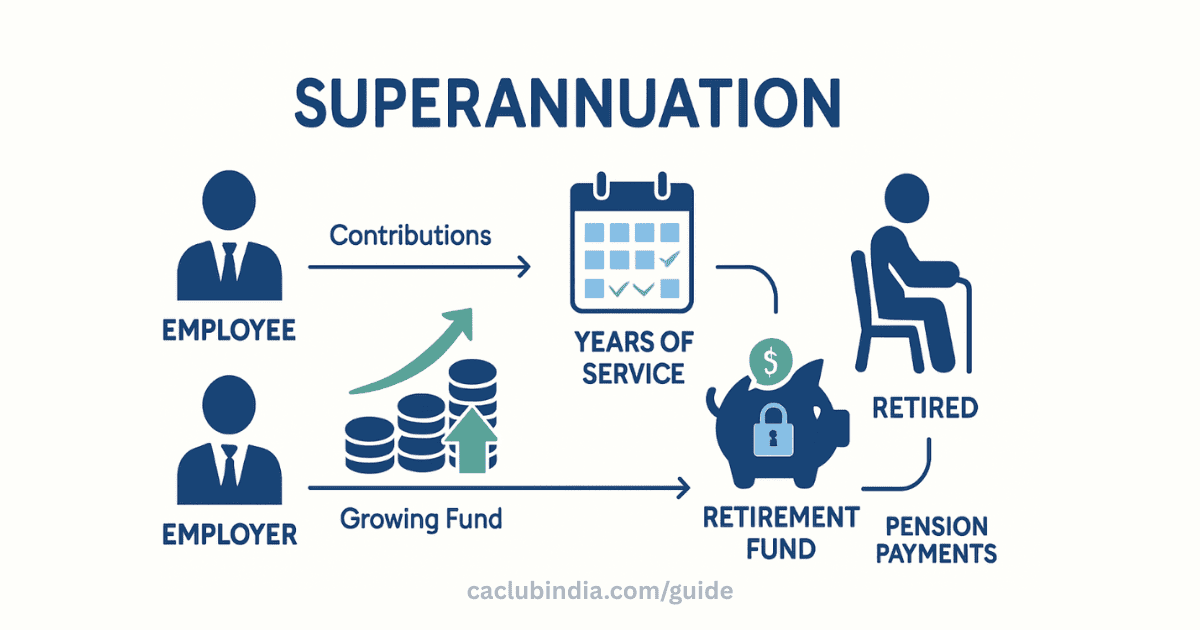

For any working professional in India, planning for a financially secure retirement is paramount. While the Employee Provident Fund (EPF) and the National Pension System (NPS) are widely discussed, another powerful tool often flies under the radar: the Superannuation Fund.

Key Takeaways

- Plan Early: Superannuation is a powerful tool for retirement; start contributing early to leverage compounding.

- Tax Optimization: Stick to exemption limits (e.g., ₹7.5 lakh employer cap) to minimize tax liability.

- Diversify: Combine superannuation with NPS or mutual funds for a balanced portfolio.

- Compliance Matters: Ensure your fund is approved to avoid taxation pitfalls.

- Review Annually: With changing budgets, revisit your superannuation strategy during tax planning season.

Who is Eligible?

- Salaried employees of companies offering superannuation.

- Minimum service period requirements (usually 5 years).

- Age criteria as per fund rules.

- Both public and private sector employees.

Types of Superannuation Funds

Superannuation funds come in various forms, each with unique features. Here’s a quick overview:

- Defined Benefit Plans: Your employer promises a fixed payout based on your salary, years of service, and a predefined formula (e.g., 1.5% of average salary per year of service). It’s risk-free for employees but burdensome for employers due to guaranteed returns.

- Defined Contribution Plans: Contributions are fixed (e.g., 10-15% of your basic salary), but the final payout depends on investment performance. Popular examples include employer contributions to the Employees’ Provident Fund (EPF) or standalone superannuation schemes. Employees may also contribute voluntarily.

- Approved Superannuation Funds: These are tax-approved by the Commissioner of Income Tax. They must comply with rules like investing at least 90% in approved securities.

- Unapproved Superannuation Funds: Offered by some employers but without tax benefits. Withdrawals are fully taxable, making them less appealing.

Choosing the right type depends on your risk tolerance and employer’s offerings. For instance, defined contribution plans suit those comfortable with market-linked returns.

Exemption Limits under Income Tax

Superannuation enjoys EEE (Exempt-Exempt-Exempt) status in many cases—exempt on contribution, accumulation, and withdrawal. However, there are limits and conditions under Sections 10(13) and 17(2) of the Income Tax Act.

Contribution Exemptions

- Employer contributions up to ₹7.5 lakh per year are tax-free (under Section 80CCD). Anything above is taxable as perquisites.

- Employee contributions qualify for deductions under Section 80C (up to ₹1.5 lakh, combined with other investments like PPF).

Withdrawal Exemptions

- Lump-sum withdrawal on retirement (after age 58) or superannuation is fully exempt if from an approved fund.

- Premature withdrawal (before 5 years of service) is taxable, except in cases of illness, discontinuation of the scheme, or death.

- Annuity payouts: 1/3rd of the commuted value is tax-free; the rest is taxed as salary income.

- Limit on Tax-Free Withdrawal: Up to ₹5 lakh aggregate exemption on employer contributions’ interest (introduced in Budget 2021 for high earners).

If your annual employer contribution exceeds ₹7.5 lakh, the excess (plus interest) is taxable. Always file ITR accurately to claim these benefits—use Form 12BB to declare to your employer.

Tax Treatment at Different Stages

| Stage | Tax Treatment |

| Contribution | Employee: 80C deduction; Employer: Exempt up to ₹1.5L |

| Growth | Tax-free accumulation of corpus |

| Withdrawal | Partial exemptions based on components |

Important Considerations

Vesting Period

- Typically 5 years of continuous service

- Early exit may result in forfeiture of employer contributions

- Employee contributions always remain vested

Withdrawal Rules

- At retirement: Full withdrawal allowed

- Job change: Transfer to new employer’s fund or personal account

- Emergency: Partial withdrawal as per fund rules

FAQs

Contributions up to prescribed limits are tax-free. At retirement, 1/3rd withdrawal is tax-free and the rest must be used to buy an annuity, which is taxable.

1. Employer contribution: Up to ₹1.5 lakh combined with PF + NPS (beyond which it’s taxable).

2. On retirement: 1/3rd of the accumulated corpus is tax-free.

Yes, employees may contribute voluntarily, and such contributions qualify for deduction under Section 80C.

The entire superannuation amount is paid to the nominee and is fully tax-free.