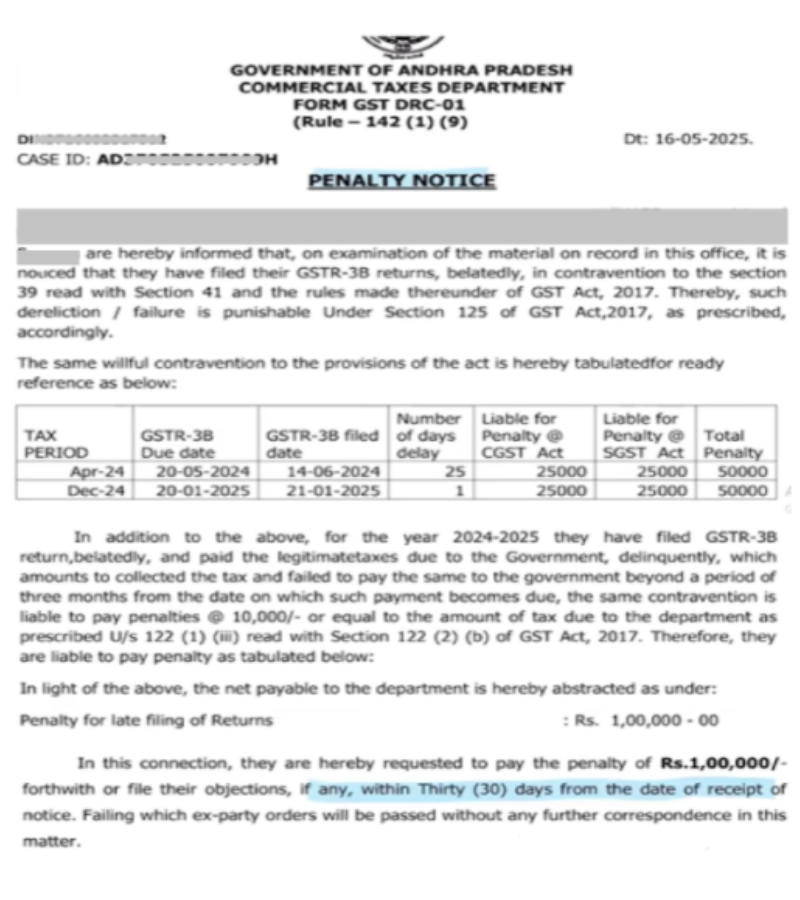

A notice has been issued to a taxpayer on 16th May 2025 where the Proper Officer alleged that he has filed GSTR-3B late.

Allegation was made on the ground of on examination of the material on record.

As per records, it is noticed that the return was filed after the due date, which attracts late fees u/s 47 of the CGST Act.

The officer has taken this late filing as the basis for imposing a penalty of Rs.50,000 penalty (Rs.25,000 CGST + Rs.25,000 SGST) even for a one-day delay in filing GSTR-3B returns.

GST Department is invoking Section 125 of the CGST Act to levy general penalties, even though there is no specific penalty prescribed for late filing.

| Section 125 – General Penalties : This section states that any person who contravenes any provisions of the CGST Act, or the rules made thereunder, for which no specific penalty is provided, shall be liable to pay a penalty of up to Rs. 25,000. |

The late fee of Rs.50/day CGST + Rs.50/day SGST is already charged by the portal. However, the department additionally imposed a penalty u/s 125, which is separate from the late fee.

Reason

In the month of:

- April 2024, GSTR-3B return was due on 20th May 2024, but was filed on 14th June 2024 which is 25 day delay.

- December 2024, GSTR-3B was due on 20th Jan 2025, but was filed on 21sth Jan 2025 which is 1 day delay.

Penalty for 2-Month Delay

A taxpayer received totaling Rs.1,00,000 penalty notice merely for late filing of GSTR-3B for two months, stressing the seriousness of delayed compliance.

Additional Penalty u/s 122

If taxes are collected but paid after 3 months of becoming due, then a further penalty up to ₹10,000 or equal to the tax amount may be imposed u/s 122(1)(iii) read with 122(2)(B) of GST Act, 2017.

Immediate Actions for Taxpayers

- Taxpayers must check if any returns were filed after due dates.

- If notices are received, he/she must prepare a proper legal reply with reference to GST provisions.

Taxpayers should check their return filing history immediately as these penalty notices are now being issued across India.