Direct Tax and International Taxation - 2 vols set - CA Final - New Syllabus 2023

by CA Shirish VyasDirect Tax Vol - 1 Content

| � | NAME OF THE TOPIC | PAGE NO. |

|---|---|---|

| 1 | Income from Business/Profession | 1 |

| 2 | Assessment of Partnership Firms | 52 |

| 3 | Computation of Tax Liability | 57 |

| 4 | Assessment of Companies [Minimum Alternate Tax] | 65 |

| 5 | Alternate Minimum Tax (AMT) | 74 |

| 6 | Income Computation & Disclosure Standards (ICDS) | 75 |

| 7 | Taxation of Gifts | 81 |

| 8 | Capital Gains | 85 |

| 9 | Transfer Pricing | 131 |

| 10 | Deemed Dividend | 169 |

| 11 | Double Taxation | 173 |

| 12 | Taxation of AOP | 177 |

| 13 | Sundry Important Topics | 178 |

| 14 | Concessional Tax Regime | 195 |

| 15 | Returns and Assessment | 203 |

| 16 | Appeals, Reference and Revision | 231 |

| 17 | Assessment Time Limits | 244 |

| 18 | Search and Seizure | 245 |

| 19 | Survey | 251 |

| 20 | Faceless Assessment and DRC | 254 |

| 21 | Updated Return | 260 |

| 22 | Advance Ruling | 262 |

| 23 | Tax Deduction at Source | 266 |

| 24 | Tax Collection at Source | 295 |

| 25 | Taxation of Non-Residents | 299 |

| 26 | Exemptions for NR | 307 |

| 27 | Taxation of Business Trust | 310 |

| 28 | Taxation of Investment Fund | 316 |

| 29 | IFSC: International Financial Services Centre | 322 |

| 30 | Taxation of Securitisation Trust | 323 |

| 31 | Equalization Levy | 324 |

| 32 | Tax Planning/Evasion/Avoidance and GAAR 3 | 30 |

| 33 | Charitable Trusts | 336 |

| 34 | Assessment of Co-operative Societies | 350 |

| 35 | Advance Tax and Interest | 352 |

| 36 | Deduction u/s 10AA | 356 |

| 37 | Section 9: Income Deemed to Accrue/Arise in India | 358 |

| 38 | Deductions under Chapter VIA | 361 |

| 39 | Residential Status | 376 |

| 40 | Clubbing of Income | 380 |

| 41 | Set-off and Carry forward of losses | 381 |

| 42 | Political Party and Electoral Trust | 386 |

| 43 | Tonnage Tax Scheme | 387 |

| 44 | Domestic Transfer Pricing | 390 |

| 45 | Case Laws | 391 |

| 46 | Additional Case Laws | 405 |

| 47 | Fundamentals of BEPS | 408 |

| 48 | Model Tax Conventions | 422 |

| 49 | Tax Treaties | 431 |

| 50 | Amendments | 438 |

| 51 | Latest Developments in International Taxation | 455 |

| 52 | Tax Audit and Ethical Compliances | 475 |

| 53 | Provisions to Counteract Unethical Tax Practices | 488 |

| 54 | Black Money Act, 2015 | 510 |

Direct Tax Vol - 2 Content

| � | NAME OF THE TOPIC | PAGE NO. |

|---|---|---|

| 1 | INCOME FROM BUSINESS | 01 - 29 |

| 2 | TOTAL INCOME AND MAT | 30 - 81 |

| 3 | CAPITAL GAINS | 82 - 127 |

| 4 | TRANSFER PRICING | 128 - 145 |

| 5 | TAXATION OF NR | 146 - 155 |

| 6 | TAXATION OF BUSINESS TRUST | 156 - 157 |

| 7 | TAXATION OF INVESTMENT FUND | 158 |

| 8 | TAXATION OF CHARITABLE TRUST | 159 - 163 |

| 9 | MAT FOR INDAS COMPLIANT COMPANIES | 164 - 166 |

| 10 | CONCESSIONAL TAX REGIME | 167 - 169 |

| 11 | ASSESSMENT PROCEDURES | 170 - 187 |

| 12 | APPEALS, REFERENCE AND REVISION | 188 - 192 |

| 13 | SEARCH AND SEIZURE | 193 |

| 14 | SURVEY | 194 |

| 15 | ADVANCE RULING | 195- 197 |

| 16 | TAXATION OF GIFTS | 198 - 199 |

| 17 | TAX DEDUCTION AT SOURCE | 200 - 207 |

| 18 | DOUBLE TAXATION | 208 - 209 |

| 19 | EQUALISATION LEVY | 210 |

| 20 | EXTRA QUESTIONS | 211 - 237 |

| 21 | TAX AUDIT AND ETHICAL COMPLIANCES | 238 - 259 |

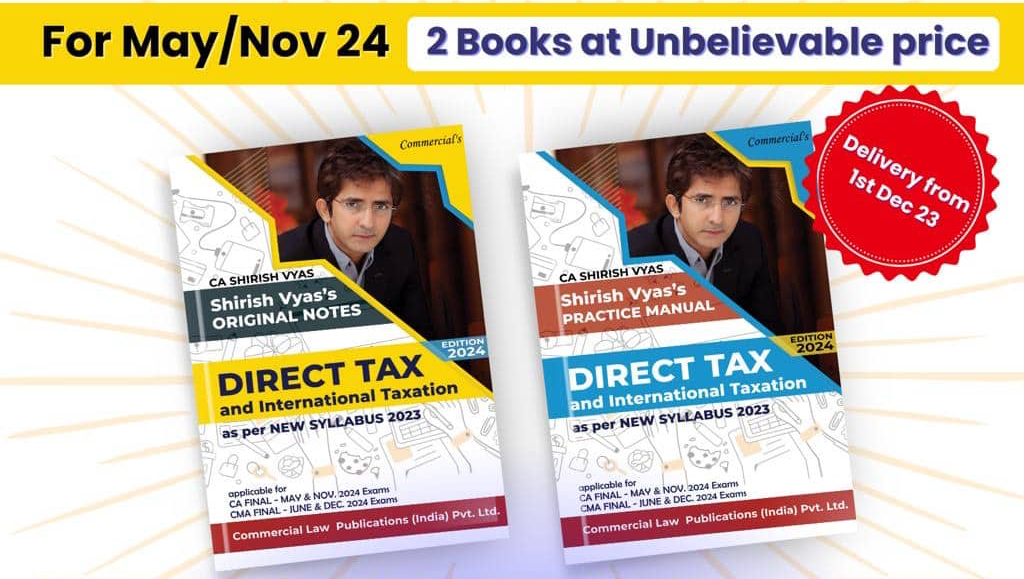

Direct Tax Practice Manual & Original Notes Combo

- Use of Mnemonics and Important Words in Red Colour For Easy Understanding & Memorizing

- Concise And Exam Oriented Notes

About the Author

CA Shirish Vyas

CA Shirish Vyas is a highly experienced and knowledgeable Chartered Accountant. He has a deep understanding of accounting principles, tax laws, and financial management. With years of experience in the field, he has developed expertise in providing financial advisory services to individuals and businesses.

Shirish Vyas has a strong track record of helping clients navigate complex financial situations and achieve their financial goals. He is known for his attention to detail, analytical skills, and ability to provide practical solutions. His clients appreciate his professionalism, integrity, and commitment to delivering high-quality services.

As a Chartered Accountant, Shirish Vyas is well-versed in various areas of finance, including auditing, taxation, and financial planning. He stays updated with the latest industry trends and regulations to ensure that his clients receive accurate and up-to-date advice.

Whether you need assistance with tax planning, financial reporting, or business advisory services, CA Shirish Vyas can provide you with the expertise and guidance you need. His dedication to client satisfaction and his passion for finance make him a trusted advisor in the field of accounting.

Have Questions About This Book?

Our course advisors are here to help you make the right decision for your career growth.

Other books

CA/CMA INTER INCOME TAX QUESTION BANK

GST (IDT) Book - 4th Edition | May, Sept 2026 & Jan 2027 Attempt

AUDIT MCQ BOOK NEW SYLLABUS

Strategic Management (SM) Book May 26 & Sept 26 onwards

AUDIT INSIGHTS BOOK May 26 & Sept 26 onwards

List your Books

Share your knowledge and help shape the next generation of tech-savvy CA & Tax professionals while building a rewarding career in education.

Get Started

CAclubindia

CAclubindia