Form 10IEA allows taxpayers to choose between the old and new tax regimes.

With effect from AY 2024-25, the new tax regime is the default for ITR Filling. So, now if you opt out New Tax Regime and want to file ITR under Old Tax Regime then you need to inform government first by filling 10IEA.

Who need to file form 10-IEA?

If an individuals earning income from profession or business and want to switch from the new regime to the old one, need to submit Form 10-IEA within the specified deadline u/s 139(1).

Liable Person

- Individual

- Hindu Undivided Family (HUF)

- Association of Persons (other than a co-operative

- Body of Individuals

- Artificial Juridical Person Referred u/s 2(31)(vii)

Requirements

For Salaried Individuals or Pensioners without Business Income

Applicable Form: ITR 1 and ITR 2

Not required to file Form 10-IEA: You can choose the old tax regime directly by selecting the option while filing the ITR.

For Individuals with Business or Professional Income

Applicable Form: ITR 3 and 4

Required to file Form 10-IEA: To opt for old tax regime, you must submit this form on or before the due date for filling your income tax return u/s 139(1).

Conditions for Filing Form 10IEA

For Business Owners ITR 3 and ITR 4: You can file Form 10IEA twice in your lifetime –

- First to opt out of the new tax regime.

- Second to re-enter into the new tax regime.

Due Date to Submit Form 10-IEA

| For Individuals, HUFs, AOPs, BOIs (not subject to audit) with business or professional income | 31 July 2025 (Extended to 15 Sep 25) |

| For Companies, other entities subject to tax audit, and partners in applicable firms with business or professional income | 31 October 2025 |

| For salaried taxpayers without business income | Can choose directly the old tax regime while filing returns, without the need for Form 10-IEA |

| For assesses under Section 92E requiring audit returns | 30th November 2025 |

Details Required to Fill in Form 10-IEA

The form 10-IEA is divided into three parts:

Basic Information

- Details such as the name of the assessee, PAN, assessment year, and their status.

- If it’s the first time filing the form, the opting-out option will be auto-selected.

- If there’s a valid form with opting-out option already on record, then the re-entering option will be auto-selected.

Additional Information

- This involves providing any additional information related to the IFSC unit, if applicable.

- Note that if the taxpayer is opting out of the new tax regime, this section will be disabled or greyed out.

Declaration and Verification

- In this part, the taxpayer declares and verifies their choice of opting out or re-entering into the new tax regime.

How to fill Form 10-IEA?

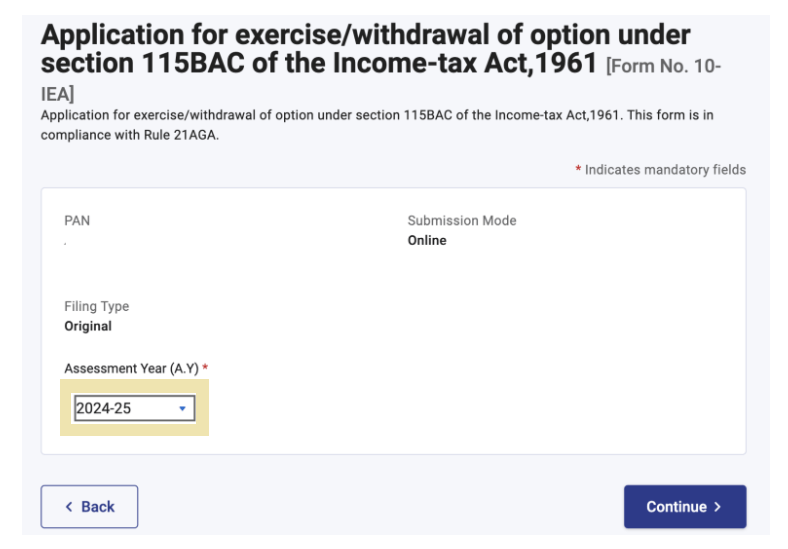

- On e-Filing portal Page enter your user ID and password.

- Then, Go to e- File menu > Income Tax Forms > File Income Tax Forms.

- On the page >File Income Tax Forms >’Persons with Business/Professional Income > select the option > Form >10IEA. Alternatively, enter Form 10IEA in the search box to file the form. On the Form 10 IEA page, select the relevant Assessment Year and click on continue.

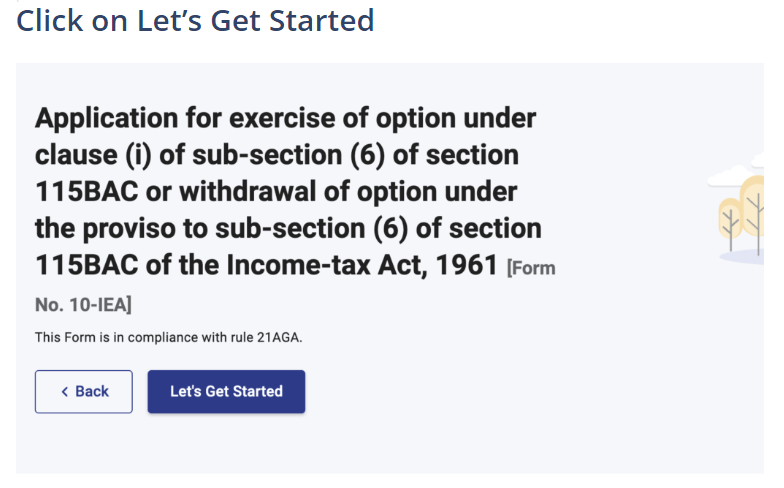

- Check the documents required for filing the form and Click on Let’s Get started

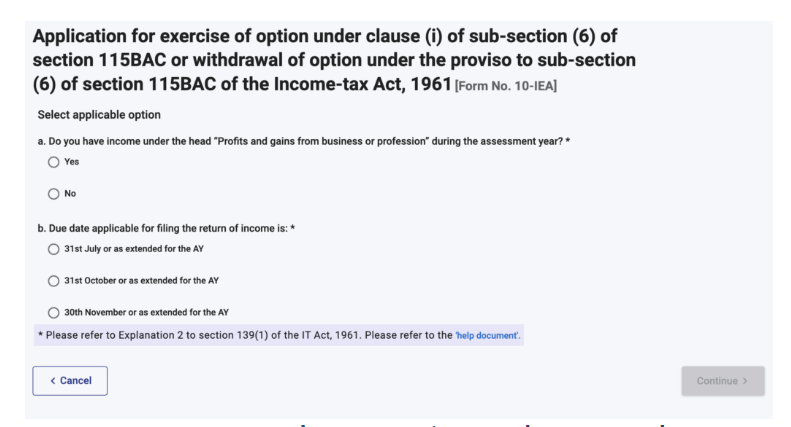

- Select Yes if you have Income under the head “Profits and gains from business or profession” during the assessment year.

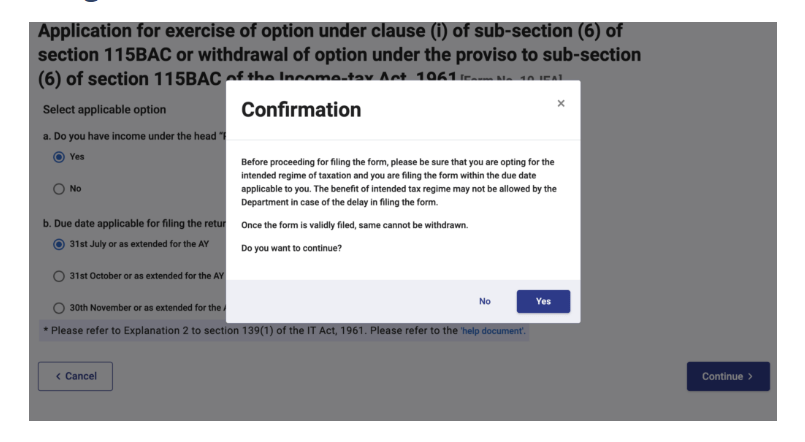

- Select the Due date applicable for of filing of return of income and click continue.

- Click ‘Yes’ to Confirm the selection of the regime.

- Form has three section, confirm each section.

- Fill the necessary details in Basic Information section, Additional information section & declaration and verification section of the form, and click on save.

- Check the all the details furnished in the form. you can edit the details by clicking on edit button otherwise click on Proceed to e-verify button.

- Select the Relevant option from below options to verify the form. After verification Click on yes to Submit the Form.

- Now, if taxpayer wants to View filed form Go to the e-file menu > View filed forms > Form

- You can download the Form and receipt. click on View details to see the life cycle of form

What is Form 10-IE?

Form 10-IE was used earlier while choosing the new tax regime manually. Now as the new tax regime is the default option from AY 2024-25, Form 10-IE is no longer needed. Instead, taxpayers who want to file their ITR with the old tax regime must file Form 10-IEA. This new form makes the process simpler and better matches current tax rules, helping taxpayers easily choose the old regime if that suits them better. So, Form 10-IEA replaces Form 10-IE to reflect this change in tax filing procedures.

New Tax Regime Benefits for FY 2024-25 Click Here

FAQs

Those who file ITR-3, ITR-4 or ITR-5 are require to submit Form 10-IEA.

Form 10IE was used to choose the new tax regime. Form 10IEA is now used to opt for the old tax regime, as the new regime is the default from the FY 2023-2024.

If an individual forgets to submit Form 10-IEA before ITR filing, they cannot choose the old tax regime as IT department will calculate tax using the new tax regime.