A Digital Signature Certificate (DSC) serves as the digital counterpart of a handwritten signature, authenticating the signer’s identity and guaranteeing the security of electronic documents. In India, DSCs hold legal validity under the Information Technology Act, 2000.

To obtain a Digital Signature Certificate (DSC) in India, you must apply through a government-approved Certifying Authority (CA). The process typically involves submitting an application, completing identity verification, and making the required payment. Most providers allow the entire procedure to be completed online for convenience.

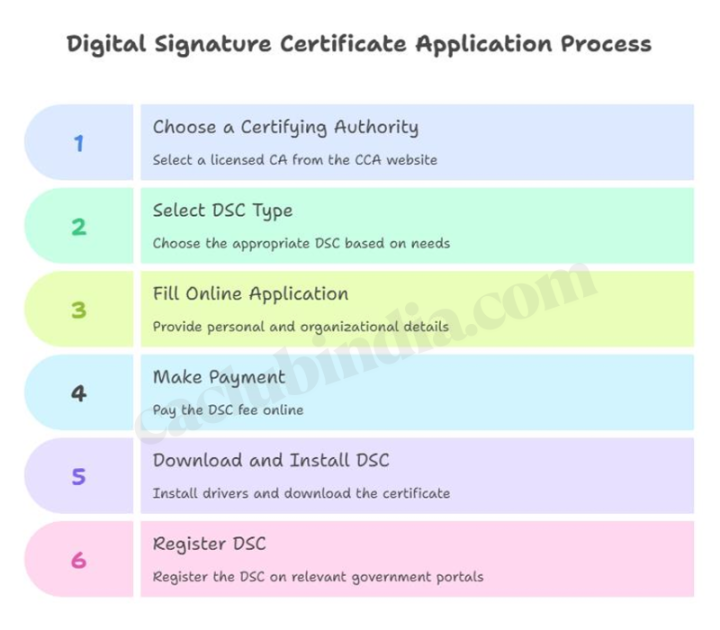

Step-by-step process

Choose a Certifying Authority (CA)

- Visit a licensed CA’s website

- The official list of licensed CAs is available on the Controller of Certifying Authorities (CCA) website.

- Some of the prominent licensed CAs include-

- eMudhra

- Sify (Safescrypt)

- nCode Solutions

- Capricorn

- VSign

- XtraTrust

- Protean (NSDL e-Gov)

- CDAC CA

Select the type of DSC

Choose based on your need (individual or organisation, signing only, signing & encryption, 1-3 year validity periods, USB token requirement, etc.).

- Class 3 DSC: This is the most commonly required type of DSC in India, offering the highest level of security. It’s mandatory for various online transactions like e-filing income tax returns for companies and audited accounts, e-procurement, GST filings, MCA filings, EPFO, and tender submissions.

- Sign DSC: Used for digitally signing documents.

- Encrypt DSC: Used to encrypt data, ensuring confidentiality.

- Combo DSC: Combines both signing and encryption functionalities.

Fill out the online application form

Provide your personal and/or organizational details accurately.

- Upload proof of identity and address (self-attested or attested by a gazetted officer/bank manager), photograph, and declaration.

- Many CAs provide digital Aadhaar eKYC options, which require only your Aadhaar OTP and no document uploads.

- Some CAs may require a short video for e-verification of documents.

- Alternatively, you can visit a CA’s office with your originals and self attested photocopies.

Make payment

Pay the DSC fee online via net banking, card, or UPI. The typical fee is ₹2,000–₹3,000 for 1–2 years, but this varies by provider and DSC type.

Download and install your DSC

Once your application is approved and you receive the USB token:

- Install Drivers: Insert the USB token into your computer and install the necessary drivers provided by the CA.

- Set PIN: Set a secure PIN for your token.

- Download DSC: Log in to the CA’s portal and follow the instructions to download your digital signature certificate onto the USB token. You might need to use specific utilities like “emsigner” for eMudhra, for instance.

Register your DSC (for specific applications)

After obtaining your Digital Signature Certificate (DSC), you may need to register it on specific government portals such as:

- Income Tax e-Filing portal

- MCA (Ministry of Corporate Affairs) portal

- GST portal

Each portal has its own DSC registration process, which typically involves logging in and following their verification steps. This ensures your DSC is linked to your account for secure transactions.

FAQs

Only licensed Certifying Authorities (CAs), regulated by the Controller of Certifying Authorities (CCA), can issue DSCs.

Classes include:

Class 1 (for email/individual use)

Class 2 (for business, official filings)

Class 3 (high security, for e-tendering, legal purposes).

DSCs are typically valid for 1 to 3 years and must be renewed before expiry.

Apply for renewal with your CA for expired DSCs. If lost, revoke the old DSC and apply for a new one with fresh documentation.

For higher-grade DSCs (Class 3), a secure USB token is often required to store the certificate and use it on multiple computers.

If the DSC is multi-utility (signing & encryption), it can be used for different online government and business services as allowed by the issuer.