If an agreement is entered into under this section, the effect of the same shall be as under:- (i) If no tax liability is imposed under the Income-tax […]

Analysing Section 54 of the Income Tax Act

Section 54 from the Bare Act According to Section 54, Any long-term capital gain, arising to an individual or HUF, from the transfer of a residential house property […]

Bill Hemmer’s Tax Returns Reveal Astounding Income

Bill Hemmer has a net worth of $35 million. Hemmer earns a $6 million salary annually from Fox News for hosting America’s Newsroom. Hemmer’s first job was with […]

Exemption on Capital Gains From Compulsory Acquisition of Land

Conditions for Section 54D There must be compulsory acquisition of land and building or any right in land or building forming part of an industrial undertaking. The land […]

Carry forward and Set Off of Depreciation [Section 32(2)]

Section 32(2) provides for carry forward of unabsorbed depreciation. Where, in any previous year the profits or gains chargeable are not sufficient to give full effect to the […]

Candace Owens’s $18 Million Tax-Free Gifts from Husband

Candace Owens has a net worth of $30 million as of 2025. She owns $18 million worth of real estate properties, most of which were tax-free gifts from […]

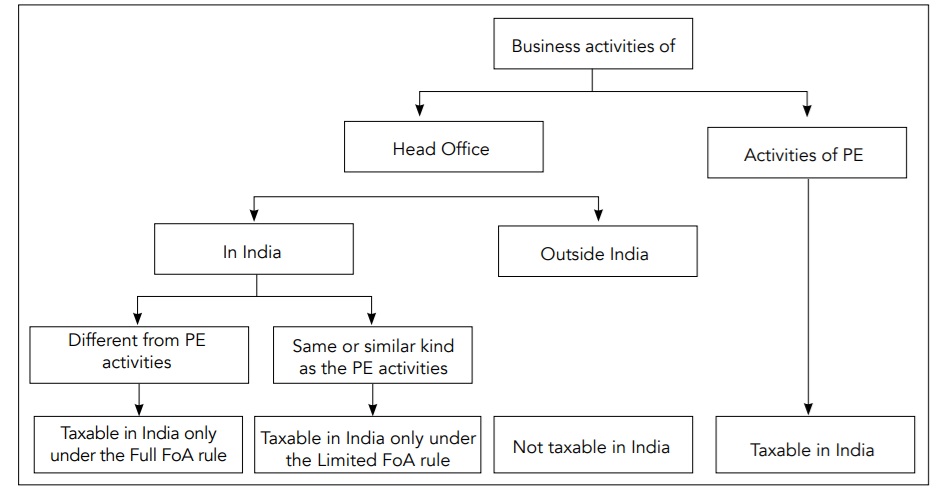

Force of Attraction (FoA) Clause in Tax Treaties

The FoA rule provides that when a foreign enterprise sets up a PE in a source state, it brings itself within the fiscal jurisdiction of the source state […]

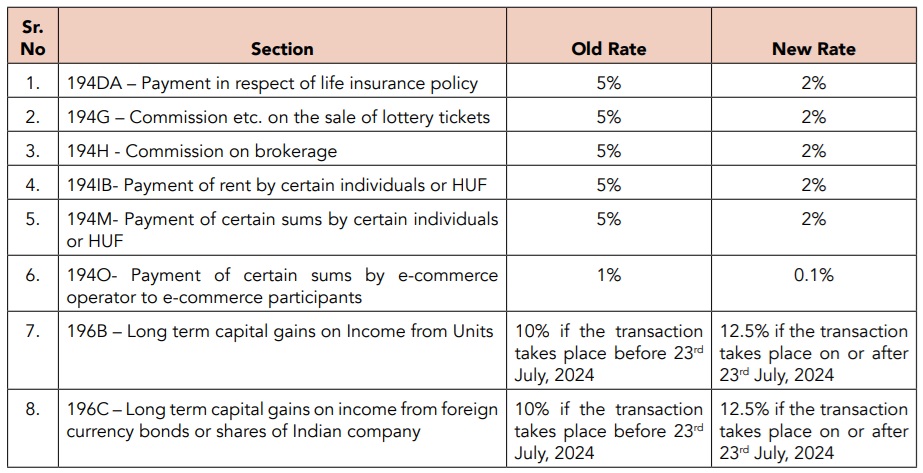

Recent Amendments in Chapter XVII-B and XVII-BB

This article analyses the amendments made by the Finance (No.2) Act, 2024 with respect to the provisions contained in Chapter XVII-B and XVII-BB of the Income-tax Act, 1961 […]

GST Indexation Benefits after the Finance Act, 2024

In a recent circular 224/18/2024-GST [CBIC-20001/4/2024-GST] dated 11th July 2024, it has been clarified that upon payment of an amount equivalent to 20% of the disputed tax amount […]

Converting Company to LLP is a Smart Tax Move

Provisions of Section 45 of the Income-tax Act, 1961 (‘the Act’) provides for charging of Capital Gains Tax on account of transfer of capital asset in the previous […]

![Carry forward and Set Off of Depreciation [Section 32(2)]](https://www.caclubindia.com/money/wp-content/uploads/2024/12/carry-forward-of-depreciation.jpg)