Latest Update

| ITR-3 notified by IT Department on 30th April 2025 via Notification No. 41/2025 which is applicable for FY 2024-25 (AY 25-26). This form must e used for income earned from April 1, 2024, to March 31, 2025. |

What is ITR-3 Form?

Form ITR-3 is for filing income tax returns applicable to individuals and HUFs having income from business or profession.

Eligible To

Taxpayers who –

- have profit and gains business or profession whether big or small (including tax audit or non-audit cases)

- is a partner in a partnership firm and earn income like remuneration from the firm.

have income from –

- salary, house property, capital gains and other sources

- intraday trading or Futures and Options (F&O) trading

- foreign assets or income from outside India

- and want to carry forward losses from previous years

Ineligible To

- Those who do not have profit and gains from business or profession.

- If sole proprietor’s business income is calculated under the presumptive taxation scheme you may use ITR-4 instead, unless your turnover exceeds ₹2 crore.

| Note: Use ITR-4 for small businesses under presumptive tax scheme with turnover up to ₹2 crore. Use ITR-3 if your turnover is above ₹2 crore or if you’re not using presumptive taxation. |

Due Date To File Form ITR-3

- For non-audit cases – 31st July

- For audit Cases – 31st October.

Major Changes in AY 2025-26

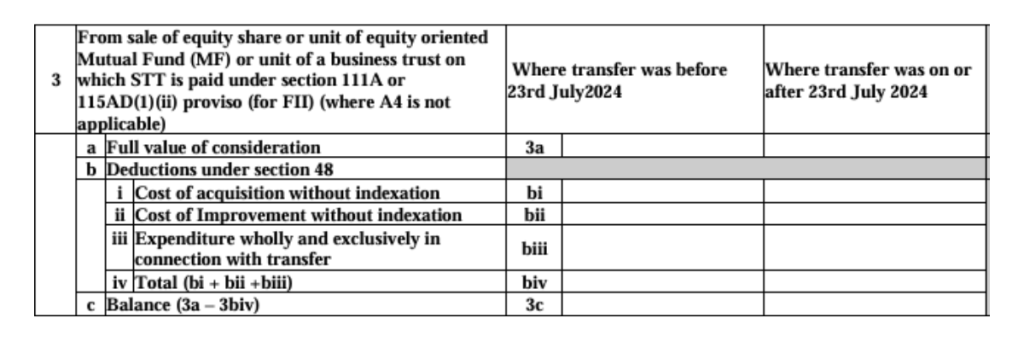

Capital Gains Schedule

Capital gains split into Pre and Post 23 July 2024. Update was made due to tax rate change in Budget 2024.

Separate Columns For

Short Term Gain (Sec 111A) and Long Term Gain (Sec 112A) with different tax rates as STCG increased from 15% to 20%, LTCG from 10% to 12.5%.

Capital Loss on Buyback Share

If you are claiming capital loss from share buyback post 1st October, 2024, must report related dividend income under “Income from Other Sources.”

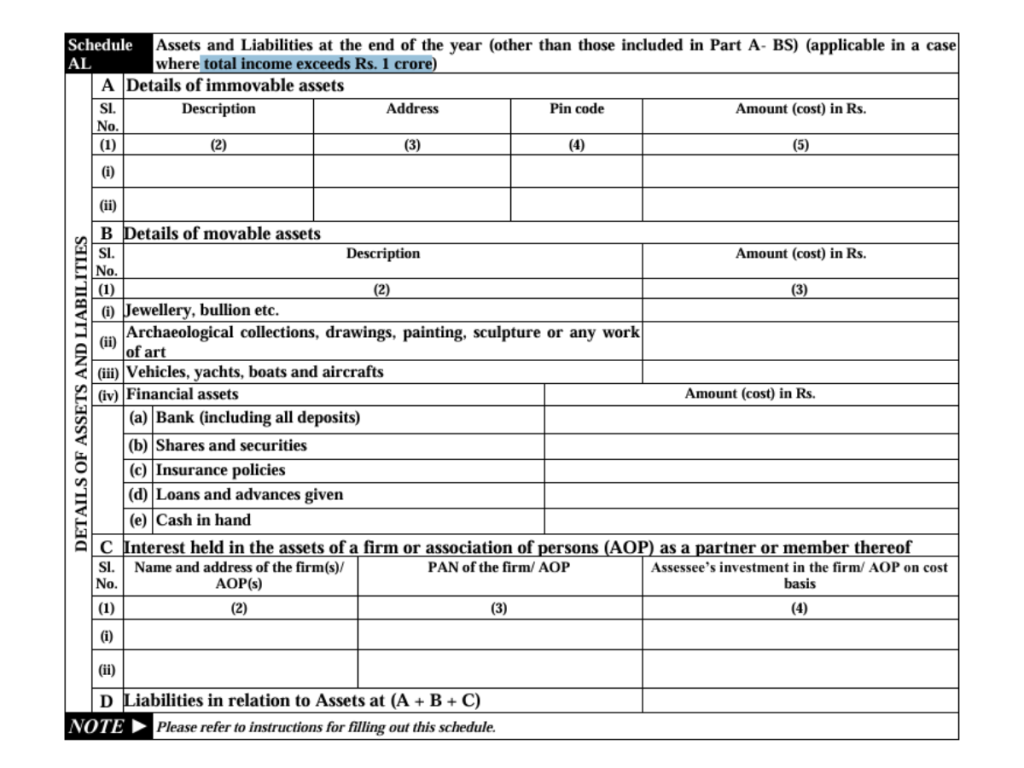

Schedule AL (Assets & Liabilities) Relaxed

Earlier applicable if total income exceeded ₹50 lakh

Now it mandatory only if income exceeds ₹1 crore.

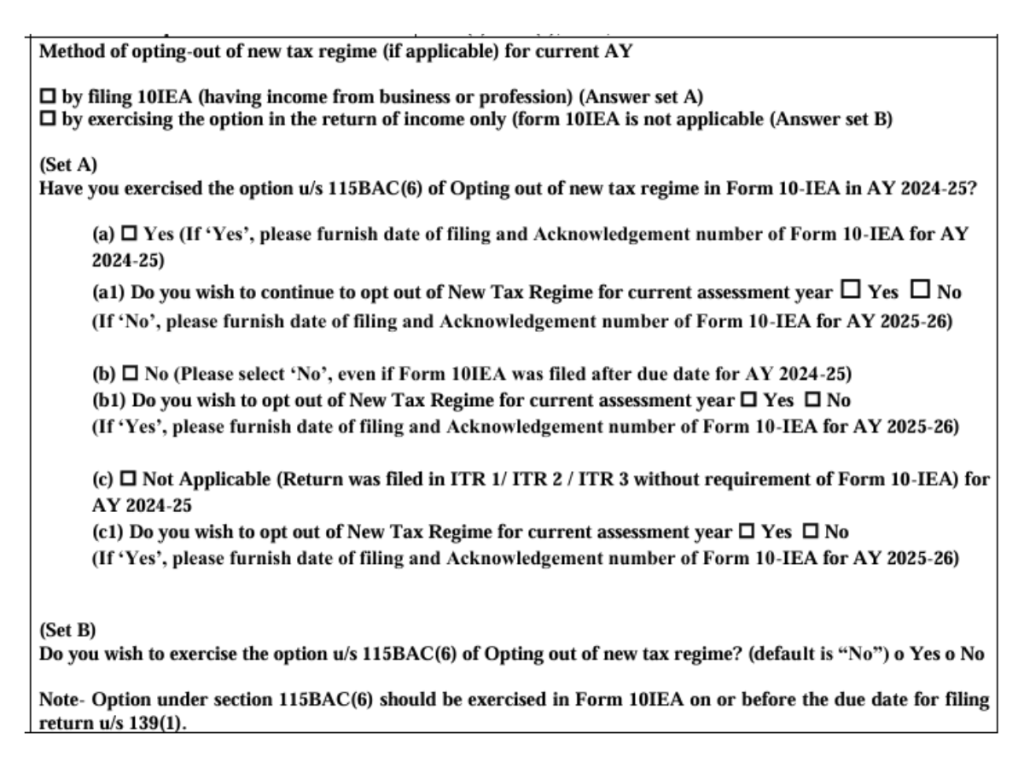

New vs Old Tax Regime Disclosure Improved

Structured dropdown added by regime section:

- Taxpayers must provide proper declaration if opting in/out of the new tax regime.

- Form 10-IE earlier acknowledge number required if opted out in previous year.

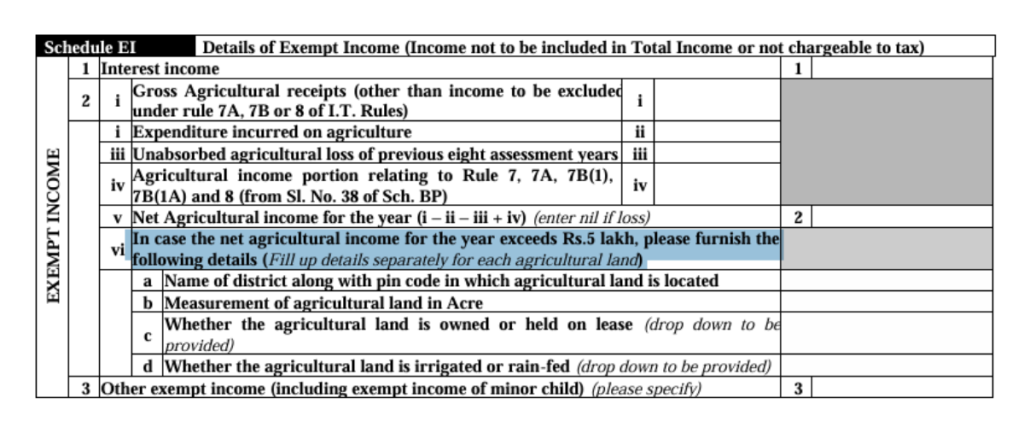

Agricultural Income Disclosure Enhanced

If agricultural income exceeds ₹5 lakh, now required location-wise details in the return.

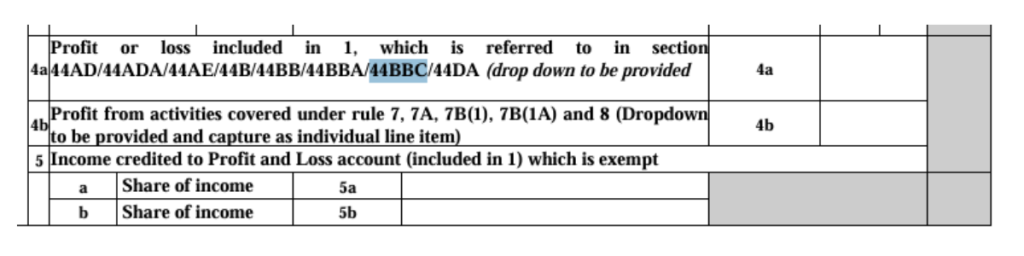

New Section 44BBC Added for Shipping Business

A new option under business income schedule (Schedule BP) has been added for those engaged in cruise shipping business.

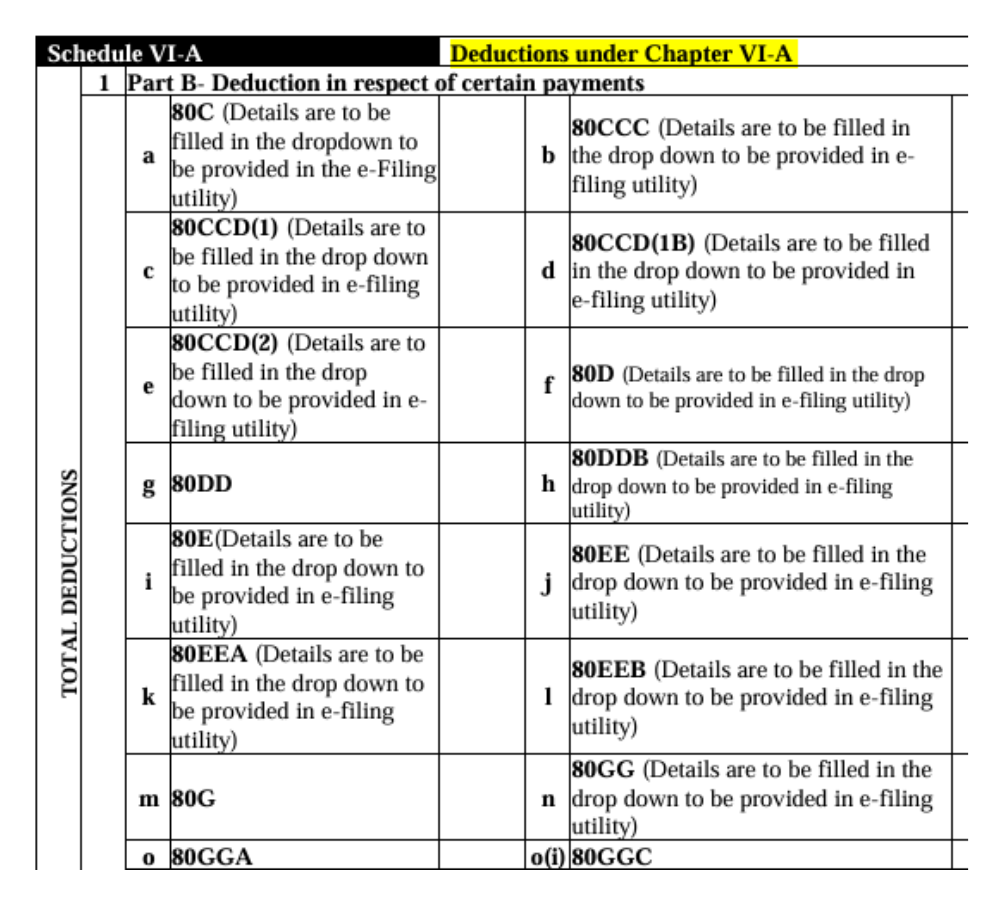

More Detailed Deductions in Old Regime

Section-wise breakup such as LIC, tuition fees under 80C, etc. in detailed is now mandatory for reporting deductions under the old regime.

Foreign Assets and High-Value Expenses Disclosures

Mandatory if –

- Deposited above ₹1 Crore.

- Spent more than ₹2 Lakh on foreign travel.

- Paid above ₹1 lakh towards electricity bills.

TDS Reporting Now More Detailed

New requirement to include specific TDS section codes and validations are now required to avoid defective returns and ensure accurate TDS credit.

Click Here to Know – CBDT Notifies New ITR-3 Form for AY 2025-26

Conclusion

These changes aim to simplify compliance, improve transparency, and align with new tax policies (e.g., updated LTCG rates).

Taxpayers must review the new form carefully, ensure accurate reporting.