting and Taxation.

About the Author

CA Vishal G Poddar,Adv Nitin Sharma, CA Pooja Garg

CA Vishal Poddar is Fellow Chartered Accountant, completed his CA at the early age of 21 years, was awarded a Silver Trophy in TIOL National Taxation Award 2022 and National Award for being Distinguished GST Trainer 2018, Tejas Puraskar in Finance 2020, Best Paper Writer Award 2021-22 GSTPAM's NRRC.' having Masters in Commerce and Diploma in Information System Audit (DISA).

Adv. Nitin Sharma has a Master's in Commerce and Bachelor's in Law, is a full-time practicing Advocate in the field of GST with experience of 19 years in Manufacturing Industries with detailed exposure to sales Tax, VAT, Excise, Service Tax, Export-Import and Income Tax. Presently, he is a Managing Partner in a Law Firm V & C� Law Associates situated at Sikri, Faridabad rendering Consultancy and legal services to Businesses from the very first stage of Incorporation to setting up of internal control and System in order to boost growth for Organisations.

CA Pooja Garg is a Chartered Accountant and a 1st Gen entrepreneur having 16 years of professional experience in F&A & Taxation. She is co-founder of Edukating, an EdTech startup, which is into providing Skill-based Training in GST, F&A, Taxation, and other finance-related courses. She also has experience in providing Training to students, Corporates and professionals in Accounting and Taxation.

�

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER COMBO - COLOURED EASY NOTES + QUESTION BANK

CA/CMA INTER EASY NOTES COLOURED

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia