CAclubindia Articles

SEBI: Related Party Transactions in XBRL mode

CS Tanveer Singh Saluja 07 September 2021 at 09:32With a view to making the disclosure more accurate and efficient, the NSE, in consultation with SEBI, has introduced a facility for filing RPTs in XBRL mode under regulation 23(9) of LODR Regulations, 2015.

Presumptive Taxation Does Not Create a Privileged Class of Taxpayers

CA.R.S.KALRA 07 September 2021 at 09:29It is the minimum rate u/s 44AD that has to be considered and higher income option is open for the taxpayers which has to be used if taxpayers have higher income.

Taxability of Interest Accrued on Employee Contribution to Recognized Fund

MOHIT JAIN 07 September 2021 at 09:24The annual interest computed on employee contribution in excess of Rs. 2.50/5.00 lacs is taxable only at the time when the accumulated balance is paid to the employee.

Important Care to be taken before filing Sept 21 GST Return

CA Umesh Sharma 07 September 2021 at 09:24Once the return of September 2021 is filed, no changes or rectifications can be made further. Thus, taxpayers must reconcile their books and returns & make the final adjustments.

Section 48: Method Of Computing Capital Gain

Ritik Chopra 06 September 2021 at 13:36The income chargeable under “Capital gains” shall be computed by deducting the amounts discussed in this article from the full value of the consideration received or accruing as a result of the transfer of the capital asset.

KYC, Re-KYC, Misconceptions around KYC and Dormant Account

Shivaprasad Laxman Chhatre 06 September 2021 at 13:36KYC is a mandatory process by which bank/s, FI/s obtain information about the identity and address of the customers to establish the legitimacy of a customer.

Tax treatment of interest income on PF contributions

Ajay Kumar Maggidi 06 September 2021 at 09:25Interest portion on PF contributions exceeding 2.5L is taxable under the head "Income from Other Sources". Taxable Contributions = ((Contributions in excess of 2.5L/5L*)+(Interest accrued thereon)-( Withdrawals)).

How to Explain GST to Your Friends: The Ultimate Guide

rumpa gupta 06 September 2021 at 09:25The Goods and Services Tax Council has set up a four-tier tax structure. The rates are 5%, 12%, 18%, and 28%, which means that the total tax burden on the product is likely to be around 18%.

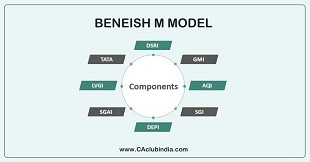

Beneish M Model - A Tool Detection Of Fraud in Financial Statements

Poojitha Raam VinayBeneish Model is a statistical model created by Professor Messod D. It is a model that studies the trend of the organisation through various ratios. This model is based on eight financial ratios.

Section 194P: Recent Updates - Specified Bank & Form of Declaration

CS Tanveer Singh Saluja 04 September 2021 at 15:24There were a lot of practical difficulties which were faced by individuals and professionals. However, CBDT has published two notifications that give clarity regarding the meaning of a specified bank and form of declaration.

Popular Articles

- TDS Rules on Cash Withdrawals: Starting From April 2026

- Fixed Deposit Limits from 2026 along with New IT Rules

- 15G and 15H Scrapped: Now One Form for All Eligible Taxpayers

- Interest Computation Changes under GST (Effective from January 2026)

- How Much Can Senior Citizens Earn Tax-Free After Budget 2026?

- Locked GSTR-3B Era Begins: How ECRS and RCM Validation Is Changing GST Compliance

- Cheque Bounce Rules in India: What Changes in 2026 Mean for You

- Tax Calculation Slabs For FY 2025-26 (AY 26-27)

Trending Online Classes

-

DT & Audit (Exam Oriented Fastrack Batch) - For May 26 Exams and onwards Full English

CA Bhanwar Borana & CA Shubham Keswani

CA Bhanwar Borana & CA Shubham Keswani -

IDT LIVE Exam Oriented Batch | May 2026, Sept 2026 & Jan 2027

CA Arpita Tulsyan

CA Arpita Tulsyan

CAclubindia

CAclubindia