Section 194P of the Income Tax Act of 1961 provides conditions for exempting Senior Citizens from filing income tax returns aged 75 years and above.

Conditions for exemption are:

- Senior Citizens should be of age 75 years or above

- Senior Citizen should be ‘Resident’ in the previous year

- Senior Citizen has pension income and interest income only & interest income accrued/earned from the same specified bank in which he is receiving his pension

- The senior citizen will submit a declaration to the specified bank.

- The bank is a ‘specified bank’ as notified by the Central Government. Such banks will be responsible for the TDS deduction of senior citizens after considering the deductions under Chapter VI-A and rebate under 87A.

- Once the specified bank, as mentioned above, deducts tax for senior citizens above 75 years of age, there will be no requirement to furnish income tax returns by senior citizens.

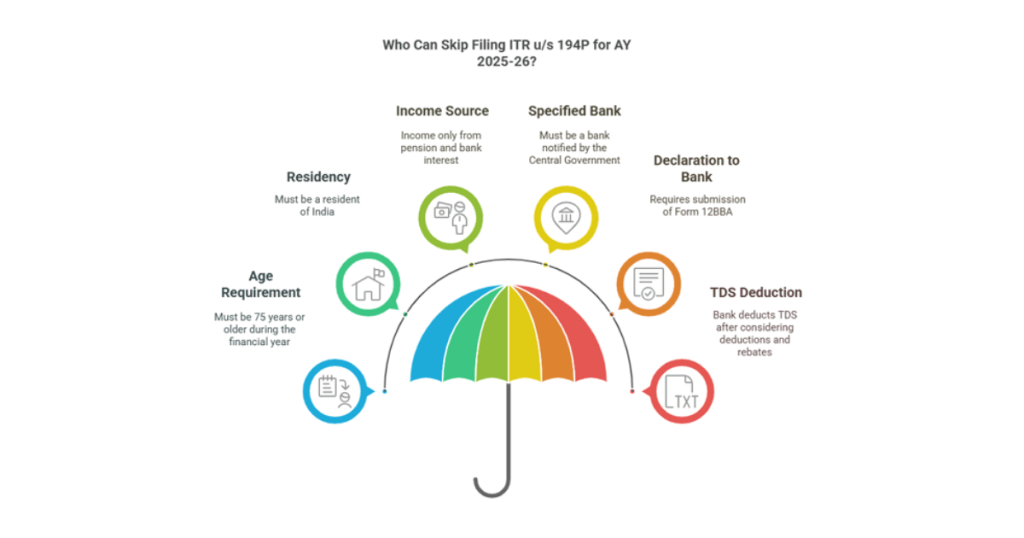

Who Can Skip Filing ITR u/s 194P for AY 2025-26?

- Age: The individual must have been 75 years or older at any time during the previous financial year (2024-25).

- Residency: The senior citizen must be a resident of India during the previous year.

- Income Source: They should only have income from pension and interest earned from the same bank where they receive their pension. No other source of income is permissible.

- Specified Bank: The bank where they receive their pension and earn interest must be a “specified bank” as notified by the Central Government. This generally includes scheduled banks.

- Declaration to the Bank: The senior citizen needs to submit a declaration (Form 12BBA) to the specified bank. This declaration contains details of their income, deductions, and other relevant information.

- TDS Deduction by the Bank: The specified bank, after receiving the declaration, will be responsible for deducting the Tax Deducted at Source (TDS) on their total income (pension + interest) after considering eligible deductions (under Chapter VIA) and rebates (under Section 87A).

Process for Availing Exemption

Declaration Submission

The senior citizen must submit a declaration (Form 12BBA) to the specified bank. This declaration includes:

- PAN and Pension Payment Order (PPO) details.

- Total income and eligible deductions under Sections 80C to 80U.

- Rebate eligibility under Section 87A.

- Confirmation that the income is solely from pension and interest46.

Tax Deduction by Bank

The specified bank will compute the taxable income after considering eligible deductions and rebates, deduct applicable TDS (Tax Deducted at Source), and ensure compliance with tax obligations on behalf of the senior citizen.

Increased Deductions for Medical Expenses under Income Tax Act (AY 2025-26)

Section 80D – Deduction for Health Insurance Premium & Medical Expenditure

Section 80DDB – Deduction for treatment of Specified Diseases

Exemption from Advance Tax Payments for Senior Citizens (AY 2025-26)

Senior citizens, defined as individuals aged 60 years and older, are exempt from paying advance tax under Section 234C of the Income Tax Act if they do not have income from a business or profession.

Applicable to

Resident individuals aged 60+ years (as of the relevant financial year).

Not applicable – if the senior citizen has business or professional income.

Eligible Income Sources

Pension, Interest (FDs, savings accounts, etc.), Rental income, Capital gains and Other non-business income.

Tax Liability to be Paid as Self-Assessment Tax

Instead of paying advance tax in instalments, the senior citizen can pay the entire tax liability by March 31 (end of the financial year).

FAQs

The exemption limit for the financial year 2024-25 available to a resident senior citizen is Rs. 3,00,000. The exemption limit for the financial year 2024-25 available to a resident very senior citizen is Rs. 5,00,000.

A very senior citizen filing his return of income in Form ITR 1/4 can file his return of income in paper mode, i.e., for him, e-filing of ITR 1/4 (as the case may be) is not mandatory. However, he may go for e-filing if he wishes.

The Income Tax Act, of 1961 provides no exemption to senior citizens or very senior citizens from filing of return of income. However, to provide relief to senior citizens (whose age is 75 years or more) and to reduce the compliance burden on them, the Finance Act, 2021, has inserted a new section 194P.