The Goods and Services Tax (GST) is a unified, multi-stage, destination-based indirect tax applied to the supply of goods and services throughout India. Implemented on July 1, 2017, it replaced numerous earlier indirect taxes—including excise duty, VAT, service tax, and various state and central cesses—establishing a streamlined tax system often described as “One Nation, One Tax.” This reform simplified taxation by consolidating multiple levies into a single structure.

Form GST ITC-02

GST ITC-02 is a crucial form used to transfer unutilized Input Tax Credit (ITC) from one GSTIN to another, primarily in cases of business restructuring, such as:

- Sale of business

- Merger

- Demerger

- Amalgamation

- Lease or transfer of business

- Change in ownership of the business

This allows the unutilised Input Tax Credit (ITC) of the transferring entity to be carried forward and utilised by the new or acquiring entity, ensuring seamless credit continuity. The procedure is regulated under Section 18(3) of the CGST Act, 2017, and Rule 41 of the CGST Rules, 2017.

When Is GST ITC-02 Used?

- During the transfer of business through sale, merger, demerger, amalgamation, lease, or any similar event when liabilities are also transferred.

- When unutilized ITC (the credit balance remaining in the electronic credit ledger of the transferor) needs to be transferred to the transferee’s GSTIN.

Key Eligibility Conditions

- Both the transferor (old business) and transferee (new business) must be registered under GST.

- The transferor should have unutilized matched ITC in the Electronic Credit Ledger.

- A Chartered Accountant’s or Cost Accountant’s certificate confirming the transfer is required.

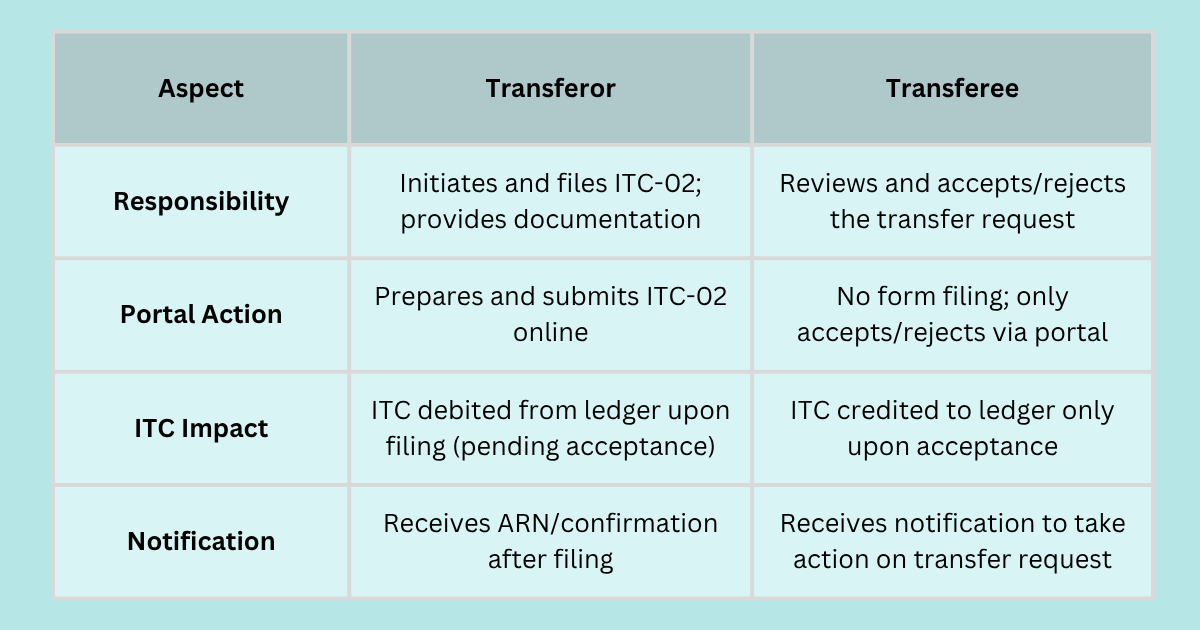

Steps for the Transferor (Original Entity) to Transfer ITC via Form GST ITC-02

Log in to the GST Portal

- Access the official GST portal using valid credentials.

Navigate to ITC Forms

- Go to: Services → Returns → ITC Forms.

Prepare Form GST ITC-02 Online

- Click on the ‘Prepare Online’ option under the ITC-02 section.

Enter Required Details

- Provide the GSTIN, Legal Name, and Trade Name of both the transferor and transferee.

- Specify the amount of ITC to be transferred under each tax head (CGST, SGST, IGST, CESS).

- Include the certificate details from a Chartered Accountant or Cost Accountant.

Upload Supporting Documents

- Attach the CA/Cost Accountant certificate in the prescribed format (PDF/JPEG).

Submit the Form

- File the form using a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

- Upon successful submission, an Application Reference Number (ARN) will be generated for tracking.

ITC Adjustment in Electronic Credit Ledger

- The specified unutilized ITC amount will be debited from the transferor’s Electronic Credit Ledger.

Steps for the Transferee (Acquiring Entity) to Accept/Reject ITC Transfer

- Log in to the GST portal using valid credentials and access the dashboard.

- Go to: Services → User Services → ITC-02 – Pending for Action.

- Review transfer request details such as check the Application Reference Number (ARN), transfer amount, and date.

- Choose to accept or reject the transfer request.

- If accepted, the ITC will be automatically credited to the transferee’s Electronic Credit Ledger.

- If rejected, the ITC will remain with the transferor.

FAQs

1. Transfer Agreement or Business Transfer Document: A copy of the agreement, scheme of arrangement, or document evidencing the transfer of business (e.g., merger, demerger, sale, amalgamation, lease, or similar event)

2. Certificate from a Chartered Accountant (CA) or Cost Accountant

3. ITC Ledger Details: Details of the matched ITC available in the Electronic Credit Ledger of the transferor as on the effective date of the transfer

4. GST Registration Details: GSTIN, Legal Name, and Trade Name of both the transferor and transferee entities.

Yes, one can transfer Input Tax Credit (ITC) after a business merger or sale by filing Form GST ITC-02, and there is no statutory time limit under the GST law to do so. The transferor must file ITC-02, and the transferee must accept the transfer for the ITC to move to the transferee’s electronic credit ledger.

This flexibility is expressly confirmed in multiple sources, which state that neither the GST Act nor the rules prescribe a specific deadline for initiating or completing this process.