GST officers across India have launched a campaign to focus on the books, returns, and data of real estate transactions, especially related to sale or purchase of flats.

Reason

To check whether the correct GST rates were applied on sale of flats.

In many cases, tax demands are also have been raised for undercharging GST.

How To Classify Real Estate Project?

Real estate projects are divided into two categories under GST notifications:

- Residential Real Estate Project (RREP) i.e. residential projects.

- Real Estate Project (REP) “other than RREP” i.e. commercial projects.

How to Determine Residential Real Estate Project and Real Estate Project?

Residential Real Estate Project (RREP)

If the carpet area of commercial units (such as – shops or offices) in a project is ≤15% of the total carpet area, the project is classified as an RREP.

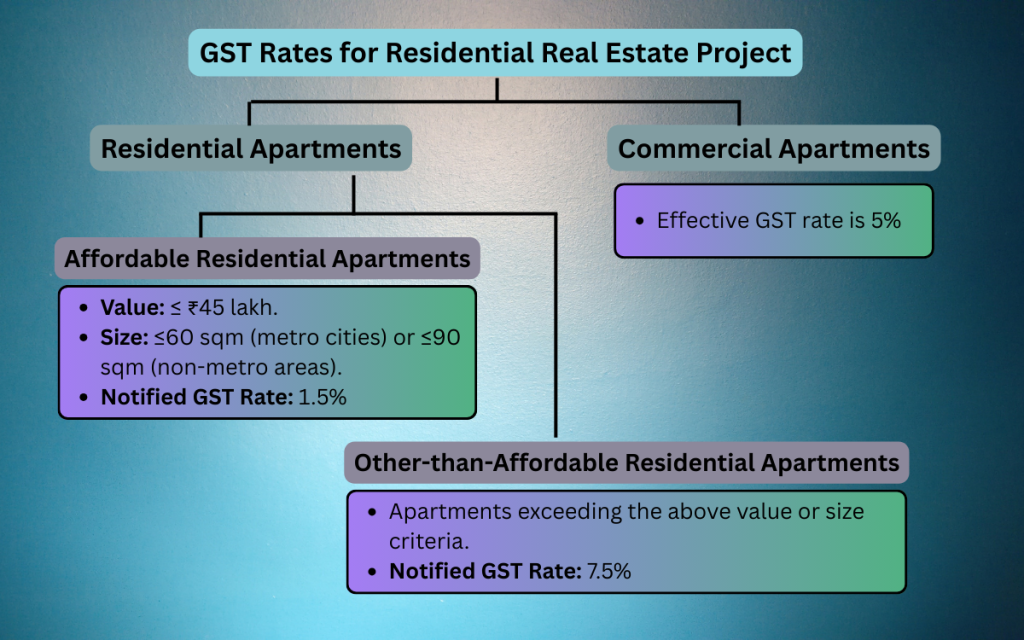

GST Rates for RREP

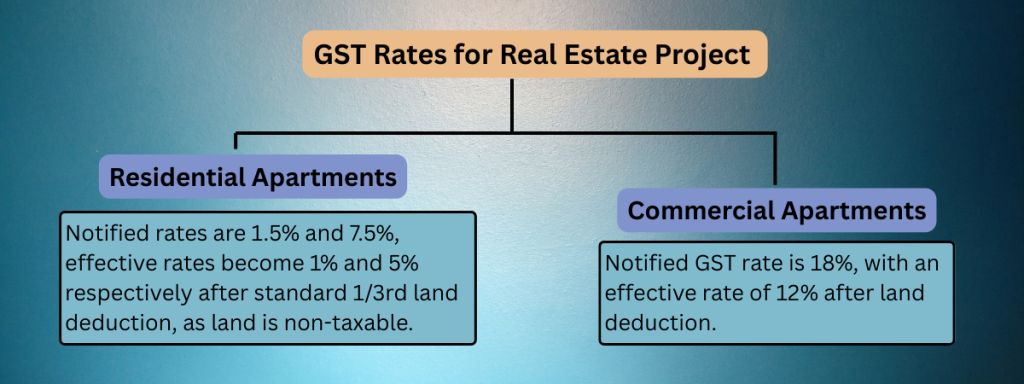

Note : Although notified rates are 1.5% and 7.5%, effective rates become 1% and 5% respectively after standard 1/3rd land deduction, as land is non-taxable.

Real Estate Project (REP)

If the carpet area of commercial units exceeds 15%, the project is classified as an REP.

GST Rates for REP

Point To Remember

The market often refers to 1% and 5% as GST rates, but these are effective rates after land deduction, not the notified rates (1.5% and 7.5%). This confusion can lead to audit issues.