INPUT TAX CREDIT UNDER GST TO BE PASSED ON BY BUILDERS TO FLAT / PROPERTY BUYERS

As required u/s 171 of the GST Act and Press Release dated 15th June 2017 issued by the Government of India, it has become mandatory for builders/developers to pass on the Input Tax Credit (ITC) benefits to the buyers of under construction flats/ properties.

It is very important to understand that the flats/ properties under construction can not be treated like any other goods or services. The construction of flats/ properties takes a long time to complete and hand over the same to the buyers. The construction of a project consisting of flats/ properties requires hundreds of different kind of goods and many type of skilled/ unskilled labours. The prices of the goods and the rates of labourers keep on changing due to government orders and also due to demand supply ratio. Accordingly the cost/benefit against GST input credit of under construction flats/ properties can not be accurately estimated as there will be variances due to quantities and rates of goods and labourers which are to be used in future years.

The ITC benefits now available to the builders under GST may be passed on to the flat/property buyers in many ways. Some of them are:

- reducing the prices of the flats/ properties

- by giving discounts to the buyers

- by crediting/ paying the ITC available, claimed and deducted from output liability to the account of the flat/property buyer.

Reducing the price or giving the discount may be based on an estimate of ITC available in future which will never be accurate due to various reasons like quantities and rates of various goods/ labourers to be utilized in future and the same will vary to a great extent due to the uncertainties of future. Further, the same may be challenged by anyone concerned including the Anti-Profiteering authorities and it will not be be possible to establish the accuracy of the price reduction or discount given due to the assumptions taken by different builders according to their own knowledge/ assumptions.

Further, there may be number of reasons for increasing the prices or giving discounts like cost of goods/ labour, festivals, stage of construction, specification of the flats/ properties, location of the projects, sudden positive/ negative developments in and around the location of projects, demand – supply ratio and many uncountable reasons beyond the imagination of anyone. Thus reducing the price or giving discounts on account of ITC benefits under GST will have to be necessarily explained as to how the same has been calculated.

Further, for how many days/ months the prices of the flats/ properties will be kept reduced or discount will be kept on being given? In this method of passing the ITC benefit it will be very difficult to increase the prices/ withdraw the discount in future, as the increase in prices or reduction in discount will again have to be explained to anyone concerned including Anti-Profiteering authorities.

The cost of flat/ properties may increase in future due to the quantities/ rates of goods/ labourers and in that case the builder has to increase the prices on that account. It will not be possible every time to re-calculate the estimates of cost and justify the price increase, there will be no takers for the same. And what about the demand – supply ratio? The builders keep low prices at the time of launching new projects and as the bookings go up, the prices also are increased to achieve the average price realisation. This system is adopted all over the world in these kinds of projects; so that the early birds get flats/ properties at rock bottom prices and the builders get finance to do the construction. Accordingly, the last few units are sold at highest prices as the flat/properties are now ready to occupy and the prices get increased due to time factor also. The buyer does not have to wait and he immediately starts using the flat/property for himself or starts earning rent on the same. In a democratic free economy like India, prices are decided by the equilibrium point of demand & supply which is the basic principle of economics.

Therefore, the prices of flats/property may get increased/ reduced due to number of reasons and it will not be possible for anyone to justify the price increase/ reduction. It will further be more difficult to explain that the GST ITC benefits have been passed to the buyer and has been considered in these prices.

Further in case of reducing the prices, there will be another problem of the reduced prices being below the government rates for stamp/ registration purposes. In that case, the builder & flat/property buyer both will have to pay Income Tax on the differential value under the provisions of the Income Tax Act, apart from being accused of using black money.

Therefore, the best way to pass on the ITC benefits under GST to the buyer of under construction flat/ property will be to pass on the amount of ITC benefits as has been claimed by the builders in their GST returns and as has been deducted from the Output liability as per GST returns which will be accurate and can be explained on the basis of claims of ITC benefits in the GST return.

The amount of ITC as claimed in the GST return and as deducted from the payment to the Government against the GST collected from buyers at the rate of 18% on 2/3rd value of the receipts may be passed on to the buyer of under construction flat/ property on month to month basis in the ratio of amount receivable from different buyers as on 1st July 2017. Further, provision of ITC benefits must be kept for unbooked flat/properties and the same has to be passed on to the buyer of such unbooked unit as soon as the same are booked.

Lastly if in the meantime the project gets completed and completion/occupation certificate for the project is received by the builder but there are still some flat/properties unbooked (which are now not under construction) and the same are booked after completion/ occupation certificate is received, then no GST is to be charged on the same. The balance amount remaining in the provision of ITC benefits for unbooked units must be distributed/ paid to the Flat/Property buyers who had booked the same as “under construction” units in the ratio of the amount paid/ payable by them after 1st July 2017.

Price Wise – Stage Wise ITC available and to be passed to flat/ property buyer

Example: Considering that a Flat is of 1,000 Sq.ft area, the following examples explain as to how the GST will impact the flat buyer in under construction property where balance work is to be done. Assuming that the cost of material is Rs. 1200/- and cost of labour is Rs. 300/-. The prices of the flats changes due to cost of land at different locations where the cost of land is high/low.

Example No. 1

Price: Rs. 4,000/- per sq.ft

Flat Size: 1,000 Sq.ft

Total Price of Flat: Rs. 40,00,000/-

(All amount in Rupees)

|

Balance work to be done on 1/7/2017 |

1 % work remaining |

10% work remaining |

50% work remaining |

90% work remaining |

100% work remaining |

|

|

|

|

|

|

|

|

A) GST collected from flat buyers @ 12% |

4,80,000 |

4,80,000 |

4,80,000 |

4,80,000 |

4,80,000 |

|

B) GST input credit on land |

0 |

0 |

0 |

0 |

0 |

|

C) GST input credit on labour assuming cost @ Rs. 300/- per sq.ft |

0 |

0 |

0 |

0 |

0 |

|

D) GST input credit @ 18% (approx.) on materials assuming cost @ Rs. 1,200/- per sq.ft to builders and to be passed on to flat buyer |

2,160

(1200 X 1000 X 18% X 1%) |

21,600

(1200 X 1000 X 18% X 10%) |

1,08,000

(1200 X 1000 X 18% X 50%) |

1,94,400

(1200 X 1000 X 18% X 90%) |

2,16,000

(1200 X 1000 X 18% X 100%) |

|

E) GST input credit passed on to flat buyer |

2,160

|

21,600

|

1,08,000

|

1,94,400

|

2,16,000

|

|

F) Net GST paid by flat buyer (A-E) |

4,77,840 |

4,58,400 |

3,72,000 |

2,85,600 |

2,64,000 |

|

G) Net GST % to be paid by flat buyer under GST regime (F / 40,00,000 (price of flat) x 100) |

11.95% |

11.46% |

9.30% |

7.14% |

6.60% |

|

H) Tax % paid by flat buyer prior to GST (Service Tax + VAT) |

5.5% |

5.5% |

5.5% |

5.5% |

5.5% |

|

I) Increase in tax burden on flat buyer due to GST |

6.45% |

5.96% |

3.80% |

1.64% |

1.10% |

Example No. 2

Price: Rs. 5,000/- per sq.ft

Flat Size: 1,000 Sq.ft

Total Price of Flat: Rs. 50,00,000/-

(All amount in Rupees)

|

Balance work to be done on 1/7/2017 |

1 % work remaining |

10% work remaining |

50% work remaining |

90% work remaining |

100% work remaining |

|

|

|

|

|

|

|

|

A) GST collected from flat buyers @ 12% |

6,00,000 |

6,00,000 |

6,00,000 |

6,00,000 |

6,00,000 |

|

B) GST input credit on land |

0 |

0 |

0 |

0 |

0 |

|

C) GST input credit on labour assuming cost @ Rs. 300/- per sq.ft |

0 |

0 |

0 |

0 |

0 |

|

D) GST input credit @ 18% (approx.) on materials assuming cost @ Rs. 1,200/- per sq.ft to builders and to be passed on to flat buyer |

2,160

(1200 X 1000 X 18% X 1%) |

21,600

(1200 X 1000 X 18% X 10%) |

1,08,000

(1200 X 1000 X 18% X 50%) |

1,94,400

(1200 X 1000 X 18% X 90%) |

2,16,000

(1200 X 1000X 18% X 100%) |

|

E) GST input credit passed on to flat buyer |

2,160

|

21,600

|

1,08,000

|

1,94,400

|

2,16,000

|

|

F) Net GST paid by flat buyer (A-E) |

5,97,840 |

5,78,400 |

4,92,000 |

4,05,600 |

3,84,000 |

|

G) Net GST % to be paid by flat buyer under GST regime (F / 50,00,000 (price of flat) x 100) |

11.96% |

11.57% |

9.84% |

8.11% |

7.68% |

|

H) Tax % paid by flat buyer prior to GST (Service Tax + VAT) |

5.5% |

5.5% |

5.5% |

5.5% |

5.5% |

|

I) Increase in tax burden on flat buyer due to GST |

6.46% |

6.07% |

4.34% |

2.61% |

2.18% |

Example No. 3

Price: Rs. 7,500/- per sq.ft

Flat Size: 1,000 Sq.ft

Total Price of Flat: Rs. 75,00,000/-

(All amount in Rupees)

|

Balance work to be done on 1/7/2017 |

1 % work remaining |

10% work remaining |

50% work remaining |

90% work remaining |

100% work remaining |

|

|

|

|

|

|

|

|

A) GST collected from flat buyers @ 12% |

9,00,000 |

9,00,000 |

9,00,000 |

9,00,000 |

9,00,000 |

|

B) GST input credit on land |

0 |

0 |

0 |

0 |

0 |

|

C) GST input credit on labour assuming cost @ Rs. 300/- per sq.ft |

0 |

0 |

0 |

0 |

0 |

|

D) GST input credit @ 18% (approx.) on materials assuming cost @ Rs. 1,200/- per sq.ft to builders and to be passed on to flat buyer |

2,160

(1200 X 1000 X 18% X 1%) |

21,600

(1200 X 1000 X 18% X 10%) |

1,08,000

(1200 X 1000 X 18% X 50%) |

1,94,400

(1200 X 1000 X 18% X 90%) |

2,16,000

(1200 X 1000 X 18% X 100%) |

|

E) GST input credit passed on to flat buyer |

2,160

|

21,600

|

1,08,000

|

1,94,400

|

2,16,000

|

|

F) Net GST paid by flat buyer (A-E) |

8,97,840 |

8,78,400 |

7,92,000 |

7,05,600 |

6,84,000 |

|

G) Net GST % to be paid by flat buyer under GST regime (F / 75,00,000 (price of flat) x 100) |

11.97% |

11.71% |

10.56% |

9.41% |

9.12% |

|

H) Tax % paid by flat buyer prior to GST (Service Tax + VAT) |

5.5% |

5.5% |

5.5% |

5.5% |

5.5% |

|

I) Increase in tax burden on flat buyer due to GST |

6.47% |

6.21% |

5.06% |

3.91% |

3.62% |

Example No. 4

Price: Rs. 10,000/- per sq.ft

Flat Size: 1,000 Sq.ft

Total Price of Flat: Rs. 1,00,00,000/-

(All amount in Rupees)

|

Balance work to be done on 1/7/2017 |

1 % work remaining |

10% work remaining |

50% work remaining |

90% work remaining |

100% work remaining |

|

|

|

|

|

|

|

|

A) GST collected from flat buyers @ 12% |

12,00,000 |

12,00,000 |

12,00,000 |

12,00,000 |

12,00,000 |

|

B) GST input credit on land |

0 |

0 |

0 |

0 |

0 |

|

C) GST input credit on labour assuming cost @ Rs. 300/- per sq.ft |

0 |

0 |

0 |

0 |

0 |

|

D) GST input credit @ 18% (approx.) on materials assuming cost @ Rs. 1,200/- per sq.ft to builders and to be passed on to flat buyer |

2,160

(1200 X 1000 X 18% X 1%) |

21,600

(1200 X 1000 X 18% X 10%) |

1,08,000

(1200 X 1000 X 18% X 50%) |

1,94,400

(1200 X 1000 X 18% X 90%) |

2,16,000

(1200 X 1000 X 18% X 100%) |

|

E) GST input credit passed on to flat buyer |

2,160

|

21,600

|

1,08,000

|

1,94,400

|

2,16,000

|

|

F) Net GST paid by flat buyer (A-E) |

11,97,840 |

11,78,400 |

10,92,000 |

10,05,600 |

9,84,000 |

|

G) Net GST % to be paid by flat buyer under GST regime (F / 1,00,00,000 (price of flat) x 100) |

11.98% |

11.78% |

10.92% |

10.06% |

9.84% |

|

H) Tax % paid by flat buyer prior to GST (Service Tax + VAT) |

5.5% |

5.5% |

5.5% |

5.5% |

5.5% |

|

I) Increase in tax burden on flat buyer due to GST |

6.48% |

6.28% |

5.42% |

4.56% |

4.34% |

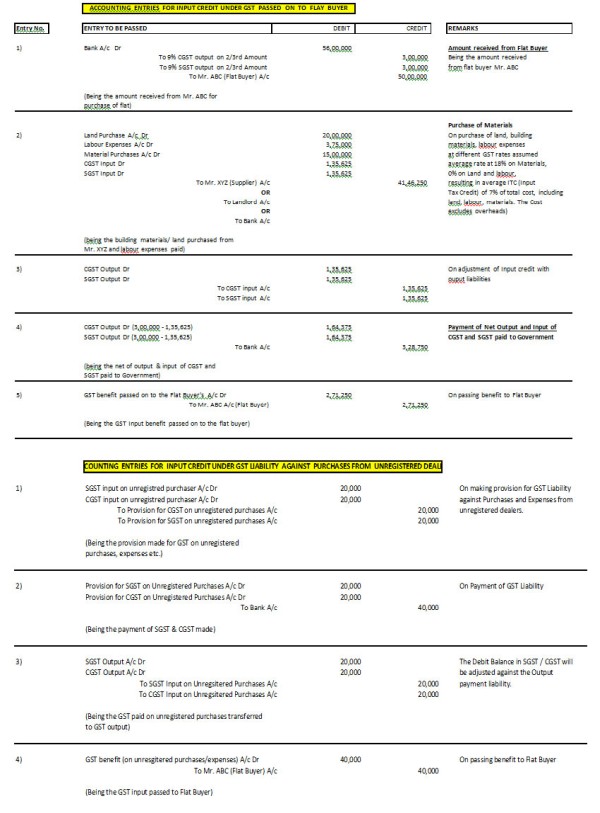

The builders will be required to do accounting entries accordingly. Please note that the following accounting entries are for the whole project and the same are to be made on a day to day basis. The figures have been assumed. The accounting entries are given below:

From the above, one may see that the flat/ property buyer will be paying extra even after the builder passes on all the Input Credit received under GST regime and the benefits vary as per price of stage of construction. The price mainly varies due to the location of the land as the cost of land is higher at good location. Accordingly the GST burden on buyers will be more if the cost of land is more and vice versa.

Author: CA Prabhat Seksaria

Jamshedpur

Attached File : 361567 20170810191921 gst on builders write up.pdf downloaded: 370 times

CAclubindia

CAclubindia