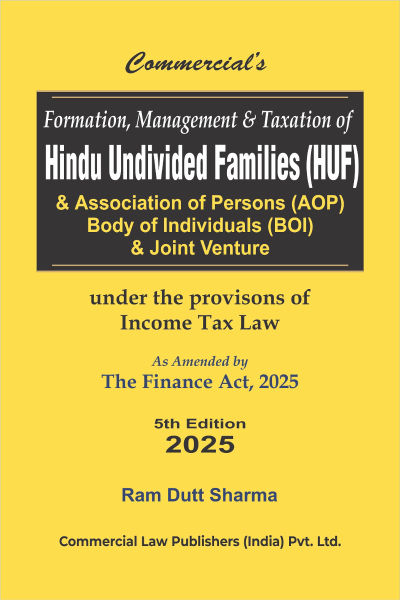

Formation Management & Taxation of Hindu Undivided Families (HUF)

by Ram Dutt SharmaCONTENT

Part : A

Hindu Undivided Family (HUF)

| 1. Introduction of Hindu Undivided Family (HUF) | 3 |

| 2. Hindu Law | 16 |

| 3. Whom we can call Hindu | 28 |

| 4. Modes of Creation of HUF | 34 |

| 5. School of Hindu Law | 59 |

| 6. Residential Status of HUF | 74 |

| 7. Concept of Coparcenery | 89 |

| 8. Doctrine of Blending | 111 |

| 9. Karta of HUF | 144 |

| 10. Gift by HUF | 154 |

| 11. Gift to HUF | 176 |

| 12. Assets of HUF [Coparcenary Property] | 180 |

| 13. Rule of Succession to Property | 193 |

| 14. Income Tax Law relating to Family Settlements Arrangements | 206 |

| 15. Hindu Undivided Family after Enactment of Hindu Succession Act, 1956 | 237 |

| 16. Hindu Undivided Family & Hindu Adoption and Maintenance Act, 1956 | 241 |

| 17. Return of Income | 247 |

| 18. Any Sum Received by an Individual as a member of a Hindu Undivided Family (HUF) is Exempt [Section 10(2)] | 256 |

| 19. Income from House Property of HUF | 260 |

| 20. Business Income of HUF | 267 |

| 21. Capital Gain Income of HUF | 271 |

| 22. Income from Other Sources for HUF | 293 |

| 23. Hindu Undivided Family (HUF) & Partnership Firm | 301 |

| 24 Clubbing Provisions in Case of HUF | 320 |

| 25. HUF : Deductions under Chapter VIA | 329 |

| 26. lncome treated as Income belonging to HUF | 343 |

| 27. Income not treated as Belonging to HUF | 362 |

| 28. Computation of Taxable Income of HUF | 374 |

| 29. Partition of HUF [Section 171] | 384 |

| 30. Partition and Re-Union of HUF | 431 |

| 31. Assessment after Partition of a Hindu Undivided Family [Section 171] | 445 |

| 32. Recovery of Tax in the case of HUF | 457 |

| 33. Hindu Converted to other Religion : HUF Taxation | 469 |

| 34. Levy of Penalty on HUF | 481 |

| 35. Offences by Hindu Undivided Families [Section 278C] | 491 |

| 36. Rates of Income-tax Applicable in Case of HUF | 496 |

| 37. Frequently Asked Questions on Hindu Undivided Family (HUF) | 503 |

| 38. Landmark Judgements on Hindu Undivided Family | 517 |

Part : B

Association of Persons (AOP)

| 39. Formation of Association of Persons (AOP) | 529 |

| 40. Determination of Residential Status of Association of Persons (AOP) | 549 |

| 41. Filing of Return of Income by Association of Persons (AOP) | 559 |

| 42. Computation of Taxable Income of Association of Persons (AOP) | 561 |

| 43. Method of Computation of Member’s Share in Income of Association of Persons (AOP) [Section 67A] | 580 |

| 44. Taxation of Members of Association of Persons in the Income of Association of Persons (AOP) [Section 86] | 592 |

| 45. Rebate, if any in the Hands of the Members of Association of Persons (AOP) [Section 110] | 606 |

| 46. Amendment of Order of Assessment in Case of Completed Assessment [Section 155(2)] | 609 |

| 47. Charge of tax where shares of members in Association of Persons (AOP) Unknown, etc. [Section 167B] | 610 |

| 48. Assessment of Association of Persons or Body of Individuals or Artificial Juridical Person formed for a Particular event or Purpose [Section 174A] | 631 |

| 49. Assessment in case of Dissolution of Association of Persons (AOP) [Section 177] | 634 |

| 50. Rates of Tax for Association of Persons (AOPs) | 642 |

Part : C

Body of Individuals (BOI)

| 51. Introduction - Body of Individuals (BOI) | 655 |

| 52. Residential Status of Body of Individuals (BOI) | 660 |

| 53. Filing of Return of Income by Body of Individuals (BOI) | 677 |

| 54. Computation of Income of Body of Individuals (BOI) | 681 |

| 55. Computation of Taxable Income of Members of a Body of Individuals [Section 67A] | 687 |

| 56. Taxation of Members of Body of Individuals in the Income of Body of Individuals (BOI) [Section 86] | 692 |

| 57. Taxation of Members of Body of Individuals in the Income of Body of Individuals (BOI) [Section 110] | 695 |

| 58. Amendment of Order of Assessment in Case of Completed Assessment [Section 155(2)] | 698 |

| 59. Charge of Tax Where Shares of Members in Body of Individuals (BOI) Unknown etc. [Section 167B] | 699 |

| 60. Assessment of Body of Individuals formed for a Particular Event or Purpose [Section 174A] | 719 |

| 61. Tax Rate for Body of Individuals (BOls) | 722 |

| 62. Taxation of Joint Venture | 728 |

| 63. Specimen of Various Useful Format | 742 |

About the Author

Ram Dutt Sharma

Ram Dutt Sharma was born on 27th June, 1958 in Narnaul, Haryana. He got his post-graduation from M.D. University, Rohtak in 1980. He joined the Income-tax Department in the year 1983 and retired as Income Tax Officer on 30.06.2018. He worked at various stations of North-West Region of Income-tax Department. He has wide experience of all wings of Income-tax Department such as Assessment Unit, Special Range, TDS Wing, Investigation Wing, etc. He has been Contributing articles and addressing on topics relating to Income Tax at NADT Regional Campus, Chandigarh & Bhopal. He has also addressed number of seminars organized by the Income-tax Department, Chartered Accountants, Advocates and various Trade Associations.

He is recipient of first-ever Finance Minister's Award 2017, the Income Tax Departments highest honour for sustained devotion, commitment to duty & promoting excellence in the field of Direct Taxation at National Level. The Hon'ble Union Finance Minister, Shri ArunJaitley conferred this Finance Ministers Award for Excellence for his meritorious services at VigyanBhawan, New Delhi on 24.07.2017.

Awarded by Hon'ble Member (Revenue& TPS), CBT, Special Secretary to the Government of India Certificate of Appreciation for his contribution recognized and included in the chapter Miscellaneous Orders in Let Us Share A compilation of Best Practices & Orders Vol. VIII released on 31stOctober, 2016.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia