As per the Income Tax Act (Section 80-IAC), a startup is an entity (company or LLP) incorporated between April 2016 and March 2028, with annual turnover not exceeding ₹100 crore, recognized by DPIIT, and engaged in an innovative business (excluding traditional sectors like real estate or agriculture), eligible for a 100% tax deduction on profits for 3 out of 10 years.

Under the Startup India Action Plan, startups that qualify as per the definition outlined in G.S.R. notification 127(E) can seek recognition under the program. Applicants must submit the required supporting documents along with their application.

Recognition

The process of recognition of an eligible entity as a startup shall be as under:

- A Startup shall make an online application over the mobile app or portal set up by the DPIIT.

- The application shall be accompanied by—

- a copy of Certificate of Incorporation or Registration, as the case may be, and

- a write-up about the nature of business highlighting how it is working towards innovation, development or improvement of products or processes or services, or its scalability in terms of employment generation or wealth creation.

- The DPIIT may, after calling for such documents or information and making such enquires, as it may deem fit, —

- recognise the eligible entity as Startup; or

- reject the application by providing reasons.

Certification for the purposes of section 80-IAC of the Act

A Startup being a private limited company or limited liability partnership, which fulfils the conditions specified in sub-clause (i) and sub-clause (ii) of the Explanation to section 80-IAC of the Act, may, for obtaining a certificate for the purposes of section 80-IAC of the Act, make an application in Form-1 along with documents specified therein to the Board and the Board may, after calling for such documents or information and making such enquires, as it may deem fit, —

- grant the certificate referred to in sub-clause (c) of clause (ii) of the Explanation to section 80- IAC of the Act; or

- reject the application by providing reasons.

Exemption for the purpose of clause (viib) of sub-section (2) of section 56 of the Act

A Startup shall be eligible for notification under clause (ii) of the proviso to clause (viib) of sub-section (2) of section 56 of the Act and consequent exemption from the provisions of that clause, if it fulfils the following conditions:

- it has been recognised by DPIIT under para 2(iii)(a) or as per any earlier notification on the subject

- aggregate amount of paid-up share capital and share premium of the startup after issue or proposed issue of shares, if any, does not exceed twenty-five crore rupees.

- It has not invested in any of the following assets,─

- building or land appurtenant thereto, being a residential house, other than that used by the Startup for the purposes of renting or held by it as stock-in-trade, in the ordinary course of business;

- land or building, or both, not being a residential house, other than that occupied by the Startup for its business or used by it for purposes of renting or held by it as stock-in trade, in the ordinary course of business;

- loans and advances, other than loans or advances extended in the ordinary course of business by the Startup where the lending of money is substantial part of its business;

- capital contribution made to any other entity;

- shares and securities;

- a motor vehicle, aircraft, yacht or any other mode of transport, the actual cost of which exceeds ten lakh rupees, other than that held by the Startup for the purpose of plying, hiring, leasing or as stock-intrade, in the ordinary course of business;

- jewellary other than that held by the Startup as stock-in-trade in the ordinary course of business;

- any other asset, whether in the nature of capital asset or otherwise, of the nature specified in sub-clauses (iv) to (ix) of clause (d) of Explanation to clause (vii) of sub-section (2) of section 56 of the Act.

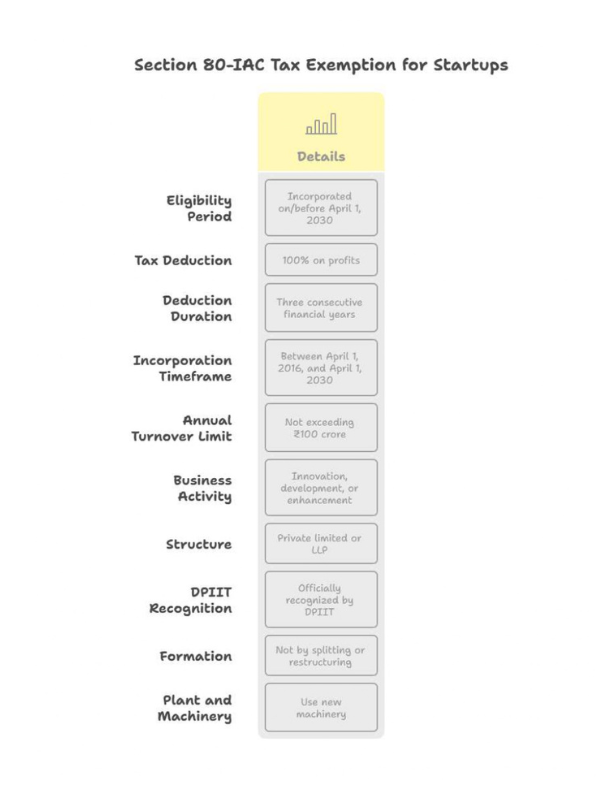

Revised Eligibility Period for Startups

Startups incorporated on or before April 1, 2030, can now qualify for tax exemption under Section 80-IAC, extending the previous deadline.

Tax Benefits

Eligible startups can enjoy a 100% tax deduction on profits for three consecutive financial years within the first ten years of incorporation.

Government Approvals

The Department for Promotion of Industry and Internal Trade (DPIIT) has recently granted approval to 187 startups for this tax benefit. Since the scheme’s launch, more than 3,700 startups have availed of this incentive.

Eligibility Requirements

To qualify for the Section 80-IAC tax exemption, startups must meet the following criteria:

- Be officially recognized by DPIIT.

- Be structured as a private limited company or a Limited Liability Partnership (LLP).

- Be incorporated between April 1, 2016, and April 1, 2030 (as per the extended deadline).

- Have an annual turnover not exceeding ₹100 crore in the financial year for which the deduction is claimed.

- Be involved in innovation, development, or enhancement of products, processes, or services, or possess a scalable business model with significant potential for employment generation or wealth creation.

- Not be formed by splitting or restructuring an existing business (with certain exceptions).

- Use new plant and machinery, though some exceptions apply for previously used imported machinery.

FAQs

The Startup should be incorporated as a private limited company or registered as a partnership firm or a limited liability partnership. Turnover should be less than INR 100 Crores in any of the previous financial years. An entity shall be considered as a startup up to 10 years from the date of its incorporation.

The Income Tax Exemption under Section 80-IAC is a key incentive under the Government of India’s Startup India initiative. Eligible startups can avail of a 100% tax deduction for three consecutive financial years within their first ten years of incorporation.

Section 79 of the Income Tax Act, 1961, restricts a company from carrying forward and setting off its past losses if there is a substantial change in shareholding.

For a business to be considered a startup in India for tax benefits and other incentives, its annual turnover must not exceed INR 100 crore in any of the previous financial years. Additionally, the entity must be incorporated or registered within the last 10 years from the date of incorporation.

According to a spokesperson of DPIIT, the tax benefit allows eligible startups a 100% income tax deduction on profits for any three consecutive years within a ten year window from the date of incorporation.

In India, angel tax applies to investments raised by startups when the amount received exceeds the company’s fair market value (FMV). The tax is charged at 30.9% (including surcharge and cess) on the excess investment amount, which is treated as income.