The Income Tax Portal has enabled ITR-1, ITR-2, ITR-3 & ITR-4 Utilities for filing Income Tax Returns for the Assessment Year 2025-26.

- ITR-1 (Sahaj) – Applicable only for Individual with income up to ₹50 lakhs from salary or pension, one house property, Agricultural Income up to ₹ 5,000 and other sources.

- ITR-4 (Sugam) – Applicable for Individual, HUF and Firm (other than LLP) with income up to ₹50 lakhs and presumptive income from business or profession.

- ITR-2: Applicable for Individuals and HUFs not having income from profits and gains of business or profession.

- ITR-3: Applicable for individuals and HUFs having income from profits and gains of business or profession.

Taxpayers can now file Original Returns u/s 139(1) of the Income Tax Act.

Click Here – Complete Guide to New Annexures in ITR Forms for AY 2025-26

Why You Should Wait Before Filing ITR-2 and ITR-3?

Even though the forms are available, filing too early may can cause issues as ITR-2 and ITR-3 has been released on 11th July 2025.

As of now utilities for other ITRs – ITR-5, ITR-6 and ITR-7 are still not live.

Recommendations For Filing ITR-2 & ITR-3

Wait until the 3rd week of July to:

- Check for TDS credits that are reflected correctly in Form 26AS.

- Ensure all income and tax details are reflected properly in AIS.

- Avoid errors and unnecessary compliance issues.

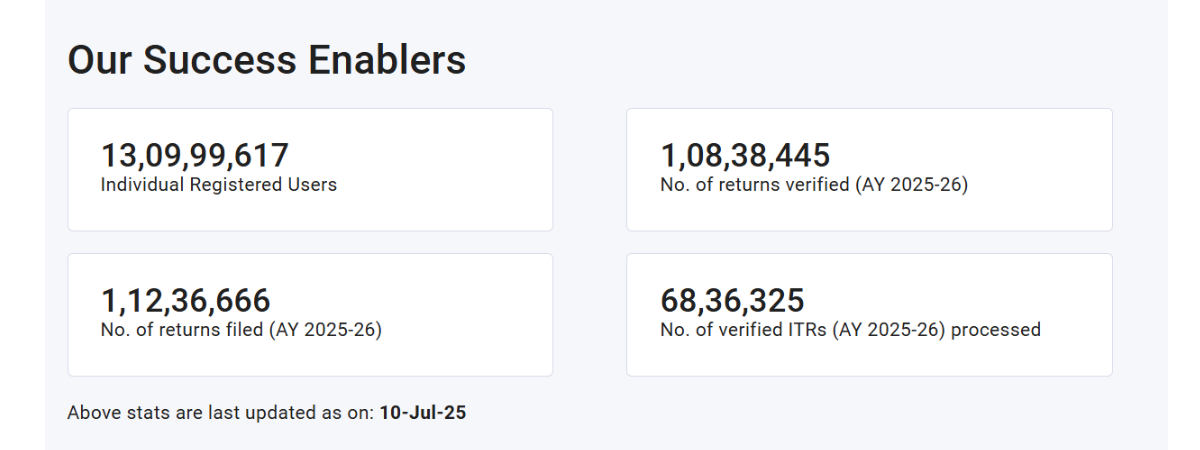

Statistics Of ITR Filing

If you check the statistics in incometax.gov.in, you will be able to see no returns for AY 25-26 has been filed yet.

Reason For Delay

Last year, IT Department modified the ITR software schema on 5th July 2024 i.e., a rebate issue u/s 87A which caused complications for taxpayers to claim Section 87A.

This year IT Department may take more time to avoid such glitches.

Expected Start For ITR-5, ITR-6, and ITR-7

Filing is expected to begin from last week of July 2025.

Changes in ITR Forms

Several new questions and requirements have been added this year, especially around switching between old and new tax regimes:

- Whether Form 10-IE was filed for opting out of the new regime. Two Methods are there to Opt-Out (Choose One):

| Set A: Filed Form 10-IEA | Set B: No Business Income |

| 1. Declare if you filed Form 10-IEA in AY 2024-25. 2. Mention if you want to continue or stop opting out for AY 2025-26. 3. Provide acknowledgment number and filing date. | 1. Just tick Yes/No in the ITR if you want to opt out (Form 10-IEA not needed). 2. Default is “No” (i.e., new regime will apply if not opted out). |

- Acknowledgement number and filling date required

- Can opt only once, switching back needs fresh Form 10-IE.

- Track maintained assessment year wise.

Capital Gains Reporting Now in More Forms

Earlier limited to ITR-2 and ITR-3, now in ITR-1 and 4 which allow long-term capital gains reporting—if applicable.

Capital Gains Tax Split

Capital gains must now be reported in two parts: pre- and post-July 23, adding complexity.

More Disclosure for Exempt Agricultural Income

If agricultural income exceeds ₹5 lakhs (though still exempt) but additional disclosures such as district, PIN code, land size in acres, ownership/lease details are also required now.

Assets and Liabilities Threshold

The asset/liability disclosure threshold increased from ₹50 lakh to ₹1 crore.

Check IT Portal Regularly

Although PDF versions of ITR-1 to ITR-7 and ITR-1 to ITR-4 Utilities are released , the actual online filing utility of ITR-5, ITR-6, ITR-7 are not live.

Taxpayers should keep checking the Income Tax portal’s “Downloads” section—once AY 2025–26 appears, filing is open.