Income Tax Notice is sent by the Income Tax Department to taxpayers informing about discrepancies or issues related to your tax filings.

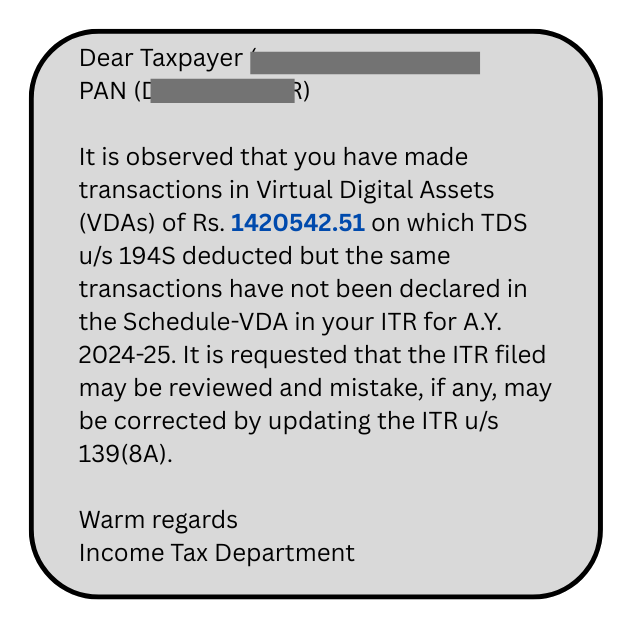

A Taxpayer while scrolling through his phone found that he received SMS from the tax department.

What’s in the Message?

The message was relate to cryptocurrency (crypto) transactions.

IT department has observed transactions in virtual digital assets and in the message says that TDS 1% was already deducted, but you have not yet declare these transactions in your ITR.

The text message was not a threat but its a reminder. A chance to correct his ITR under Section 139(8A) before it was too late.

IT Department’s New Way of Tax Communication

The IT Department has moved on from traditional letters that took weeks to arrive by post.

Now, they are sending messages and alerts directly to your phone – faster and more efficient with the rise of AI.

Points To Remember

- If you sell crypto and provide PAN, 1% TDS is deducted by the buyer.

- For example: If you sell Bitcoin worth ₹1,50,000, you will get ₹1,48,500 after tax.

- As per Section 194S, crypto sales must be declared in the “VDA Schedule” of your ITR.

- Even if TDS is paid, if you don’t mention it in your return, you may get a message from the department.

- You can use AIS, TIS, and Form 26AS to check what the department sees.

- You have now 4 years to correct an ITR, but:

- If delayed, you may have to pay 25% to 70% extra as penalty.

Overview – Types of Income Tax Notices You May Receive

Notice Under Section 133(6)

The IT Department may issue notices u/s 133(6) if they found any discrepancy between the information in your Income Tax Return and the data in the Annual Information Statement (AIS).

Reasons for receiving notice under section 133(6)

- ITR not filed despite having income above the basic exemption limit.

- Incorrectly reported taxable income such as salary, capital gains etc in ITR.

Notice Under Section 142(1)

This notice may be issued when assessing officer needs more information or documents to verify it even if you have filed your return. Notice u/s 142(1) may be issued officer requires you to file your IT Return when you have not filed it.

Consequences of Ignoring Notice Under Section 142(1)

- A penalty of Rs 10,000 for each failure.

- Prosecution that may extend up to 1 year.

Intimation Under Section 143(1)

Once filing income tax returns, the Central Processing Centre (CPC) processes them and issues an intimation under Section 143(1). This can result in:

- Outstanding tax liability that needs to be paid.

- A refund being determined.

- No refund or demand but an adjustment in the declared loss.

Reasons for receiving this notices

- Incorrect details reported

- Arithmetical error in the ITR

- Incorrect claims like excess expenditure or loss.

Time Period of letter

Intimations must be issued within nine months from the end of the year in which the return was filed. Example: for AY 2023-24 time limit is 31st Dec 2024.

Notice Under Section 143(2)

Notice Under Section 143(2) is issued only when your return has been selected for scrutiny. The reason includes:

- Huge losses.

- Huge income tax refund.

- Large exempt income like agricultural income.

- Excessive cash deposited buy ITR not filed.

Time limit to Respond

You must respond to the questionnaire and provide the required documents within three months after the assessment year.

Notice Under Section 148

An assessing officer can issue a notice under Section 148 if they believe you have not disclosed your income correctly, resulting to lower taxes, or if you have failed to file your return when required.

FAQs

When you income tax notice from the department first read the notice carefully, gather the necessary documents, and try to respond within the deadline.

If you fails to respond notice within the specified time then a penalty amounting 10,000 will be imposed.

Some common mistakes are:

1. Claimed TDS credit but fail to report the corresponding income.

2. Mismatch in Gross Receipts.

3. Incorrect income reporting.

4. The name in Income Tax Return does not match the name as per the PAN database.

5. Incomplete Reporting for Business Income like you have income under the head “Profits and Gains of Business or Profession” but fail to fill in the Balance Sheet and Profit and Loss Account.