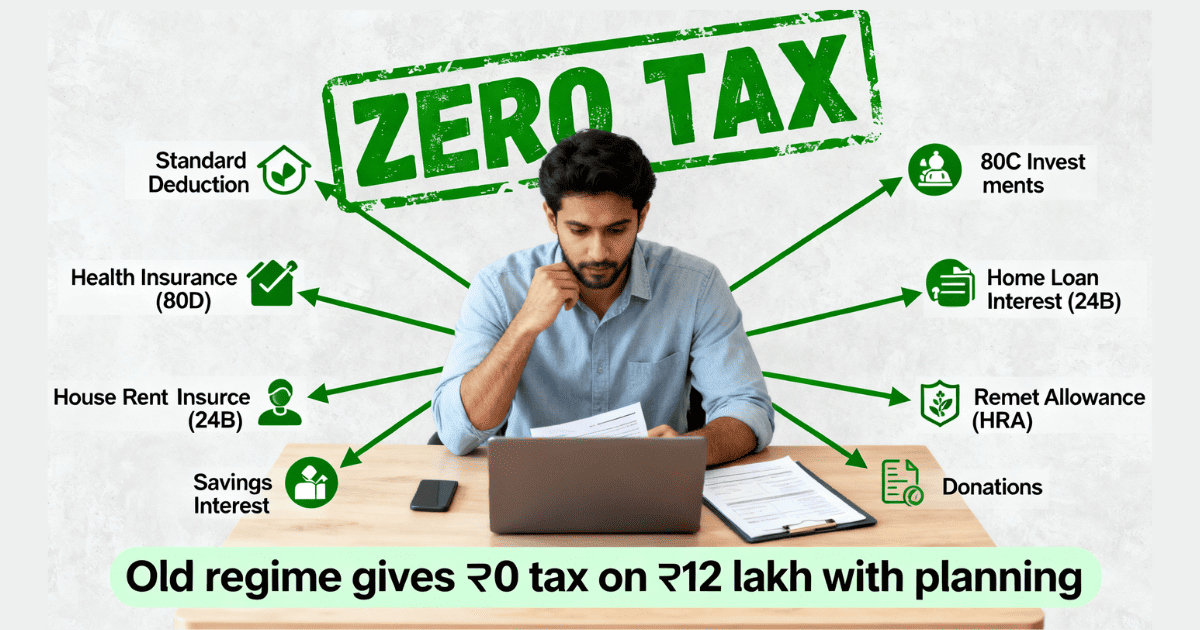

Under Old Tax Regime, the government allows many deductions (80C, 80D, home loan interest, HRA etc.) to reduce taxable income. In this Regime, taxpayers can avail tax exemptions up to ₹12 lakh income by utilizing these deductions and planning effectively. This means even if you do not opt for the New Tax Regime, you can legally pay zero tax on income up to ₹12 lakh.

Deductions Included

Standard Deduction – ₹50,000

Applicable for all salaried persons and pensioner. No proof required to claim this deduction as it automatically deducted from their taxable income.

Section 80C – Up to ₹1,50,000

Eligible investments for individuals and HUF include – Employee Provident Fund (EPF), Public Provident Fund (PPF), Recognized Provident Fund, Statutory Provident Fund, Employee contribution to National Pension Scheme (employee contribution under 80CCD(1) included here), Self employed contribution to NPS (20% of GTI), Life Insurance Premiums, home loan principal repayment, fixed deposits (minimum 5 years), National Savings Certificate (NSC), Sukanya Samriddhi Yojana, senior citizen savings schemes, ULIP premium for self/spouse/children, Tution fees for upto 2 children allowed, ELSS mutual funds (3 year lock in).

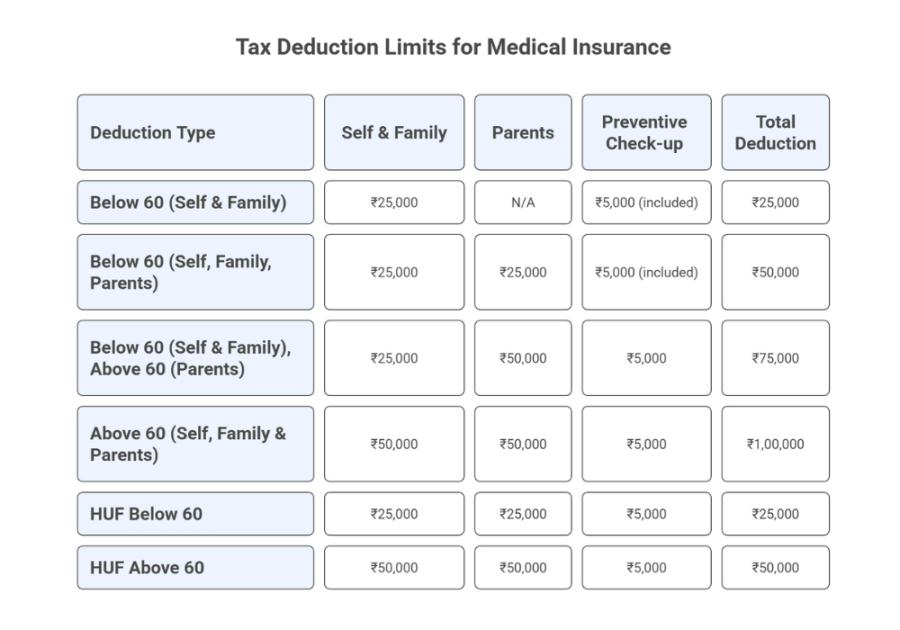

Section 80D – Medical Insurance and Health Expenditure

Home Loan Interest – Section 24(b) – Up to ₹2,00,000

- Up to ₹2,00,000 interest paid for a self-occupied property is deductible

- If house under construction earlier, pre-construction interest allowed for 5 years

- If joint owners and pay EMI then both can claim ₹2 lakh separately.

Note: if construction delays, deduction can reduced to ₹30,000.

HRA Exemption up to ₹2,00,000

- Salaried individuals receiving HRA can claim exemption up to ₹2 lakh based on rent paid and salary.

- Conditions include – you must have rent receipts, rental agreement, landlord’s PAN if rent exceeds ₹50,000 per month, and HRA must be part of salary.

- Exemption depends on whether the city is metro (50% of salary exempt) or non-metro (40% exempt).

NPS Additional Deduction – 80CCD(1B) – ₹50,000

You can get extra ₹50,000 over and above 80C. This additional is very useful for reducing taxable income.

Savings Account Interest

- For non-senior citizens → 80TTA allows: ₹10,000

- For senior citizens → 80TTB allows ₹50,000.

Section 80G – Donations

Donation to approved institutions gives:

- 100% deduction for some institutions

- 50% deduction depending on the organizations.

Note

- Donation must be through banking mode.

- Cash allowed only up to ₹2,000.

For Example

Let’s assume your gross income = ₹12,00,000.

Now subtract all deductions:

| Standard Deduction | ₹50,000 |

| 80C Deduction | ₹1,50,000 |

| 80D (normal person with non-senior parents) | ₹50,000 |

| Home Loan Interest (24b) | ₹2,00,000 |

| HRA Exemption | ₹2,00,000 |

| NPS – Additional (80CCD(1B)) | ₹50,000 |

| 80TTA Savings Interest | ₹10,000 |

| 80G Donation | ₹50,000 |

Here,

| Gross Income | ₹12,00,000 |

| Less: Deduction | ₹7,60,000 |

| Taxable Income becomes | ₹4,40,000 |

Since, taxable income is below ₹5,00,000 you will get – 100% rebate u/s 87A on tax.

Final tax payable = ₹0

With these combined deductions you can reduce taxable income significantly and benefit from zero tax payout up to ₹12 lakh income under the Old Tax Regime legally.

FAQs

It totally depends on your deductions and exemptions — if you have significant deductions such as home loan interest, HRA, 80C, 80D, etc. then Old Tax Regime may be better. Otherwise, New Regime’s simpler slabs may suit you.

To opt for Old Regime, salaried employees can switch annually; those with business or professional income must file the relevant form Form 10-IEA before ITR filing deadline.