Introduction

With the growth of Indian economy & increasing integration with the global economies, Indian corporates are raising capital globally. Under the circumstances it would be imperative for Indian corporates to adopt IFRS for their financial reporting. The convergence with IFRS is set to change the landscape for financial reporting in India. IFRS represents the most commonly accepted global accounting framework as it has been adopted by more than 100 countries.

¨ One of the basic features of the IFRS is that it is principle based standard rather than rule based.

¨ A separate set of IFRS for Small & Medium–Sized Enterprises has been issued by the IASB in July 2009

¨ IFRS stands for International Financial Reporting Standards & includes International Accounting Standards (IASs) until they are replaced by any IFRS & interpretation originated by the IFRIC (International Financial Reporting Interpretation Committee) or its predecessor, the former Standing Interpretation Committee.

¨ IFRS are developed and approved by IASB (International Accounting Standard Board)

According to the Preface to IFRS issued by the IASB the main objectives of IFRS are

¨ To develop in public interest, a single set of high quality, understandable & enforceable global accounting standards that require high quality, transparent & comparable information in financial statements & other financial reporting to help participants in the various capital markets of the world & other users of the information to make economic decisions

¨ To promote the use & rigorous application of those standards

¨ In fulfilling the objectives associated above to take account of, as appropriate, the special needs of small & medium-sized entities & emerging economies

¨ To bring about convergence of national accounting standards & IFRSs to high quality solutions.

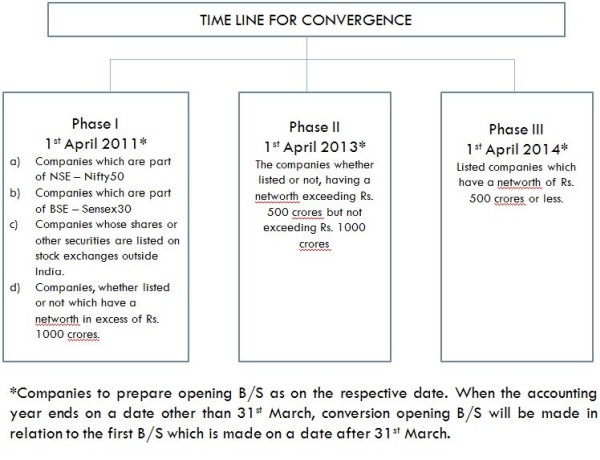

¨ At its 269th meeting the council of ICAI has decided that public interest entities such as listed companies, banks insurance companies & large sized organisations to converge with IFRS for accounting period commencing on or after 1st April, 2011.

¨ For small & medium sized entities ICAI had proposed that a separate standard may be formulated based on the IFRS for SMEs issued by the IASB after modifications, if necessary.

IFRS in not mandatory for the following Companies.

¨ Non-Listed Companies which have a networth of Rs. 500 crores or less and whose shares or other securities are not listed on stock exchanges outside India.

¨ Small & Medium Companies (SMCs)

¨ Encourage international investing & thereby increase in foreign capital inflow.

¨ Benefit the economy by increased international business.

¨ More relevant, reliable, timely & comparable information to investors.

¨ Better understanding of financial statements would benefit investors who wish to invest outside the country.

¨ Capital at lesser cost from foreign market.

¨ Reduced accounting requirements prevailing in various countries & hence reduced cost of compliance.

¨ Professional opportunity to serve international clients.

¨ Increased mobility to work in different parts of the world either in industry or practice.

¨ Increase in cost due to dual reporting requirement till full convergence is achieved.

¨ Changes may be required to various regulatory requirements such as Companies Act, Income Tax Act, SEBI, RBI, etc..

¨ If IFRS is to be uniformly understood training may be reuired to all stakeholders such as employees, auditors, etc.

¨ Additional cost towards modification in IT systems & Proceedures.

¨ Difference between Indian GAAP & IFRS may impact business decision & financial performance.

¨ Limited pool of trained resource & persons having expert knowledge on IFRSs.

Qualitative Characteristics

¨ Understandability

¨ Relevance

¨ Reliability

¨ Comparability

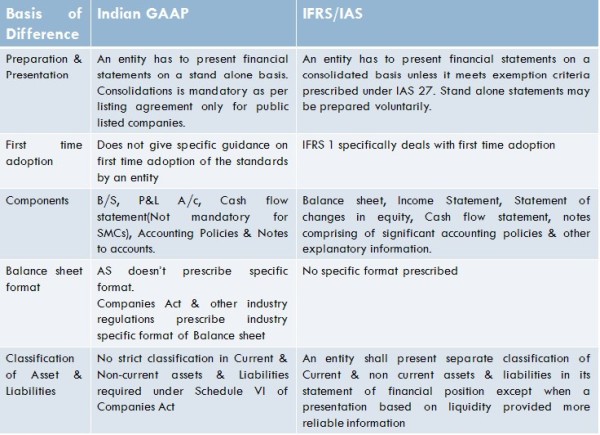

Contents :

- A statement of financial position as at the end of the period (Balance Sheet)

- A statement of comprehensive income for the period (Income Statement)

- A statement of changes in equity for the period

- A statement of cash flows for the period

- Notes comprising of significant accounting policies & other explanatory information

- A statement of financial position as at the beginning of the earliest comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it classifies items in its financial statements.

CAclubindia

CAclubindia