Section 44AB of the Income Tax Act mandates a compulsory tax audit for businesses and professionals in India whose annual turnover or gross receipts exceed prescribed limits. The primary objectives are to ensure the accuracy of financial statements, verify adherence to tax regulations, and foster transparency within the tax system.

The key objectives of a tax audit under Section 44AB are to:

- Verify Financial Accuracy: Scrutinize and validate the financial statements of taxpayers whose turnover or receipts surpass the statutory thresholds.

- Prevent Non-Compliance: Identify and deter instances of tax evasion or fraudulent reporting.

- Uphold System Integrity: Promote voluntary compliance and ensure the maintenance of fair and transparent accounting records.

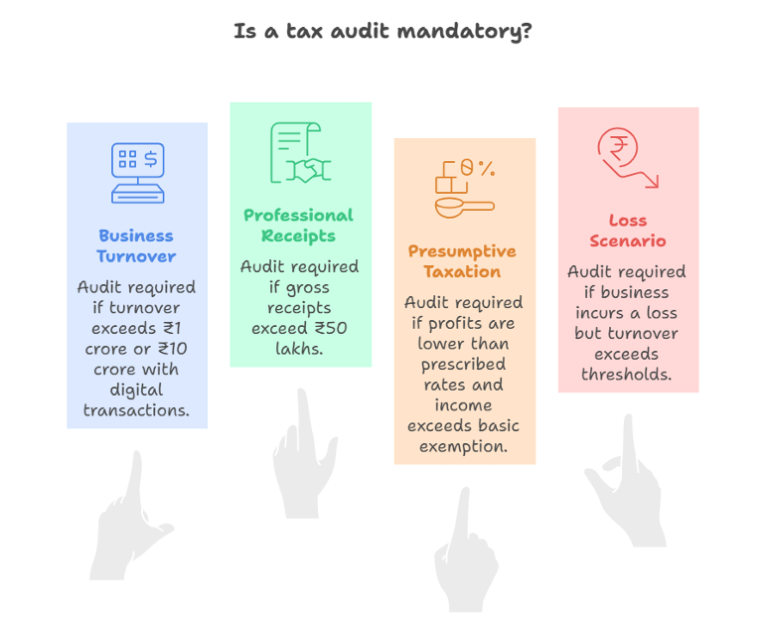

When is a Tax Audit Mandatory?

A tax audit is required under the following circumstances:

For Businesses (General Rule)

- If your total sales, turnover, or gross receipts exceed ₹1 crore in a financial year.

- Higher Threshold for Digital Transactions: This limit is increased to ₹10 crores if the total amount of cash receipts and payments during the year does not exceed 5% of your total turnover.

For Professionals:

If your gross receipts from professional services exceed ₹50 lakhs in a financial year.

Under the Presumptive Taxation Scheme:

- For Businesses (u/s 44AD): An audit is required if you declare profits lower than the prescribed rate (6% or 8% of turnover) and your total taxable income exceeds the basic exemption limit.

- For Professionals (u/s 44ADA): An audit is required if you declare profits lower than the prescribed rate (50% of gross receipts) and your total taxable income exceeds the basic exemption limit.

- Opting Out of the Scheme: An audit is also mandatory if you have opted out of the presumptive taxation scheme in any of the five previous years and your income exceeds the basic exemption limit.

Other Specific Scenarios:

If your business incurs a loss, but your turnover still exceeds the ₹1 crore threshold (or the enhanced ₹10 crore limit, if applicable).

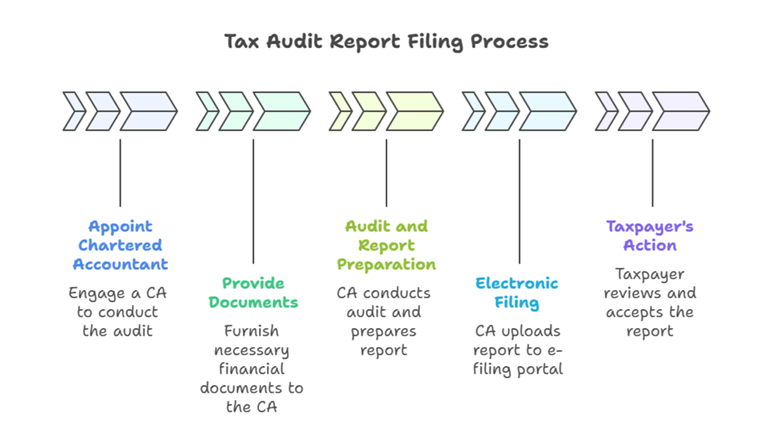

How to File the Tax Audit Report?

The tax audit report must be filed electronically on the Income Tax e-filing portal. The process involves both the taxpayer and a Chartered Accountant (CA).

Steps for Filing:

- Appoint a Chartered Accountant (CA): You must appoint a practicing CA to conduct the audit of your accounts. The CA will examine your books of accounts and other financial records.

- Provide Documents: Furnish all necessary documents to the CA, including financial statements, books of accounts, bills, and receipts.

- Audit and Report Preparation: The CA conducts the audit and prepares the audit report. The report is submitted in specific forms:

- Form 3CA: Used when a person is already required to get their accounts audited under any other law (e.g., the Companies Act). This form certifies that the accounts have been audited under that law and that the tax audit report is attached.

- Form 3CB: Used for taxpayers who are not required to get their accounts audited under any other law. This is the main tax audit report form.

- Form 3CD: A statement of particulars that must be furnished with either Form 3CA or Form 3CB. It contains detailed information about the assessee, their business, and various financial disclosures as required by the Income Tax Act.

Electronic Filing:

The taxpayer must add their appointed CA on the Income Tax e-filing portal.

- The CA will then upload the tax audit report (Form 3CA-3CD or 3CB3CD) on the portal. The CA must use their Digital Signature Certificate (DSC) to do this.

- Once the CA uploads the report, it will be available in the taxpayer’s account for acceptance.

Taxpayer’s Action:

The taxpayer must log in to their account, review the uploaded report, and accept it. The filing is considered complete only after the taxpayer has approved and verified the report using a DSC or Electronic Verification Code (EVC).

Due Date and Penalty

- The due date for filing the tax audit report is generally September 30th of the relevant assessment year.

- Failure to get the accounts audited or to furnish the report on time can lead to a penalty under Section 271B. The penalty is the lower of 0.5% of the total sales/turnover/gross receipts or ₹1,50,000. The penalty may be waived if the taxpayer can prove a “reasonable cause” for the delay.

Important Pointers for a Smooth Tax Audit

- Maintain Timely Records: Keep your books of account updated and perform regular reconciliations to ensure a hassle-free audit process.

- Stay Informed on Form 3CD: Be aware that the audit report (Form 3CD) has been expanded. It now requires additional details, including:

- GST reconciliation.

- Reporting of specified transactions (digital, crypto, foreign).

- A vendor-wise breakdown under Clause 44.

- Consult Your CA Proactively: Regularly engage with your Chartered Accountant to stay updated on the latest notifications from the Income Tax Department (ITD) and the Institute of Chartered Accountants of India (ICAI).

This overview clarifies the triggers for a tax audit under Section 44AB and outlines the essential steps for complying with the latest filing procedures for Assessment Year 2025-26.

FAQs

Yes, Section 44AB of Income Tax Act makes a tax audit compulsory if businesses with turnover exceeds ₹1 crore and professions with gross receipts exceeds ₹50 lakhs.

The audit must be conducted by a Chartered Accountant.

A Chartered Accountant can handle up to 60 tax audit assignments per year.