Sometimes when taxpayers make income tax payments online, they often make mistakes such as:

- Selecting the wrong assessment year.

- Choosing the wrong tax head, e.g., select “Advance Tax” instead of “Self-Assessment Tax”.

These mistakes can be corrected online instantly using the Income Tax e-filing portal.

How To Check The Mistake?

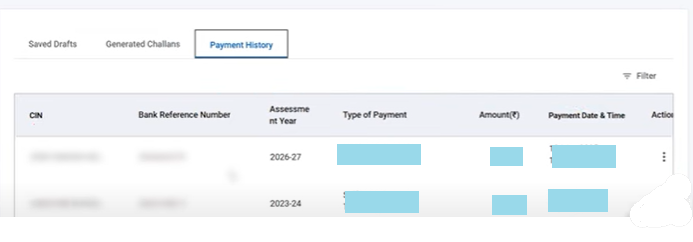

To correct a challan, you need to:

- First login to the Income Tax e-filing portal.

- Go to e-file → e-Pay Tax → Payment History.

- Download the specific challan by clicking the three dots and check where the mistake occurred.

How To Correct This Mistake?

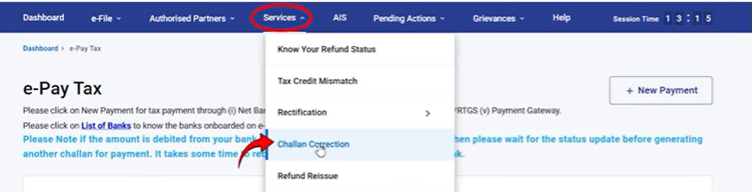

To correct the challan online:

- Login to the Income Tax portal using your PAN number and password.

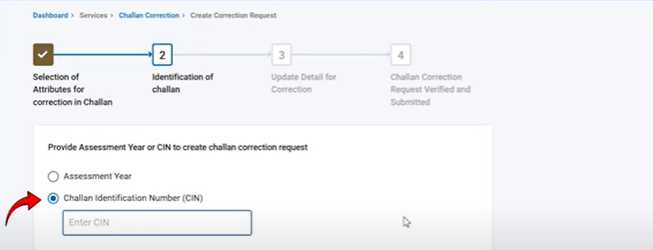

- Go to Services → Challan Correction on the portal.

- Click on Create Challan Correction Request.

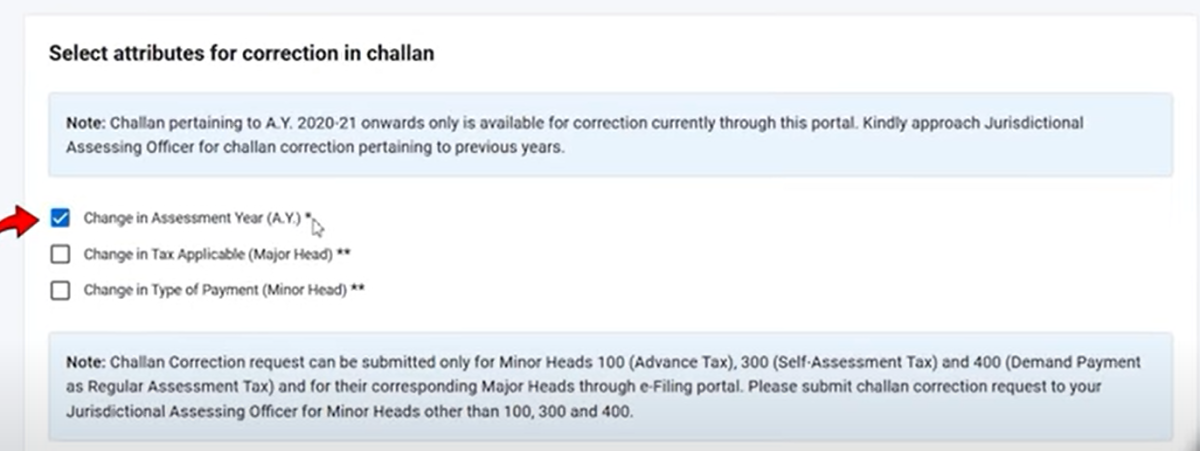

- Choose the type of correction:

- Assessment Year

- Minor Head (like Advance Tax, Self-Assessment Tax)

- Major Head (usually not required for individuals)

- Copy the CIN from the Challan and paste Challan Identification Number and click continue.

- Proceed and make the necessary corrections.

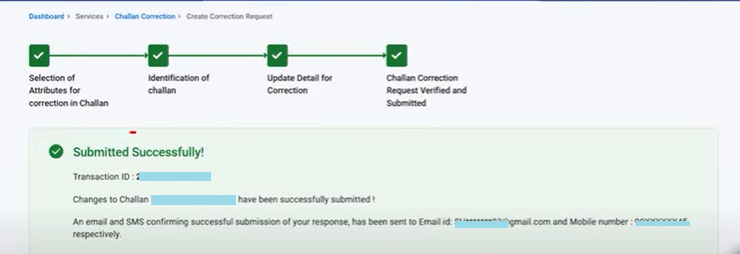

- To submit the correction, you must verify using one of the following methods:

- Aadhaar OTP (on your mobile number registered with Aadhaar)

- Digital Signature Certificate (DSC)

- Electronic Verification Code (EVC)

- Once verification, a message will be displayed that it has been submitted successfully with transaction ID.

Note

The corrected challan can be downloaded within 1-2 hours from the portal and used for accurate ITR filing.

Correction Timeline and Conditions

Different types of corrections have different time limits:

- Assessment Year Correction: Must be done within 7 days of depositing the challan.

- Minor or Major Head Correction: Must be done within 30 days of challan deposit date.

If this time limit is crossed, then the taxpayer must physically visit their jurisdictional Assessing Officer to request the correction.